|

| | Martin Armstrong /file de suivi de ses principaux articles |    |

| |

| Message | Auteur |

|---|

Martin Armstrong /file de suivi de ses principaux articles Martin Armstrong /file de suivi de ses principaux articles

par marie Mar 15 Mar 2011 - 4:50 | |

| Martin Armstrong est libéré MartinArmsrongRelease03-08-2011.pdfet pour ma part j'en suis ravie ...... pour ceux qui ne connaissent pas encore le bonhomme et son back ground www.lemetropolecafe.comThe Martin Armstrong saga has been an incredible one. Where it all started as far as GATA is concerned... September 7, 1999 - Spot Gold $256.30 a big unch. - Spot Silver $5.15 down 4 cents Princeton Economics Director Charged in Multi-Billion Fraud New York, Sept 13 (Bloomberg) -- "An officer of Princeton Economics International Inc, a money-management firm, has been arrested and charged with cheating Japanese investors in a multi-billion ponzi scheme that was allegedly aided by a top executive of Republic New York Securities Corp., prosecutors said. Princeton Economics director Martin Armstrong cheated Japanese clients of the firm, which sold more than $3 billion of notes, U. S. prosecutors charged. Of that money, about $1 billion is still owed to investors of Princeton Economics, according to a criminal complaint filed in federal court in New York. The president of Republic New York Securities' futures division at the time of the alleged wrongdoing provided Armstrong with false confirmation letters purporting to show that the clients' investments were worth far more than they actually were, prosecutors alleged. The charges didn't name the Republic executive. Princeton, New Jersey-based Princeton Economics and its units maintained Princeton Economics investors' accounts at Republic New York Securities, the charges said. Republic Securities and its parent company, Republic New York Corp., weren't charged, according to the U.S. Attorney's Office in New York. Armstrong, Princeton Economics, and another company Armstrong controlled -- Princeton Global Management Ltd. -- were also sued for fraud by the U.S. Securities and Exchange Commission." Reuters just added the following info: "Princeton covered up $500 million in trading losses in accounts held for some 300 Japanese investors, prosecutors said…… In fact, the officials charge, accounts were commingled using funds in one to pay off interest due in another. In addition, Armstrong ran up trading losses of more than $504 million……. The U.S. Attorney's office and the SEC estimate that Armstrong owes investors a total of $1 billion against a remaining balance of $46 million in his funds…. Armstrong faces up to 10 years in jail and a fine of $1 million or twice the gain or loss resulting from the crime." This is the same Martin Armstrong that had this to say to GATA Secretary, Chris Powell: Dear Chris: I understand your frustration that gold has been perhaps the worst investment for the past 20 years. But to argue that it is being manipulated due to large short positions is not justified. There is no interest in gold at this time and the central banks are all sellers. After they sell their gold, then we will see a bull market. Once those supplies are gone, no one will be able to lean on that supply and your bull market will begin. I hate to tell you, but gold will drop to under $200 before it turns. I find it extremely one-sided how a Buffet and company of tagalongs is not a manipulation because they buy, while selling is a manipulation. The very guys you argue are manipulating gold down were big sellers of gold and buyers of silver during the Buffet rally. GS or not, the economy simply does not support your position. And I do not want to hear how I am short or some nonsense to try to discredit my views, because it is not true. PEI owns a 51 percent stake in a public gold mine in Australia. That is my long-term view; it does not change my short-term view. And made this public commentary about GATA: Gold: Manipulation or Exaggeration? By Martin A. Armstrong Copyright 1999 / Princeton Economics International June 10, 1999 "A two-man army, calling itself GATA, has begun to besiege the media, attempting to gain a lot of press on the platform that gold is being "manipulated" by a cartel of investment banks. They constantly point to what they call the huge "carry trade" in gold where there is far more gold sold than exists." *** I am not sure where to begin here. First, I hate to see anybody go down, but the man has no concept of reality and has mocked us in public. This is what GATA has been fighting - so many like him. How many other "accepted" mainstream gold shorts are feeding the public the same drivel? So let us get to what this might mean. First, even bullion dealers that deny he is short hundreds of tonnes of gold, say that they believe he is mega short silver. One called tonight and wanted to know what the price of silver was doing. Second, we have heard now from two, very, very good sources that Martin Armstrong is short 24 million ounces of gold. That is right, 746 tonnes of gold. How is that going to be covered if he is wiped out? The press statement says that $1 billion is owed to Princeton Economics Investors. Where is the money?. Did it all go down the drain in a short crude oil/short yen/long bond position? Will the Fed pull another LTCM to bail out another loser? The LTCM bailout happened, in part, because the investors were part of the establishment "in crowd." Armstrong is an outsider and now that law enforcement is involved, that does not seem likely. So, if we are correct about his humongous "borrowed gold" short position, how does that get covered? What will Republic Bank do about the matter? We will stay all over it for you. What this may do is to shed some light on what the Café has been telling you month after month. The gold loans are much, much bigger than any of the mainstream crowd understands or is letting on. We now think they are short 10,000 to 13,000 tonnes. We think the specs have borrowed more gold than few, outside of our crowd, can imagine. We believe just 4 hedge funds are short 50 million ounces of gold, or almost 1500 tonnes. "4". What about all the spec gold borrowers combined? All that physical "borrowed gold" supply that has hit the market is what has kept the gold price so low. The "Hannibal Cannibals" have been trying to keep that fact from the gold community and press at large. The Café and GATA have been trying to bring the truth out - and few will listen. The next few months could be incredibly exciting as the gold market "scam" becomes self evident. I leave for Vancouver tomorrow morning, be back Wednesday nite. Will have much to say by Thursday. I am sure... *** Times change ... fast forward to this commentary in MIDAS: December 31, 2008 - Gold $882.80 up $13.80 - Silver $11.27 up 35 cents On Martin Armstrong, formerly of Princeton Economics and of very high acclaim, who has been in jail nearly as long as my MIDAS commentary…. Hi Bill If you have not seen it Martin Armstrong has written a 77 page treatise and there is a link to it at this page. It is a truly fascinating expose that documents the manipulation of various markets by the 'club' along with a bunch of other stuff, its brilliant & well worth a read. Happy New Year Cheers Alan Brownhttp://www.contrahour.com/contrahour/2008/11/martin-armstrongs-new-essay-its-just-time.html….. It is an interesting read, best part starts at p 43. There is a load of comments from Armstrong that implicate JP Morgan, Goldman Sachs, the CFTC, Buffet (the silver play of 1997) etc. All these completely support what Gata has been on about, empirical evidence of CP's statement that "there are no such thing as free markets in the US." What is most impressive to me is MA's humility.. they have screwed him completely and yet he pleads for free market activity, without the interference from the manipulators. In some ways it is a very tough read... cheers AB Over the years GATA's CP tried to visit Martin A in jail, but was denied. During the time Chris, which seems like forever, Chris also received some correspondence from Martin A. The case was a strange one. Martin Armstrong was known as one of THE financial gurus in the world at the time of his arrest. If you care to learn more, you can do a Cafe Search. All I know is Martin Armstrong spent as much time in jail as those who commit murder ... a tragic story all the way around. Martin Armstrong was released from jail last week. A letter from him... MartinArmsrongRelease03-08-2011.pdfMartin Armstrong paid some price for whatever he did, or did not do. We wish him well.   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par marie le Ven 17 Fév 2012 - 14:25, édité 1 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par nofear Mar 15 Mar 2011 - 12:36 | |

|   Nofear / Hardinvestor / On appelle esprit libre celui qui pense autrement qu'on ne s'y attend de sa part en raison de son origine, de son milieu, de son état et de sa fonction, ou en raison des opinions régnantes de son temps. Il est l'exception, les esprits asservis sont la règle. Ce que ceux-ci lui reprochent, c'est que ses libres principes, ou bien ont leur source dans le désir de surprendre ou bien permettent de conclure à des actes libres, c'est-à-dire de ceux qui sont inconciliables avec la morale asservie." (Friedrich NIETZSCHE, Humain, trop humain) mon tweet perso: @ghostbikerman |

|

Chef cuistot

Inscription : 03/10/2009

Messages : 2398

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par marie Mar 22 Mar 2011 - 13:39 | |

| http://www.businessweek.com/news/2011-03-15/financier-martin-armstrong-released-after-11-years-in-jail.html Financier Martin Armstrong Released After 11 Years in JailMarch 15, 2011, 6:46 PM EDT By Zeke Faux and David Glovin (Updates with Armstrong statement in third paragraph.) March 15 (Bloomberg) -- Financier Martin Armstrong, jailed since January 2000 on civil and criminal charges stemming from what prosecutors said was a $700 million Ponzi scheme, was released from prison last week. Armstrong, the founder of now-defunct Princeton Economics International Ltd., will be confined to his home until his time in federal custody ends in September, said Chris Burke, a spokesman for the U.S. Federal Bureau of Prisons. Armstrong is permitted to leave for work and will check in periodically at a halfway house in the Philadelphia area. “I would like to take the time to thank everyone who has stood by me these many years,” said a letter under Armstrong’s name posted on the website MartinArmstrong.org. “What I have seen is the deep corruption that lingers through the political- financial system that threatens the future of my family and friends.” Armstrong was jailed a record seven years for defying a judge’s order to produce gold bars, coins and other assets. His detention for contempt in a high-security Manhattan prison was the longest of its kind in a federal white-collar civil case. In 2006, Armstrong was sentenced to five more years in prison after pleading guilty to conspiracy in a related criminal case. He has repeatedly challenged his guilty plea. The former money manager built his reputation on his theory that economic cycles recur over centuries. His firm, which was based in Princeton, New Jersey, operated from an office overlooking Tokyo’s Imperial Palace and grew to manage as much as $3 billion. Japanese Investors Thomas Sjoblom, a lawyer who represented Armstrong when he was jailed for contempt, didn’t immediately respond to a phone call and e-mail seeking comment. Armstrong’s daughter didn’t immediately respond to an e-mailed request for comment. Armstrong was charged in 1999 with defrauding mostly Japanese investors out of more than $700 million. In December 2001, Republic Securities, now a unit of HSBC Holdings Plc, pleaded guilty to helping Armstrong swindle Japanese clients and paid $569 million, then the largest reimbursement by any corporation to investors victimized in a fraud. Two ex-Republic employees and a former Armstrong worker also pleaded guilty. In the civil case, the Securities and Exchange Commission and the Commodity Futures Trading Commission sued Princeton Economics and Armstrong in 1999. The judge in that case jailed Armstrong in January 2000 for contempt after Armstrong refused to surrender $14.9 million in gold bars and rare coins. Violent Attack Armstrong said he didn’t have them to turn over. While in prison, Armstrong said he spent lengthy periods in isolation. A violent attack left him hospitalized in intensive care. Armstrong spent his first 7 1/2 years in a high-security federal detention center in Manhattan and the remainder of his sentence in a prison camp in New Jersey. The criminal case is U.S. v. Armstrong, 99-cr-997, U.S. District Court, Southern District of New York (Manhattan). --Editors: Stephen Farr, Pierre Paulden. To contact the reporter on this story: Zeke Faux in New York at zfaux@bloomberg.net; David Glovin in Manhattan federal court at dglovin@bloomberg.net. To contact the editor responsible for this story: David Rovella at drovella@bloomberg.net.   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par nofear Jeu 31 Mar 2011 - 23:29 | |

| HOW and When sa dernière mouture avec un gold à 5000 - 12500 dollars http://www.martinarmstrong.org/files/how%20and%20when%2003-01-2011.pdfet la réponse de Jim sinclair : comment ? quand? mais surtout pourquoi? - Citation :

- Why in the world, if you believe that the gold price can go to $5000

and $12,500, as the article says, do you give a damn about the next 90

days?

You must realize that the economic and political damage is already done.

You must realize that the mountain of OTC derivative paper is not going away.

You

must realize that all the old legacy assets (broken OTC derivatives)

demand to be adjusted at each market turn in order to maintain any

semblance that they are serious contracts.

You must realize that this adjustment means adding on new OTC derivatives.

You must realize that this means the mountain of OTC derivative weapons of mass financial destruction can only grow.

You

must realize that it is not whether or not QE will continue, it is what

it already has done to the Western economies that much higher gold

prices will reflect.

You must realize this is not a business problem, but rather a debt problem as it applies to the gold price.

You must realize the monumental change in the Middle East is NOT positive for the West in any manner, shape or form.

You must realize that the change in the Middle East is from some form of government to chaos.

You must realize that the beneficiaries of chaos in the Middle East are Iran and Russia.

You must realize that the main product of the establishment of a no fly zone in Libya is to benefit the Rebels.

You must realize that the rebels are an unknown factor in Libya.

You must realize that a second product of the no fly zone is greater hatred in the Middle East for all things West.

You must realize that the peak production of energy is behind us.

You must realize that the production of energy in chaos will be less than under some form of rule.

You

must realize that this combination of monumental Middle East change and

peak oil means peak oil is no longer a consideration 10 to 15 years

from now, it is now.

You must realize that the Angels (gold

prices) are not simple talk but rather a method used by the great market

maven, Jesse Livermore.

You must realize that on the next trip to $1444, that price will fall to the long term bull market on gold.

You must realize that $1650, a place where gold will trade, is so low it will be comical looking back from 2015.

You must realize that "QE to Infinity" is not a choice but all there is left in the tool box of the US Fed.

You must realize the truth of today’s comment by Dallas Federal Reserve Bank President.

You must realize that what the President of the Federal Reserve Bank fears will occur.

You must realize no sovereign country needs to go broke.

You must realize they simply refer to QE as policy.

You must realize that it is the currency that breaks, not the country.

You

must realize that the point of correctness in the article "How and

When" that is true is his $5000 to $12,500 figure and not the

prognostications of the next 90 days.

http://jsmineset.com/2011/03/24/how-when-but-more-importantly-why/   Nofear / Hardinvestor / On appelle esprit libre celui qui pense autrement qu'on ne s'y attend de sa part en raison de son origine, de son milieu, de son état et de sa fonction, ou en raison des opinions régnantes de son temps. Il est l'exception, les esprits asservis sont la règle. Ce que ceux-ci lui reprochent, c'est que ses libres principes, ou bien ont leur source dans le désir de surprendre ou bien permettent de conclure à des actes libres, c'est-à-dire de ceux qui sont inconciliables avec la morale asservie." (Friedrich NIETZSCHE, Humain, trop humain) mon tweet perso: @ghostbikerman |

|

Chef cuistot

Inscription : 03/10/2009

Messages : 2398

| |   |  manip de Philbro et de Buffett sur silver market1993-1997 manip de Philbro et de Buffett sur silver market1993-1997

par marie Ven 17 Fév 2012 - 14:24 | |

| L'article traite de la façon dont la recherche et les analystes sont en conflit et comment les analystes et les investisseurs et les gourous peuvent être aveuglés par leurs préjugés un vrai bull market ( ou un vrai marché baissier ), non manipulé, monte ou baisse dans TOUTES les devises et reprend en intro et en détail, la collusion Buffett-Philbro contre Armstrong à titre d'illustration de cette période, graphique de l'argent avec les achats 1997 de Buffett Comme vous le voyez sur le graphe, c'est à ce moment là que Buffett a acheté 1/5eme de la production mondiale : les prix ont rebondi, mais le soufflet s'est rapidement dégonflé.  c'est un très long Pdf, dont voici l'extrait essentiel. Murphy confirme d'ailleurs que le trader "silver" de Philbro était bien, à l'époque, Jimmy DiPiazzaEh oui .. - Citation :

-

10 February 2012

Martin Armstrong on metals manipulation Below are some relevant extracts from Martin Armstrong's The Analytical Shill. The article is generally about how research and analysts are conflicted and how analysts and investors and gurus can be blinded by their biases. The paragraphs below are straight from the article and will jump around a bit because I've just pasted them in order they appeared without all the extraneous stuff. Martin Armstrong: The metals were one favorite sector where they were constantly bullish – never bearish for 19 years. But hey, the market manipulators always needed cheer-leaders to get people to buy every high so they could sell. On the Buffett Silver Manipulation, it was PhiBro who had a shill call the Wall Street Journal and tell them I was trying to manipulate silver down because I was short. When the WSJ & I argued and they refused to print the name Buffett they demanded I give them, that forced the CFTC to act calling me to ask where was it taking place. I told them London and they called the Bank of England. When they in turn ordered all silver brokers to show up the next morning, Buffett was forced to come out and admit he bought $1 billion worth of silver but denied he was manipulating the price. You can ask the guys at GATA. They were well aware of the first 1993 Manipulation by PhiBro (Philips Brothers). They got in bed with Buffett when he stepped in to run Salomon Brothers after they got caught MANIPULATING the US Government bond auctions. They began buying silver and the CFTC stepped in demanding to know who their client was. Now if it had been anyone else, PhiBro’s reply was they refused to tell the name of the client. Forget the law. That does not apply to New York firms. The CFTC responded saying if they could not know who their client was, then PhilBro had to exist the trade. They did and of course made a fortune for the hawkers had all the little guys buy silver just in time for PhilBro to sell it to them. This is WHY the manipulations began to move to London. Not only did PhiBro try to get me on board, their broker walked across the floor and SHOWED my broker Buffett’s orders at the low! To create the fundamental, they moved inventory from New York to London. They were manipulating silver as always. Playing games with the inventories. They were moving silver from New York to London where the Buffett orders were being executed. This made the US warehouse inventories drop sharply. Go look at the analysts who talked silver up on that very fundamental. If they said there was a shortage of silver and you better buy it is going to $100, then you may be dealing with a shill or a biased analyst. Many of the metals analysts with an agenda back then hated my guts. How dare I say there was a manipulation when it was at last silver was going up instead of down. Now I was part of some covert conspiracy hell bent on suppressing the metals because I dared to say "they are back" (manipulators) and the target was $7 by January 1998. To this crowd, a manipulation is always to the downside and never up. Go check the recommendations of analysts back then. See where they stood. The best one I heard was silver was in demand in London because it was .9999 there instead of .999 in New York. GATA began to see the same nonsense that I did during the early 1990s. It was just that I saw the manipulations as being UNBIASED. In other words, they did not care what they manipulated as long as there was a guaranteed profit. They manipulated even base metals such as rhodium. They manipulated platinum in league with Russian politicians who strangely recalled all platinum to take an inventory. Hell, Ford Motor Company filed suit over that manipulation. How do you distinguish a REAL bull market from a bullshit manipulation? Most manipulations can be seen easily when you look at a market in terms of a Basket of Currencies. Why? Because a REAL bull market must take place ONLY when it rises in terms of ALL currencies. Unless that takes place, investors in some countries will be sellers while others are buyers. Here is a classic example as to why we were bearish on gold for 19 years despite the hate mail and the best attacks of the shills. The manipulators ALWAYS need to get the metals guys worked up into a fever to sell to them to make their profits and big bonuses. So when analysts only espouse one side, be very careful. For no matter what the market, there is always a time to rally and a time to pause. Nothing is ever straight up or straight down. Anyone who portrays that is either ignorant of the market behavior, or a shill – paid cheer-leader. Putting out bogus research has been the name of the game. Unfortunately, there are just some people who are hardcore. Markets are the same mix as politics. There are people who simply believe in a given position and no matter what you say or what evidence you present to the contrary, they will never believe it. Thus, I have NEVER been interested in preaching to the choir. I have always preferred the independent thinker – the investor who wants to really learn about market behavior and not read someone who simply supports their never changing view of the world. Nor am I interested in exchange words with those who may not be shills, but are just part of a particular hardcore group. I am cheered only when I agree, and if I disagree, I am despised. But that is expected in the retail world – NEVER in the professional institutional world. There cannot be a perpetual bull market in anything anymore than you can stand there with your arm straight up in the air. Oh shore, you can do it briefly. But then your arm will feel so heavy you can no longer keep it up. Everything takes a pause for the same reason you sleep at night. Nothing can maintain the same energy output all the time. People come up with all sorts of excuses why they are right yet the market declines. Usually it is some conspiracy of a mythical group so powerful that they just win. Markets collapse because EVERYONE who ever thought of buying has bought. They are now counting their profits for the next eternity. Something happens and scares the herd. Suddenly, the long try to sell but there is no bid. The market collapses in the blink of an eye. Why, because the majority has already bought and there are no new buyers to keep the momentum going. It is never some mythical short player preventing the upward advance. It is just not time yet. Philip Tetlock, a professor of organizational behavior at the Haas Business School at the University of California-Berkeley, has been following the so called experts for some 25 years studying primarily the institutional forecasting skill of political experts. He had signed up nearly 300 academics, economists, policymakers and journalists keeping track of more than 82,000 forecasts plotting them against real-world results. He analyzed not just what the experts said but how they reasoned and how quickly they changed their mind in the face of contrary evidence. He also tracked how they reacted when they were wrong, which was of course the majority of the time. Most could not even beat a random forecast generator. Tetlock's research did discover that there was one kind of expert turns out consistently more accurate forecasts than others. The most important factor he discovered was not how much education or experience the experts had but how they actually thought. The best forecasters were those who were self-critical, eclectic thinkers who were constantly updating their beliefs when faced with contrary evidence instead of clinging to dogma. He found the best were suspicious of grand schemes and conspiracies and were more practical about their predictive ability. The less successful forecasters clung to the same ideas never wavering pushing the same idea to the breaking point of absurdity. These types of people were more often embraced by the media because they loved to articulate and persuade as to why their idea explained absolutely everything. Tetlock uncovered widespread forecasting failures. Of course, there is the herd of followers who for some reason want a GURU and unrealistically expect infallibility. This may reinforce the pundits that like to put on a show and claim why they are personally better than everyone else and only their ideas are correct and when wrong, it is the result of some giant conspiracy, not their lack of ability to forecast. The key to the future lies in the UNBIASED view of whatever it is. You cannot be married to a single position EVER! Tetlock points out that a successful analyst always qualifies their arguments with "however" and "perhaps," while the dangerous analysts build up momentum with "moreover" and "all the more so" as they try to be more entertaining. The dangerous analyst wants to keep the clients happy and to a large extent preaches to the choir telling them what they want to hear. The one thing about markets is that the MAJORITY just have to be wrong! Why? They are the fuel that drives the market up and down. Trap the majority either long or short and you create the fuel for the next move in the opposite direction. So for now, it is far better to let the markets speak. As I stated at just about every conference I have ever given, there is ONLY one analyst that is never wrong – that is the market itself. The key to successful trading & forecasting is to learn how to let the market speak to you and go with the flow. It does so in both TIME as well as PRICE. Turning points are NEVER specific events, but inflection points where highs and lows take place. It would have been nice to have a low first and a more orderly advance afterwards. But markets like to create the worst of all worlds. So for anyone who thinks he can beat the game as an analyst or trader, must remember one thing. The market is always right. To survive, we have to align ourselves with the market and listen when it speaks. This is not a game for arrogance and prognostications fixed in stone steeped in bias and dogma. History repeats – but also with a slight twist. So how high will gold go? It is a question of CONFIDENCE. You will ALWAYS be your greatest adversary, for to succeed you must conquer your own biases, fears, and doubts. You cannot do that as Philip Tetlock has keenly demonstrated with fixed ideas. If you are married to a philosophy and will not yield and blame everyone else for conspiring against you and that is the reason something has not yet unfolded, you better see a shrink. -END- http://armstrongeconomics.files.wordpress.com/2012/01/armstrongeconomics-analytical-shill-012712.pdf  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Rob Kirby explique pour quelles raisons réelles, Martin Armstrong a été emprisonné Rob Kirby explique pour quelles raisons réelles, Martin Armstrong a été emprisonné

par marie Mar 19 Juin 2012 - 17:13 | |

| ces raisons réelles sont d'après Kirby, le recyclage de faux lingots fourrés au tungsténe, via les activités de gold leasing ( préts d'or ) à travers le gold carry trade et la montée en puissance du hedging des années 1995 Martin Armstrong était en étroite relation avec Edmond Safra, un très puissant homme d'affaires , dont le job était d'écouler ces faux lingots, pour le compte de ..., évidemment En déc 1999, ce monsieur est assassiné dans des circonstances non élucidées ... et il détient des bandes magnétiques fort compromettantes, dont Armstrong, connait l'existence . Armstrong est arrété en sept de la même année et accusé de fraude massive par les autorités US On notera avec intérêt que la républic banque de N york, la boite de Safra, a été rachetée par... HSBC, après son assassinat. ******************* The real reason why Armstrong was jailed for so many years. Rob Kirby l'article originel ( très long ) a été publié sur le site de zero hedge en mars 2010 http://www.zerohedge.com/article/genesis-gold-tungsten-rest-storyextraits 1995 is the year that gold leasing “TOOK-OFF GLOBALLY”. We know this due to the historical record of communication between Frank Veneroso and Terry Smeeton [from the Bank of England];

I [Frank Veneroso] started out on this crazy voyage with a statement that was made by a man from the Bank of England---Mr. Terry Smeeton---who was in charge of the gold operations of the Bank of England. On something like November 21st or 22nd of 1995 at the 5th Annual Banking Conference in the city of London, he addressed the issue of gold lending. He gave some statistics. He basically said that gold lending had roughly doubled over the last year and a half. Precisely, what he said was that gold loans more than doubled and gold swaps increased by more than 50%.

Edmond Safra: Gold Was His SpecialtyEdmond Safra gradually built his banking empire at a prodigious pace. Gold was his specialty. He handled all the South African gold, the Russian gold, and several nations’ gold reserves. He single-handedly established the Eurodollar market so that Russian companies can hold their dollar reserves without fear of confiscation. His clientele was his main secret, and in the 1990's he may have controlled one trillion dollars. Edmond Safra’s Republic Bank of New York [no stranger to the clandestine precious metal trade], among others, were likely involved in facilitating the movement of ‘fake gold’. Safra, who had some 10 body guards, was found dead under extremely dubious circumstances in his Monaco condo on Dec. 3, 1999. Coincidentally, HSBC [a serial gold and precious metals futures shorter] now owns the former Republic Bank gold business. Safra and Martin Armstrong / Princeton Economics were confidants and business associates. To this end, there is a distinct Safra / Martin Armstrong nexus to this sordid story too: Armstrong was arrested Sept. 13 [1999] and charged with massive securities fraud by the U.S. Attorney's Office, the Securities and Exchange Commission and the Commodity Futures Trading Commission. He was jailed for contempt of court on Jan. 14, 2000. Excerpts of notes from GATA Chairman Bill Murphy’s Jan. 2000 phone conversation with Martin Armstrong:

“My [Bill Murphy’s] phone conversation with Armstrong touched on many subjects. I mostly just listened -- my mouth wide open most of the time, as the conversation centered around such subjects as Armstrong's receiving death threats from the Japanese, the billionaire's club that manipulates the metals markets, incriminating Republic Bank tapes, bribes paid in Thailand, the Japanese and Republic Bank, the persecution of his family, including his 81-year-old mother, and the efforts of the U.S Attorney's office efforts to deprive him of his First and Fifth Amendment rights.

The scariest part of the conversation was about Edmond Safra, the recently murdered Republic Bank founder. Marty knew which phone lines that Safra spoke on directly to the Republic traders. According to Armstrong, "All the conversations about every manipulation you ever wanted to hear are there." He said that the problem was that 10 days after he told the feds that he was after sensitive information that would expose the manipulations, Safra died mysteriously in Monaco.”……

,,,,,,,” He [Armstrong] told us that he could provide evidence (tapes and documents) that the metals markets in New York have been manipulated.”

Armstrong had revealed to federal authorities his knowledge that Safra had made tapes detailing gold market manipulation. 10 Days later Safra was dead. One can only wonder if tapes made by Safra, which Armstrong admitted to the Feds he knew about, led to Safra’s demise and Armstrong’s otherwise inexplicable incarceration. According to revelations made by GATA’s Bill Murphy - Armstrong had claimed he had access to these [Safra’s] tapes. In further correspondence from Armstrong [then in jail] to Chris Powell, GATA Secretary and Treasurer, it was revealed exactly how determined [afraid perhaps?] the U.S. Government was by preventing Armstrong from having his day in court [presumably, where taped evidence from Safra / Republic New York might surface]:

“Still alive so far. I will speak to my lawyer to see if early next week is OK for a meeting. One of our clients has sued Republic and we are unofficially cooperating together to try to get additional discovery.

U.S. government has rushed in to try to stay our discovery. We are about to make a fight next week to try to force Republic [New York] to comply with our subpoenas. The

bastards are hiding behind the U.S. government big-time.

I am not sure what is going on. I have been told that the receiver is now going to try a contempt charge for my not handing in my keys despite the fact that the locks and security codes have been changed.

They just don't want me out and about…..”

This explains why Armstrong ROTS in jail on trumped up charges to this day. It’s a WONDER he’s still alive.   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  controverse Hommel /Armstrong controverse Hommel /Armstrong

par g.sandro Mer 20 Juin 2012 - 8:34 | |

| ça tombe bien Armstrong vient de pondre un très long Pdf, où il avance entre autres, que si les marchés de dérivés ou de futures sur l'or n'existaient pas , l'or coterait à .... 55.000 $ l'once

http://www.inflateordie.com/files/Why%20You%20Should%20Buy%20Gold%2006-14-2012.pdf

réponse point par point de Jason Hommel

http://silverstockreport.com/2012/armstrong.html

En fait leur controverse (intéressante) porte sur les arguments (*ridicules selon Hommel) développés par Armstrong pour parvenir à ce chiffre de 55.000$:

Hommel est plus sur "61.000$....voire nettement plus si on se sert de la référence du plus cher costume en vente ...

(pour faire simple; il y a ensuite une mini polémique sur le périmètre, avec la haute couture sur mesure ou seulement en considérant prêt à porter et en intégrant une armure de cérémonie... ou pas) et c'est sur le reste:

(marchés des futures, notion de "monnaie" etc...) qu'ils se pouillent... Hommel se voulant "LE" défenseur du métal accuse même Armstrong de feindre d'en être un... - Citation :

Martin Armstrong: Wrong on Gold

(Is he a Charlatan or an Ignoramus? That's not the point.)

Silver Stock Report

by Jason Hommel, June 19th, 2012

On June 14th, Martin Armstrong bashed the idea that gold would be worth about $55,000 if there were no paper gold. He used only ridicule, not rational arguments, and he is wrong, as I will show.

First, I will present two facts.

The first fact is that all dollars are a form of paper gold, since they used to be a promise to deliver silver or gold on demand. Today, dollars are a form of defaulted gold bearer bonds that paid zero interest. They are literally a substitute for gold, and can be redeemed for gold at any gold dealer. If all the US debt were to be backed by the US gold hoard, we can see what the value would be. $16 trillion divided by 261 million OZ. = $61,000/OZ. which is not far off the number that Armstrong ridicules.

Second. An ounce of gold was not worth "a man's suit" in most of human history, unless you counted it as the most expensive suit possible, such as a suit of armor. The most expensive suits today range from $40,000 to $100,000 to even $1 million. Link: http://most-expensive.net/mens-suits

In 1441, a suit of squire's armor cost 5-6 pounds sterling in the 1500's.

http://www.lonniecolson.com/medieval/armourcost.html

By 1817, the pound became the British Sovereign, a gold coin worth about 1/4 of an ounce of gold. So, a suit of armor was worth about an ounce of gold, or about a year's salary.

In responding to Martin's comments, I will reply in ALL CAPS. I'M NOT SHOUTING, IT'S JUST EASIER TO READ WHO IS SAYING WHAT, IN THE EVENT THAT YOU READ THIS IN A TEXT ONLY FORMAT WITH COLORED TEXT REMOVED. JASON: REPLIES IN ALL CAPS.

Here is Martin's report:

http://www.inflateordie.com/files/Why%20You%20Should%20Buy%20Gold%2006-14-2012.pdf

I'M REFUTING A PART OF THE REPORT, STARTING ON ABOUT P. 20. YOU MIGHT WISH TO READ ARMSTRONG'S PIECE IN FULL, FIRST, BEFORE MY REBUTTAL, WHICH INTERRUPTS HIS FLOW.

Gold v Paper Gold

The one piece of propaganda about gold that has gained a lot of traction is it would be worth more than $50,000 an ounce if the “Paper Gold” was eliminated for that is the conspiracy that keeps gold down.

JASON: IT'S NOT PROPAGANDA TO SAY GOLD IS GOING UP VERY HIGH. PROPAGANDA IS WHEN YOU WRITE STUFF THAT THE GOVERNMENT WANTS PEOPLE TO BELIEVE. FREEDOM OF THE PRESS IS WHEN YOU WRITE STUFF THAT EXPOSES GOVERNMENT'S LIES, SUCH AS THEIR PROPAGANDA. WHILE ARMSTRONG APPEARS TO BE FOR GOLD, HE REALLY WRITES AGAINST GOLD.

A typical comment I receive:

“I agree gold will be the hedge, but remember, with gold valued at physical only, it'll be worth at least $55,000 in today's dollars. That will get every government out of a hole. Some lucky individuals that have seen the way the tide is turning will benefit too, but mostly it'll be governments around the globe. There is no way they can tax their way out of this mess.”

This argument is just nuts and so insane it is hard to grasp who even makes up this shit.

JASON: PLEASE NOTE THE LANGUAGE HE USES, IT SHOWS HE IS NOT RATIONAL, AND HE ADMITS HE CANNOT GRASP IT, INTELLECTUALLY.

ALL commodities trade in futures and physical.

JASON: NOTE, GOLD IS NOT LIKE OTHER COMMODITIES IN MANY WAYS, ABOUT 9-10 AS I COUNT THE MAJOR WAYS. GOLD IS MONEY, FOR THE FOLLOWING REASONS.

1. THE ABOVE GROUND SUPPLY OF GOLD IS VERY LARGE RELATIVE TO NEW SUPPLY. 5 BILLION OZ. VS. 80 MILLION NEWLY MINED OZ. THIS RATIO IS 5000/80 OR 62.5:1, OR INVERSELY, NEW SUPPLY ADS 1.6% TO THE OLD GOLD. NOTE THE FOLLOWING 9 ATTRIBUTES, IN 3 MAJOR CATEGORIES. THIS NEXT SECTION IS A CUT AND PASTE FROM MY LETTER: http://silverstockreport.com/2012/know-gold.html

Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par g.sandro Sam 30 Juin 2012 - 3:30 | |

| - Citation :

- The Problem With Ideals

Posted on June 20, 2012

“My first impression is that this Jason Hommel is as frustrated as the rest of us with the fact that the world (essentially US govt.) does not acknowledge gold as money.

His statement: I BELIEVE ARMSTRONG IS SIMPLY A PRODUCT OF THE AGE OF PAPER IN WHICH WE ALL LIVE. reveals to me the denial Jason suffers re the fact that we are all enslaved in the ‘age of paper’ . . .. the operative word being ‘enslaved’ . . . . . & Armstrong’s ‘reality check’ in that circumstance is antithetical to Jason’s ‘ideal’. Knowing that this is not ‘right’ does not change the reality in which we live. I think Armstrong is on to something when it comes to facing this ‘reality’.”

Gold is not official money and you better stop praying it is for they will only come take it away. It is the hedge against corrupt government and it should be FREE never fixed for that is doing what Marx himself tried with Communism – to eliminate the business cycle which is why any fixed exchange rate fails – ie even British Pound v DMark 1992, Asian Currency Crisis 1997 etc.. Unless you have been a major trader, you cannot see reality. Short the hell out of currency that is fixed. If you are wrong, government guarantees there will be no loss. If you are right, you make a fortune! Remember Soros 1992? I warned the Euro Commission the currency would fail. This is also why the Euro is collapsing. I was not being a brilliant forecaster – just a down to earth trader. As long as each member still had their own debt, I could isolate just Greece and short their bonds making it a VIRTUAL currency! This is the REAL world – not dreamland. Money is simply a derivative that in reality trades as a stock in a company. Currency has become valued purely on the whims of confidence in a country. Still want to buy some Greek bonds?

If you cannot see that government is trying to eliminate ALL tangible forms of money and go to electronic debit cards etc, you are blind to what is taking place because you are too focused on a dream that has NEVER taken place! Perpetuate fixed exchange rate killing the business cycle. Kondratieff gave his life because he warn the cycle would defeat the government. They hate my guts for the same reason. They do not like to hear they are noy 120% in control. That is why there is no longer a FREE press. Mainstream media will not publish the truth if it offends government. Look at MF Global!

In the failed bill HR 4646 the original idea was to eliminate the income tax replacing it with a 1% tax on ALL transactions in a bank account. This is not income. This is money flow – a 1% tax on all bank transactions which will include paychecks, retirement checks and Social Security checks. It was designed to get rid of government checks and force everything into direct deposit and eliminate “paper money” and checks to make it easy to tax everything.

Why people are living in the past and cannot see the trend right before their eyes is truly amazing. Even if gold was revalued to $60,000 to match the outstanding debt making the bonds redeemable in gold, that is why Nixon closed the gold window – to stop the redemption that would have drained all gold from the USA. What then? The holder say thanks, here is your worthless bond and we will take all the gold? The gold standard failed because you cannot flat-line the economy.

It also makes no sense to say governments are keeping gold from rallying & that is the conspiracy when in 1971 they were the ones pushing it all higher. So why would they suppress gold now, and sell as much as they can removing even VAT taxes in Europe if they BELIEVED gold was money and were conspiring to keep it down in price? This nonsense is bantered about to explain why they are NOT wrong and gold would be $60,000 but for this conspiracy?

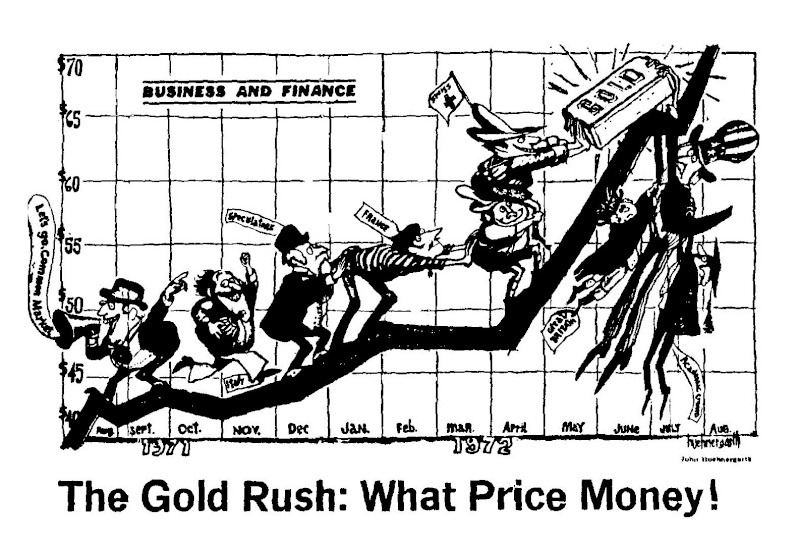

Gold is the REAL hedge against government because it is what will be left in a crisis in the UNDERGROUND economy not the ABOVEGROUND dominated by electronic deposits. Look to coins rather than bullion. To verify the authenticity of a US $20 gold coin, you have to verify the weight and size since the purity is .900 fine. There is NO need to test the metal for the size & weight cannot match using lead or anything else. Each metal has a unique density.  http://armstrongeconomics.files.wordpress.com/2012/06/goldpush-1971.jpg http://armstrongeconomics.files.wordpress.com/2012/06/goldpush-1971.jpg  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Piano bar

Inscription : 03/01/2012

Messages : 1035

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par Imhotep Ven 4 Sep 2015 - 11:07 | |

| Non merci.

Ce genre de "prédicateur" qui a toujours tout vu mieux que les autres et qui a des "modèles" qui annoncent les cours de la bourse à la minute près, très peu pour moi.  Si tu es prêt à sacrifier ta liberté pour te sentir en sécurité, tu ne mérites ni l'une ni l'autre.En matière de complots, il y a deux pièges à éviter : le premier, c'est d'en voir nulle part ... et le second c'est d'en voir partout.A la bourse tu as deux choix : t'enrichir lentement ou t'appauvrir rapidement. Si tu es prêt à sacrifier ta liberté pour te sentir en sécurité, tu ne mérites ni l'une ni l'autre.En matière de complots, il y a deux pièges à éviter : le premier, c'est d'en voir nulle part ... et le second c'est d'en voir partout.A la bourse tu as deux choix : t'enrichir lentement ou t'appauvrir rapidement.

J'ai dépensé 90% de mon fric en filles, boissons et bagnoles. Le reste je l'ai gaspillé |

|

Chef cuistot

Inscription : 26/09/2011

Messages : 1558

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par g.sandro Sam 5 Sep 2015 - 0:09 | |

| Why not, le dimanche je peux être sur les Champs vers 13.00, ça ne m'arrange pas des masses, mais si je décale à la veille ce que je fais d'habitude à cette heure là, c'est jouable...à confirmer avant quand même... par contre je ne vais pas pouvoir passer à la Fnac pécho les biftons.

Pis sinon au pire on pourra le voir en salle à partir du 16 ...mais c'est vrai que profiter d'une occase de discuter avec Armstrong, ça peut être sympa.  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Piano bar

Inscription : 03/01/2012

Messages : 1035

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Piano bar

Inscription : 03/01/2012

Messages : 1035

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Piano bar

Inscription : 03/01/2012

Messages : 1035

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  C'était très bien, je vous recommande le film qui va sortir. C'était très bien, je vous recommande le film qui va sortir.

par g.sandro Dim 13 Sep 2015 - 20:04 | |

| C'était très bien, je vous recommande le film qui va sortir.

Merci d'abord à Lulu pour sa proposition, gràce à lui, nous avons passé un bon moment.

Nous, qui avions suivi, ici, bien que de loin, et pour cause, les terribles démêlés d'Armstrong avec les autorités judiciaires...avons eu confirmation de l'odieuse machination ourdie par la CIA et Cabalas pour lui extorquer sa formule; allant jusqu'à bafouer ses droits les plus élémentaires en l'incarcérant 12 ans dont 7 sans procès et 5 après lui avoir extorqué un "plaider coupable" sous la menace de 135 ans d'incarcération...quand on découvre les liens familiaux et financiers entre le juge, les experts etc...on dirait un film de série B...Bien entendu GS est dedans jusqu'à l'os, c'est le contraire qui nous eut étonnés.

Je ne tue pas le suspens, le film est bien.

M.A s'est un peu livré lors des questions de la salle....et nous sommes quelques uns à l'avoir un peu torturé à la sortie de la salle puis sur le trottoir: voilà ce que je retiens de ses propos:

- le 01/10/2015, début du Krach obligataire, sans doute en lien avec la N ième polémique sur le N ième relèvement du plafond de la dette fédérale.

- Hausse du Dollar avant sa baisse ultérieure

- Les actions sont en train de corriger mais doubleront d'ici leur sommet.

- Le pétrole baisse et ce n'est pas fini en lien avec une révolution énergétique, moteurs électriques etc...

Point bas intermédiaire des obligations vers novembre 2016, - le point culminant de la crise obligataire prévu pour 2017 menant à un rebond jusqu'au 24 novembre 2017 et rechute balaise==> Janvier 2020 (top des PM's ?), etc, puis rebond des obligations etc... pendant un Bonds bear (hausse des taux) de 33 ans...Bref, on n'est pas sorti de l'auberge...

- Troubles civils quasiment partout, pendant une inévitable prise de conscience que l'UE ne peut pas tenir et que l'€uro est condamné, donc baisse de l'€uro avant sa dislocation .

- forts risques de guerres sur l'ensemble de la planète, 2017/2020 sera une période carrément flippante.

- Perte de confiance dans les politicards professionnels qui vont être de plus en plus rejetés, au profit de politiciens non professionnels émergents.

- Pour Armstrong, il n'y a plus que 3 mois (ou 4 je ne suis pas certain de ce qu'il m'a répondu) avant le bottom des métaux précieux (Gold sous 1000), qui, de ce point bas, rebondiront vite et haut pour (selon le réalisateur interrogé par moi après la conférence) au moins doubler, potentiel 3 à 4000 $ /Gold oz entre 2020 et 2022.

- l'Immobilier locatif restera un placement correct, mais pas l'immo en général qui sera concurrencé par les taux élevés désolvabilisant, de fait, la demande d'achats, donc, les gens seront obligés de rester ou de devenir locataires, c'est ce qui soutiendra l'immo résidentiel (qui, sinon, serait concurrencé par les placements financiers qui généreront des intérêts en hausse).

- L'Or n'est pas (ou n'est plus) vraiment un refuge contre les Krachs monétaires , actions ou obligataires, mais contre les gouvernements, et c'est pour ça qu'il va monter.

Aucune possibilité de changer quoi que ce soit, il FAUT l'effondrement AVANT d'envisager un changement politique ou sociétal significatif.

Commentaire perso:

Très convaincant tout ça... crédible et tout...MAIS...avec cependant toujours le même bémol me concernant...comme je l'ai déjà écrit souvent ici (ou ailleurs avant), si on en croit les Gann, Eliott, Charles Dow, Fibo et autres Martin Armstrong, tout serait en quelque sorte écrit, il y aurait donc une forme de destin et il serait aussi immuable que cyclique. Ceci implique que quoi qu'on fasse, c'est écrit... (C'est le fameux Mektoub des Reubeux) .

J'ai un vrai problème avec ça, car si les grands hommes (et femmes) qui ont changé le monde avait raisonné ainsi, rien ne les aurait motivé à accomplir leur oeuvre salvatrice...Or, postuler que tout est prédestiné (lisez bien;"Pré-destiné") implique qu'ils ou elles n'auraient été que des jouets du destin et non le fruit de leurs valeurs personnelles...j'ai du mal avec ça...

Lulu corrigera mes erreurs et/ou mes omissions. j'ai retrouvé quelques prévisions sur le 01/10/2015 et aussi sur les PMs La vue sur l'or et l'argent http://www.armstrongeconomics.com/archives/35602 Why Money Need Not Be “Tangible” http://www.armstrongeconomics.com/archives/tag/gold Vous avez prédit un pic économique en Octobre 1, et vous suggèrent qu'il peut y avoir un arrêt du gouvernement américain ce jour-là. Qu'est-ce qui va se passer dans les mois suivants? http://www.armstrongeconomics.com/archives/tag/2015-75  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par g.sandro le Lun 14 Sep 2015 - 0:52, édité 9 fois |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par Lumiere Dim 13 Sep 2015 - 22:10 | |

| Ton débriefing est parfait   J'ai strictement rien à modifier J'ai cependant une remarque à formuler à nos compatriotes français 150 places furent pré-réservées sur 400 disponibles De ce fait la salle était à moitié vide Un des organisateurs était étonné du peu d'attrait des français à l'égard de Martin Armstrong Tout en me signalant que cet événement avait fait salle pleine en allemagne Cette remarque en dit long sur la curiosité et l'ouverture d'esprit de nos chers compatriotes Je ne vise personne , je ne fais que retranscrire un message reçu Dernier point : Canal + était présent Un extrait de la conférence est normalement prévu sur leur chaine mercredi à 19H30 |

|

Piano bar

Inscription : 03/01/2012

Messages : 1035

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par g.sandro Dim 13 Sep 2015 - 23:37 | |

| Oui, Lulu, c'est un excellent signe "contrarien" du reste...La masse est lobotomisée et pas du tout curieuse...bref, mûre pour l'abattoir.

J'ai réédité mon CR car il comportait une phrase coupée dont la fin continuait plus loin; cette faute de cop/coll donnait une formulation ambiguë qui pouvait prêter à confusion sur le calendrier obligataire.

La reformulation est plus claire.  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par g.sandro Lun 14 Sep 2015 - 0:38 | |

| J'oubliais que, toujours selon son modèle, depuis 2006 on est entré dans un cycle baissier de 300 ans de l'activité solaire et que les températures vont descendre, descendre, descendre... pendant encore 290 ans.générant des vagues d'émigration, et d'immigration selon l'endroit de la terre dont on parle... à en croire les épisode identiques modélisés, les maladies vont flamber et la population baisser... ça aussi, ça semble contre-intuitif quand on l'entend parler de baisse du pétrole... parce que, bon...faudra bien se chauffer... EDIT: du reste, il vient juste de publier un article là dessus, ce que j'ignorais en écrivant mon post... http://www.armstrongeconomics.com/archives/date/2015/09  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par Lumiere Lun 14 Sep 2015 - 10:25 | |

| Je ne souhaitais pas aborder ce sujet , mais tu me tends la perche En partie publique , certains sujets sont délicats A savoir : Sur le fond les prévisions d'Armstrong m'intéressent peu , ce qui m'intrigue c'est le personnage Tout comme Jim Rickards d'ailleurs En fin de conférence ce très cher Monsieur à confirmer l'une de mes convictions En transmettant cette information solaire , Martin Armstrong me fascine encore plus Pourquoi un personnage multi-millionnaire s'intéresse-t-il à ce type d'événement ? La règle générale de ce type de personnage c'est d'abord l'oseille et rien d'autre Ils se contrefoutent de notre avenir Alors pourquoi nous aviser d'un événement lié au soleil ? Perso , j'ai ma petite idée , je ne compte pas la débattre ici , n'y même la développer et encore moins poluer cette file Je me permets juste une remarque : Les personnes ouvertes d'esprit apprécient la recherche , y compris les recherches pouvant paraître farfelues Depuis 2 ans je m'intéresse à ce type de sujet , je ne dis pas que j'y adhère , mais j'y ouvre mon esprit Force est de constater que Martin Armstrong et Jim Rickards sont biens plus que de simple Oracles http://www.topsecret.fr/les-rencontres-du-magazine-top-secret-edition-2015-cest-reparti/La prochaine aura lieu : http://www.topsecret.fr/les-rencontres-de-top-secret-a-paris-3e-edition/ |

|

Piano bar

Inscription : 03/01/2012

Messages : 1035

| |   |  Re: Martin Armstrong /file de suivi de ses principaux articles Re: Martin Armstrong /file de suivi de ses principaux articles

par Lumiere Lun 14 Sep 2015 - 10:33 | |

| Sandro a écrit : ça aussi, ça semble contre-intuitif quand on l'entend parler de baisse du pétrole... parce que, bon...faudra bien se chauffer... T'as raison c'est contre-intuitif , plusieurs remarques de sa conférence furent contre-intuitivent ça me chiffonne et confirme mes convictions Je perçois plus ce type de conférence comme un message pour l'humanité J'arrête là , sinon je vais partir en sucette  |

|

Piano bar

Inscription : 03/01/2012

Messages : 1035

| |   | | |

| |   | |

Sujets similaires |  |

|

| Page 1 sur 2 | Aller à la page : 1, 2  | | | | Permission de ce forum: | Vous ne pouvez pas répondre aux sujets dans ce forum

| |

| |

; | |

Hardinvestor

Hardinvestor

Hardinvestor

Hardinvestor

» COMSTOCK MINING Inc. (NYSE : LODE) Fil dédié:

» WORLD WAR III ? je suis vert de rage d'ouvrir ce fil dédié, on serre les miches: on commence avec Gerald Celente

» Les Podcast et interviews de David Brady, Sprott, Rick Rule, Katusa, Bix Weir, etc...SILJ (Hardin mini-fonds Silver Juniors et Royalties)

» Uranium /minières uranium

» a quoi joue la Russie ..

» TREASURY METALS PFS publiée edit: *NB: TML est devenue NEXTGOLD (NXG)

» Wheaton précious metals/ WPM

» Comment l'Union européenne nous prend pour des imbéciles