|

| | réserves d'or de la banque centrale de russie |    |

| |

| Message | Auteur |

|---|

| |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: réserves d'or de la banque centrale de russie Re: réserves d'or de la banque centrale de russie

par marie Lun 24 Jan 2011 - 23:01 | |

| hoho, c'est marrant ça la banque centrale de russie déclare vouloir acheter 100T d'or / an !! .. à d'autres banques.. sachant qu' en 2010 , les réserves officielles de 790T ont augmenté de 23.9% sur l'année ... ce qui montre bien qu'avec 100T /an , +12%, on est tout à fait "dans les cordes".. amah et comme toutes les réserves est orientales, le chiffre officiel de leurs réserves est sousestimé.. cette déclaration n'en reste pas moins interessant ..au contraire .. http://news.tradingcharts.com/futures/4/2/152093024.htmlMOSCOW, Jan 24, 2011 (Dow Jones Commodities News Select via Comtex) -- The Central Bank of Russia plans to buy from domestic banks 100 metric tons of gold a year in order to replenish the country's gold reserves, Deputy Head of the bank Georgy Luntovsky said Monday, according to the bank's press service. In 2010 Russia's gold reserve increased 23.9% to 790 tons, or 25.4 million Troy ounces. -By Grigori Gerenstein, contributing to Dow Jones Newswires; gerenstein@hotmail.com (END) Dow Jones Newswires 01-24-11 0910ET et sur www.lemetropolecafe.comla même info, avec plus de détails Central Bank plans to buy over 100 tons of gold every year MOSCOW, January 24 (Itar-Tass) -- The Central Bank of Russia plans to buy more than 100 tonnes of gold to renew the country’s gold and foreign exchange reserves (or international reserve assets) every year, CBR First Deputy Chairman Georgy Luntovsky told reporters on Monday, giving no details pertaining to the terms. Earlier, in an interview to the Prime Tass economic news agency First Deputy Chairman of the Bank Alexei Ulyukayev said that the Central Bank would increase the share of gold in the national reserves. In the middle of October 2010, Director of the Bank’s Department of Financial Operations Sergei Shvetsov said that the bank did not import gold in 2010. The bank buys gold on the domestic market (in Russian banks). According to the Central Bank, the reserves of gold in the Russian international reserve assets increased by 23.9 percent (152.4 tonnes) in 2010 to reach 25.4 million net troy ounces (790 tonnes) as of January 1, 2011, Prime Tass said. As of January 1, 2009, the amount of monetary gold in Russia’s international reserves was at 16.4 million ounces (510.1 tonnes), the economic news agency said. In 2009, the Central Bank’s gold reserves increased by 4.1 million ounces (127.5 tonnes) to reach 20.5 million ounces (637.6 tonnes) as of January 1, 2010, Prime Tass said.   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Bank of Russia says it's buying only domestic gold Bank of Russia says it's buying only domestic gold

par g.sandro Mar 25 Jan 2011 - 2:18 | |

| Bank of Russia says it's buying only domestic gold

|  |

Submitted by cpowell on 04:46PM ET Monday, January 24, 2011. Section: Daily Dispatches 4:43p PT Monday, January 24, 2011 Dear Friend of GATA and Gold: The report from the ITAR-TASS news agency in Russia appended here seems notable for quoting the Bank of Russia as saying that it is buying gold only on the domestic market, and from Russian bullion banks, rather than on international markets as well, a change of the position articulated in 2005 by Russia's then-president, Vladimir Putin, now Russia's prime minister, who said then that the bank would be buying gold on all markets. Of course this policy of buying only domestic production rather than messing up the Western paper gold markets seems to be China's policy as well. CHRIS POWELL, Secretary/Treasurer Gold Anti-Trust Action Committee Inc. * * * Central Bank Plans to Buy Over 100 Tons of Gold Every Year From ITAR-TASS, Moscow Monday, January 24, 2011 http://www.itar-tass.com/eng/level2.html?NewsID=15884581&PageNum=0MOSCOW -- The Central Bank of Russia plans to buy more than 100 tonnes of gold to renew the country's gold and foreign exchange reserves (or international reserve assets) every year, the bank's first deputy chairman, Georgy Luntovsky, told reporters on Monday, giving no details pertaining to the terms. Earlier, in an interview to the Prime Tass economic news agency, the first Deputy chairman of the bank, Alexei Ulyukayev, said the central bank would increase the share of gold in the national reserves. In the middle of October 2010, the bank's director of the financial operations, Sergei Shvetsov, said the bank did not import gold in 2010. The bank buys gold on the domestic market, in Russian banks. According to the central bank, the reserves of gold in the Russian international reserve assets increased by 23.9 percent (152.4 tonnes) in 2010 to reach 25.4 million net troy ounces (790 tonnes) as of January 1, 2011, Prime Tass said. As of January 1, 2009, the amount of monetary gold in Russia's international reserves was at 16.4 million ounces (510.1 tonnes), the economic news agency said. In 2009, the central bank's gold reserves increased by 4.1 million ounces (127.5 tonnes) to reach 20.5 million ounces (637.6 tonnes) as of January 1, 2010, Prime Tass said.  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  Re: réserves d'or de la banque centrale de russie Re: réserves d'or de la banque centrale de russie

par marie Sam 29 Jan 2011 - 17:20 | |

| la russie passe au 8eme rang des réserves mondiales d'or, devant le japon

Russia lifts gold reserves to world's 8th largest

* Russian cenbank adds 135 T to gold holdings

* Russia overtakes Japan in league table of gold holders

* Less than 1 T of gold sold by cenbanks in CBGA yr to date

LONDON, Jan 28 (Reuters) - Russia added 135 tonnes of gold to its reserves in the first eleven months of last year, including 9 tonnes in December, to become the world's eighth largest bullion holder, the World Gold Council said on Friday.

The WGC said in a statement that with these additional purchases, Russia has surpassed Japan in gold reserves. Central banks' interest in gold has risen in recent years as the global financial crisis boosted gold's appeal as a haven from risk.

This has in turn helped support prices of the precious metal , which rose nearly 30 percent last year, hitting record highs at $1,430.95 an ounce.

"This week deputy chairman Georgy Luntovsky of the Central Bank of Russia indicated that gold reserves at the bank increased by 280 tonnes over the past two years and would continue to grow at a similar speed, with purchases of at least 100 tonnes every year," bank Natixis said in a research note.

"Russia seeks to do so through domestic mine production and not imports, as was implied by prime minister Vladimir Putin in recent comments," it added.

Russia was expected to be the world's fifth largest gold producer last year behind China, Australia, the United States and South Africa, metals consultancy GFMS said, with output of 205.2 tonnes.

************

accessoirement, mais ceux qui suivent la file WAG, le savent déjà deouis longtemps nos bons amis du WGC nous confirment que les banques de l'eurosystéme, signataires du wag, ont quasi cessé leurs ventes ..

et se gardent bien de faire remarquer que compte tenu des achats des BC "orientales", les BC sont passées net acheteuses !

EURO ZONE CEBANK SALES EASE

The WGC added that gold sales from euro zone central banks had amounted to less than 1 tonne in the second year of the Central Bank Gold Agreement to date, which started in late September. Annual sales under the CBGA are capped at 400 tonnes.

Total sales in the second year of the pact so far, including those made by the International Monetary Fund, totalled 52.2 tonnes. The IMF is not a signatory of the pact, but agreed to make 403 tonnes of planned sales under its umbrella.

Its sales programme finished in December.

The five-year CBGA was first signed in 1999 to curb hefty official sales that had pressured gold prices in the 1990s, and is currently in the second year of its third incarnation.

Sales in the first year of the third pact totalled just 136 tonnes, down from 497.2 tonnes five years previously.

The WGC said the latest figures demonstrate "a reduced appetite among the eurozone banks for disposing of gold reserves."   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Russia just increased their December 2013 gold holdings by 700,000 ounces of gold = 21.77 tonnes Russia just increased their December 2013 gold holdings by 700,000 ounces of gold = 21.77 tonnes

par g.sandro Ven 24 Jan 2014 - 0:39 | |

| *Russian Gold Purchase

Source: Le Midas du jour

Bill,

I have been tracking the Russian Central Bank gold purchases since October of 2006. Until today, the Russian Central Bank gold purchases seemed to have recently gone dead. There was no change in the Russian Central Bank gold holdings for Sept. 2013, Oct. 2013, and Nov. 2013.

Normally, the Russian Central Bank reports changes in their gold holdings like clockwork on the 20th of each month. When I checked again on January 21, there was no report for December of 2013. I was starting to wonder if the Russian Central Bank website was broken. When I checked again today on January 22, they finally reported their change in gold holdings for December 2013. Russia just increased their December 2013 gold holdings by 700,000 ounces to 33.3 million ounces. The monthly increase of 700,000 ounces is tied for the 3rd biggest increase since Oct. of 2006. You have to go back to September of 2010 to find an increase of 700,000 ounces of gold for 1 month.

http://www.cbr.ru/eng/statistics/credit_statistics/print.asp?file=liquidity_e.htm

To put this into perspective, 700,000 ounces of gold = 21.77 tonnes. China took delivery of 204.88 tonnes of gold in December of 2013 through the SGE. China is on track to take delivery of another 200 tonnes or so in January of 2014 if they keep buying at this pace.

The timing of the Russian gold purchase is of the most interest to me. Russia makes no change in gold holdings for September, October, and November of 2013 as gold is testing its bottom in December of 2013. All of a sudden, Russia makes a very large purchase in December of 2013. Did Russia anticipate a double bottom in December of 2013?

It is very unusual for Russia to report no change in gold holdings for 3 months in a row as they did for September through November of 2013. You have to go back to March 2007 through May 2007 to find another 3 month time period with no change in gold holdings. June 2007 turned out to be an excellent time to resume gold purchases.

Paulpaul@thegoldandsilveranalyst.com  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  + 7.245 tonnes en février + 7.245 tonnes en février

par marie Mer 26 Mar 2014 - 15:10 | |

| + 7.245 tonnes d'or en février, pour un montant total de 1040 tonnes, avec les sanctions contre la Russie, on pourrait voir des choses interessantes ... - Citation :

- Russia has increased its gold holdings by 7.247 tonnes to 1,042 tonnes in February. Turkey and Kazakhstan also raised their bullion reserves, data from the International Monetary Fund showed today.

Turkey's gold holdings rose 9.292 tonnes to 497.869 tonnes, the data showed.

Many analysts are ignoring the important context of today's new geopolitical backdrop. Russia alone has some $400 billion in foreign exchange reserves - mostly in U.S. dollars. If they were to diversify just 5%, worth some $20 billion, of those reserves into gold - it would be equal to nearly 500 tonnes of gold or nearly 25% of global annual production.

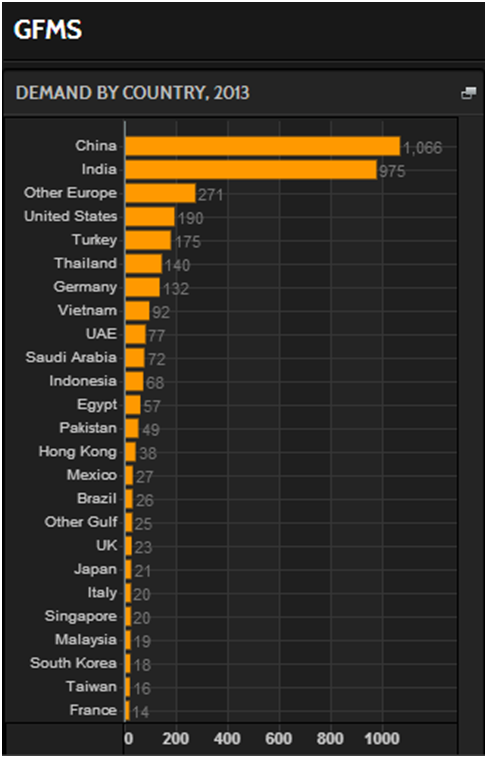

Demand By Country (GFMS via Thomson Reuters)

Russia bought another 7.247 tonnes of gold in February. It will be interesting to see what Russian demand is in March and indeed in the coming months. Sanctions could lead to materially higher demand from the Russian central bank, Bank Rossii.

This would cause a material strain on the already fragile supply demand dynamics of the physical gold market. The possibility of a default on the COMEX gold exchange would become more likely, with a consequent surge in the cost of gold coins and bars and a difficulty of securing physical gold either in

allocated gold accounts or for delivery. http://www.goldcore.com/goldcore_blog/Russia_Raises_Gold_Holdings_By_7.247_Tonnes_To_Over_1040_Tonnes_In_February  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Le génial coup du cavalier de Poutine a fait gagner à la Russie 20 milliards de dollars en quelques jours Le génial coup du cavalier de Poutine a fait gagner à la Russie 20 milliards de dollars en quelques jours

par g.sandro Jeu 10 Avr 2014 - 0:04 | |

| Le génial coup du cavalier de Poutine a fait gagner à la Russie 20 milliards de dollars en quelques jours par Sergey Shikunov http://www.tlaxcala-int.org/article.asp?reference=11839 La Russie a mis à profit la crise de Crimée pour réaliser un coup en bourse fumant : en quelques jours, le pays a gagné 20 milliards de dollars et a récupéré une grande partie des actions des grandes entreprises énergétiques russes qui étaient aux mains d'investisseurs ouest-européens et usaméricains. Jusqu'à récemment une partie des actions des entreprises énergétiques russes appartenaient à desinvestisseurs étrangers (US et Européens). Cela signifiait que presque la moitié des revenus de l'industrie gazière et pétrolière n'allaient pas dans les caisses de l'État russe, mais sur les comptes des "requins de la finance" occidentaux. Au fil de la crise en Crimée le rouble a commencé à chuter fortement, mais la banque centrale russe n'a rien fait pour soutenir son cours. Des rumeurs ont même commencé à circuler, selon lesquelles la Russie n'aurait simplement pas eu de réserves de devises lui permettant de maintenir le cours du rouble. Ces rumeurs et les déclarations de Poutine, se disant prêt à protéger la population russophone de l'Ukraine, ont conduit à une forte baisse des prix des actions des entreprises d'énergie russes, et les "requins de la finance " ont commencé à mettre en vente des actions avant qu'elles perdent toute valeur. Poutine a attendu toute la semaine et s'est contenté de sourire à des conférences de presse, mais quand les prix des actions ont atteint le plancher, il a donné pour instructions d'acheter rapidement et simultanément ces actions à tous les Européens et USAricains . Le temps que les " requins" comprennent qu'ils avaient été roulés dans la farine, il était déjà trop tard : les actions étaient entre les mains des Russes. Non seulement la Russie a gagné en ces quelques jours environ 20 milliards de dollars , elle a aussi ramené à domicile les actions de ses entreprises. Maintenant, les revenus du pétrole et du gaz ne s'écouleront plus à l'étranger, mais resteront en Russie, le rouble se redresse de lui-même, il ne sera pas nécessaire  de toucher aux réserves d'or de toucher aux réserves d'or    de la Russie pour le relever, et les "requins" de la Russie pour le relever, et les "requins"  sont éberlués sont éberlués   . . Leurs actions, qui rapportent des milliards de dollars, ont été rachetées en quelques minutes pour quelques centimes et les ont laissés sans revenus du pétrole et du gaz. L'histoire des marchés boursiers avait rarement vu une opération aussi brillante.  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  Re: réserves d'or de la banque centrale de russie Re: réserves d'or de la banque centrale de russie

par Imhotep Jeu 10 Avr 2014 - 0:58 | |

| Ouais enfin : "Leurs actions, qui rapportent des milliards de dollars, ont été rachetées en quelques minutes pour quelques centimes"

quelques centimes faut pas charrier, les marchés russes ont perdu une vingtaine de % tout au plus avant de remonter, même à -20% c'est quand même des milliards

"quand les prix des actions ont atteint le plancher, il a donné pour instructions d'acheter rapidement et simultanément ces actions à tous les Européens et USAricains"

c'est bien connu, Poutine connait exactement le point bas de marchés boursiers, seul face aux fameux "requins" de la finance qui vendent par millions simultanément et en panique, facile ! il devrait arrêter de se faire chier au Kremlin et faire du trading allongé dans un transat aux caraibes

"les "requins de la finance " ont commencé à mettre en vente des actions avant qu'elles perdent toute valeur."

mais bien sûr, ces fameux "requins" sont tous passés en mode panique comme des abrutis, c'est bien connu en bourse, c'est les requins de la finance qui sont toujours les dindons de la farce ... je me demande pourquoi on les appelle pas les "pigeons" de la finance ;-)

Non franchement, comme sur tout sujet il faut avoir un peu de recul, l'histoire est belle, pourquoi pas certains investisseurs qui ont eu la chance d'en profiter, bravo à eux, mais là on entre clairement dans la propagande style "vous avez vu comme on est forts nous les russes et notre grand timonier"

ça mériterait de chercher un peu de détail sur ce Sergey Shikunov mais j'ai pas envie là !  Si tu es prêt à sacrifier ta liberté pour te sentir en sécurité, tu ne mérites ni l'une ni l'autre.En matière de complots, il y a deux pièges à éviter : le premier, c'est d'en voir nulle part ... et le second c'est d'en voir partout.A la bourse tu as deux choix : t'enrichir lentement ou t'appauvrir rapidement. Si tu es prêt à sacrifier ta liberté pour te sentir en sécurité, tu ne mérites ni l'une ni l'autre.En matière de complots, il y a deux pièges à éviter : le premier, c'est d'en voir nulle part ... et le second c'est d'en voir partout.A la bourse tu as deux choix : t'enrichir lentement ou t'appauvrir rapidement.

J'ai dépensé 90% de mon fric en filles, boissons et bagnoles. Le reste je l'ai gaspillé |

|

Chef cuistot

Inscription : 26/09/2011

Messages : 1558

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  la Russie achète 900.000 onces d'or en Avril soit 28 tonnes la Russie achète 900.000 onces d'or en Avril soit 28 tonnes

par marie Mer 21 Mai 2014 - 16:08 | |

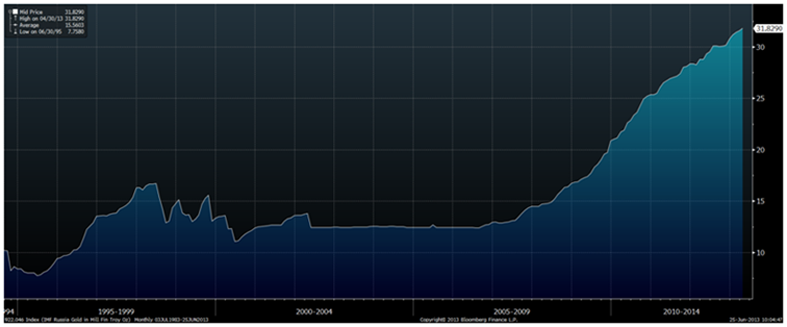

| la Russie achète 900.000 onces d'or en Avril soit 28 tonnes , portant ses réserves à 34.4 millions d'onces d'or, ce qui ne représente que 10% du montant total de ses réserves en devises  Réserves d'or de la Russie en Million Fine Troy Ounces - 1995-2014 - Monthly Chart (Bloomberg) Réserves d'or de la Russie en Million Fine Troy Ounces - 1995-2014 - Monthly Chart (Bloomberg) - Citation :

-

Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April

The Russian central bank has again increased its gold reserves by another 900,000 ounces worth $1.17 billion in April.

Russia's gold reserves rose to 34.4 million troy ounces in April, from 33.5 million troy ounces in March, the Russian central bank announced on its website yesterday. The value of its gold holdings rose to $44.30 billion as of May 1, compared with $43.36 billion a month earlier, it added.../...

Russia's gold & foreign exchange reserves remained virtually unchanged at USD 471.1billion in the week ending May 9. Russia’s reserves have fallen since the crisis began but remain very sizeable. The reserves include monetary gold, special drawing rights, reserve position at the IMF and foreign exchange.

The 900,000 ounce purchase is a lot of physical gold in ounce or tonnage terms but as a percentage of Russian foreign exchange reserves it is a very small 0.24%.

Gold as a percentage of the overall Russian reserves is now nearly 10%. This remains well below the average gold holding as a percentage of foreign exchange reserves of major central banks such as the Bundesbank, Bank of France and the Federal Reserve which is over 65%.

The Russian central bank has been gradually increasing the Russian reserves since 2006 (see chart above). On average they have been accumulating 0.5 million troy ounces every month. Therefore, the near 1 million ounce purchase in April is a definite increase in demand. http://www.goldcore.com/goldcore_blog/Russia_Buys_900_000_Ounces_Of_Gold_Worth_1_17_Billion_Dollars_In_April   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

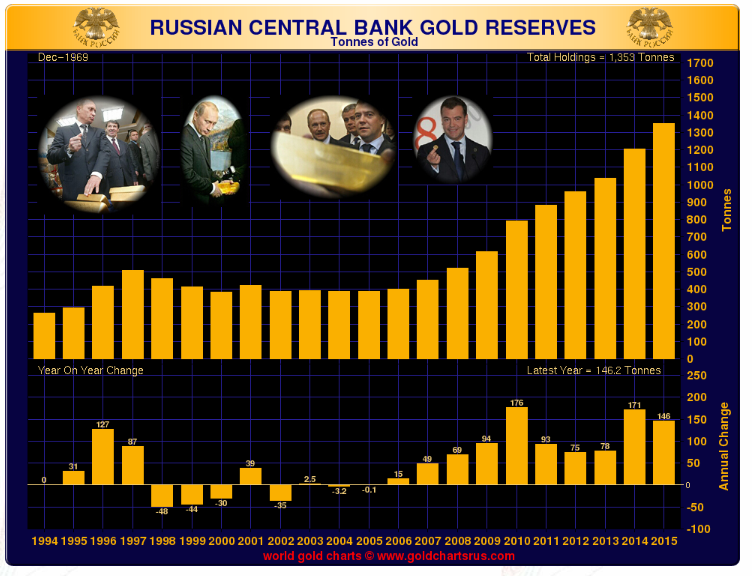

| |   |  + 31.3 tonnés d'or en août 2015 + 31.3 tonnés d'or en août 2015

par marie Lun 21 Sep 2015 - 16:54 | |

| achat de 31.3 tonnes d'or en août 2015record depuis mars ( 30.5 tonnes )    Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  + 34.21 tonnes d'or en septembre 2015 + 34.21 tonnes d'or en septembre 2015

par marie Mer 21 Oct 2015 - 17:41 | |

| achat de 34.21 tonnes d'or en septembre 2015portant le total de ses réserves à 1353 tonnes d'or    Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par marie le Ven 20 Nov 2015 - 21:17, édité 2 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

| |   | |

Sujets similaires |  |

|

| Page 2 sur 3 | Aller à la page :  1, 2, 3 1, 2, 3  | | | | Permission de ce forum: | Vous ne pouvez pas répondre aux sujets dans ce forum

| |

| |

; | |

Hardinvestor

Hardinvestor

Hardinvestor

Hardinvestor

» COMSTOCK MINING Inc. (NYSE : LODE) Fil dédié:

» WORLD WAR III ? je suis vert de rage d'ouvrir ce fil dédié, on serre les miches: on commence avec Gerald Celente

» Les Podcast et interviews de David Brady, Sprott, Rick Rule, Katusa, Bix Weir, etc...SILJ (Hardin mini-fonds Silver Juniors et Royalties)

» Uranium /minières uranium

» a quoi joue la Russie ..

» TREASURY METALS PFS publiée edit: *NB: TML est devenue NEXTGOLD (NXG)

» Wheaton précious metals/ WPM

» Comment l'Union européenne nous prend pour des imbéciles