|

| | US mint: file de suivi des ventes gold et silver eagle |    |

| |

| Message | Auteur |

|---|

US mint: file de suivi des ventes gold et silver eagle US mint: file de suivi des ventes gold et silver eagle

par marie Ven 15 Aoû 2008 - 22:21 | |

| GS forcast et suspension vente d'or par US Mint les 2 news n'ont pas vraiment de rapport entre elles.. quoi que ..  us mint suspend la vente de piéces d'or us mint suspend la vente de piéces d'or c'est LA news du moment, ça , mes amis .. le prix du spot papier est une pure fiction ! évidemment que us mint ne trouve pas d'or à fondre au cours du spot actuel ... d'ou shortage de physique à ce cours dérisoire .... ça vous rappelle rien??? ( apres les silver american eagles ....suspension des gold american eagles ) http://www.gata.org/node/6489 ************* GS: gold forecast 745 $ sont gentils de prévenir bien apres que l'attaque à laquelle ils ont participé, ait commencé  )) comme chacun sait, GS annonce, le contraire de ce qu'ils font .. au moment de l'annonce, évidemment donc un message d'espoir qui laisse à penser que le gros de la correction est passé .. je pense pas que ce soit tout à fait bouclé .. puisque les techs funds vont prendre le relais en shortant sur la phase finale ( d'où l'objet de cette annonce tardive par GS qui espére ainsi arriver à cet objectif ) ... mais je peux pas en dire plus avec les infos dont je dispose à l'heure actuelle mieux encore, on remarquera le soudain changement de position de GS sur le $ .. qui passe de bear à bull, APRES qu'il ait fait son move up ( ce sont les derniers à s'etre joint au camp des bull $ et c'est pas ds leur habitude d'etre les derniers à ce genre d'annonce) ...s'est fait rappeler à l'ordre par général Paulson, grand ordonnateur des "cérémonies", ou quoi??  http://www.reuters.com/article/hotStocksNews/idUSN1432180620080814?sp=true http://www.reuters.com/article/hotStocksNews/idUSN1432180620080814?sp=true

Dernière édition par marie le Ven 13 Jan 2012 - 16:12, édité 1 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Lun 18 Aoû 2008 - 22:57 | |

| il ny a pas que sur l'argent et qu'aux usa, que la pénurie de physique se fait sentir .. regardez donc ce qui se passe en inde, et pour les "barres" d'or ... et ce alors que LA saison indienne ( mariages et joailleries ) va commencer en sept.. ça promet  - Citation :

- "London, 15 August 2008 - Available bars of gold in India have all but disappeared, due to a 'perfect storm' that has restored gold's lustre and forced physical premiums skyward ahead of the peak season for jewelery demand.

"Pretty well everyone is sold out of stock there. We have seen premiums as high as $2.50 an ounce which is unheard of in India. Most refiners are now booked solid through September," said a senior figure at a bullion bank in London" http://premium.thebulliondesk.com/news/editorial.aspx?GUID=5808081513131412&V=0plus édifiant encore, les prémiums physique qui atteignent des records sur ces marchés www.lemetropolecafe.comIndia was closed on Friday for Independence Day, perhaps the most scrupulously observed of all the Indian public holidays. In effect, the Bears had a free paw. Some Indian cities will be closed tomorrow as well. Indian ex- duty premiums today: AM $21.14, PM $11.83, with world gold at $798.70 and $797.90. Astonishingly high: far above legal import point. This was basis Ahmedabad, but the other Indian importing cities showed similar results. et toujours sur le même sujet, cette série d'articles http://www.thehindubusinessline.com/2008

/08/17/stories/2008081751400300.htm http://sify.com/finance/fullstory.php?id=14739470 |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par GdB Mer 20 Aoû 2008 - 10:21 | |

| Je dois dire que c'est assez amusant cette double caractéristique des métaux précieux, servant à la fois de réserve de valeur (son aspect monétaire) et de matière première pour l'industrie et surtout la joaillerie... Dans un cas c'est évidemment quand son prix monte qu'il est recherché (comme pour une monnaie) dans l'autre cas c'est quand il baisse car c'est du coup comme toutes les marchandises: on achète quand ça baisse... Et les petits malin jouent sur les deux tableaux en achetant la marchandise quand elle baisse en sachant qu'elle est aussi une réserve de valeur future ! Je n'invente pas l'eau chaude en disant ça mais c'est nécessaire de le souligner. Et ça rend le travail de  et de la finance pure d'autant plus compliqué: manipuler du virtuel titrisé au cube avec otpions à terme c'est une chose, virtualiser un truc qui a un ancrage réel bien... REEL (  ) c'est une autre histoire! C'est sur que les cours du spot sont indicatifs et n'ont de valeur que tant qu'ils correspondent à un semblant de vérité dans le monde réel... Si ça c'est remis en cause alors comme tu disais Marie c'est la crédibilité du COMEX qui explose... Je me faisais une réflexion sans doute de débutant, mais si la prime au physique explose, des tas de gens opérant sur le COMEX auront intérêt à prendre livraison au lieu de ne jouer que sur le papier non? Malgré les lourdeurs de la chose (vs l'apparente facilité du papier) la lourdeur finit un moment par être équilibrée et dépassée par la prime... Auquel cas il y aura défaut? GdB |

|

Piano bar

Inscription : 03/04/2006

Messages : 1366

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Mer 20 Aoû 2008 - 14:33 | |

| - Citation :

- C'est sur que les cours du spot sont indicatifs et n'ont de valeur que tant qu'ils correspondent à un semblant de vérité dans le monde réel... Si ça c'est remis en cause alors comme tu disais Marie c'est la crédibilité du COMEX qui explose...

Je me faisais une réflexion sans doute de débutant, mais si la prime au physique explose, des tas de gens opérant sur le COMEX auront intérêt à prendre livraison au lieu de ne jouer que sur le papier non? Malgré les lourdeurs de la chose (vs l'apparente facilité du papier) la lourdeur finit un moment par être équilibrée et dépassée par la prime...

Auquel cas il y aura défaut? oui, c'est exactement ça : le rationnement du physique peut conduire à d'avantage de demandes de livraison ... il faut toutefois savoir que ces demandes de livraison sont largement encadrées par la réglementation du comex ...et sont sujettes à limitation ... évident quand on connait la taille ridicule des seuls stocks du comex.. stock qui d'ailleurs vadrouille électroniquement de NY à londres et retour, en fonction des besoins d'approvionnement du marché mais, et on l'a également vu ds un autre article, s'il y a un risque potentiel de défault , en ce moment même .. le marché le plus fragile c'est l'etf silver de barclays https://000999.forumactif.com/les-hard-investors-f7/butler-un-default-cache-sur-silver-etf-barclays-t8562.htmjust pour l'info, mode d'emploi d'une demande de livraison sur le comex .. on notera au passage, les institutions concernés par ce pb (warehouses ) ... soulignées en rouge par mes soins ... visiblement l'appel a été lancé dans la communauté des gold silver bugs ...Let's all be the Hunts" et c'est pas à prendre à la légére ... vu le succés précédent d'israel friedman sur l'appel à achat de silver eagles ( voir cet article ) et que tant qu'il n'y a pas concentration entre les mêmes mains, les demande de livraison sont illimitables ... d'où le slogan qui prend toute sa saveur: soyons, chacun d'entre nous et tous ensemble, les frères Hunt

source: www.lemetropolecafe.com Taking delivery of silver… Bill, Yesterday's Midas contained a note from a member asking about how he could take delivery of silver through Comex. While I replied to him directly through the e-mail address he attached, it occurs to me that others may be interested in actually taking delivery. Indeed David Bonds piece, "Let's all be the Hunts" suggests essentially doing just that. Ted Butler has similarly suggested that if the commercial shorts are in as much trouble as he and others believe they are, taking delivery of silver by both industrial users and investors may be the quickest way to break there manipulative strangle hold of the PM markets. Actually taking delivery of futures contracts is not as difficult as it sounds. One does not have to literally prepare to receive 5,000 ounces of silver. When you take 'delivery' you will receive a warehouse contract from the warehouse in which your five 1000 ounce bars are stored. (The actual weight of each bar will likely be somewhat less or more than 1000 ounces. You will pay for the 'delivery' to you based on the actual weights of the five bars). The warehouse receipt will have spaces on the back showing the names of the party who owned it before you and the signatures for each prior sale. The receipt will also have a serial number identifying each bar which is held in your name. Each month that you own the bars you will receive a storage bill from the entity who is storing your silver. The current insurance premium is approximately $30 per month for one contract (five bars). While $360 dollars a year for storage may seem a little pricey, you are in fact holding an investment currently worth $65,000 (and recently worth $105,000). The entity holding your silver will be someone like HSBC, Scotia Mocatta, Brinks or one of the other Comex certified warehouses I realize most cafe members may not have $65,000 of currently liquid assets. However, I would point out the difference between taking delivery as opposed to current investments in either a silver or a gold ETF. When you take delivery the silver is YOURS. In an ETF you don't own silver and you won't have access to silver when the price goes parabolic. You are also exposed to the multitude of fine print associated with the ETFs. Lastly, if Ted Butler is correct, putting your money in an ETF may be assisting the Cartel to keep the pressure on paper prices. (He asserts that the ETFs are engaged in naked shorting of their own shares). The timing is right if you are interested in taking delivery. The last trading day for September silver is one week from today, August 27th. Delivery notices will begin the end of next week. I do not know whether all futures brokers will allow clients to take delivery as it involves considerably more effort on their part than simply closing out a contract with a key stroke or two. However, I do know that Cannon Trading, based in California, will arrange for you to take delivery. I have worked with John Thorpe there for approximately five years. Their number is 1-800-454-9572. John is there from approximately 8:30 to 3:00 eastern time. Just be sure to make clear that you are buying a future contract with the probable intent of standing for delivery and John will explain any questions you may have. Where else can you buy 5,000 ounces of silver today for $13 an ounce? Kevin |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Jeu 21 Aoû 2008 - 18:45 | |

| reuters confirme l'info sur la suspension de piéces gold american eagles, par us mint et le shortage de physique chez les principaux revendeurs us .. j'adore le paragraphe sur kitco qui prétend en avoir, mais ne s'engage pas sur les délais de livraison ... indéfinis .. ( dont on a déja parlé sur une autre file ) http://www.reuters.com/article/marketsNews/idUSN2151501220080821?rpc=401& Reuters: Eagle gold coins sold out ! NEW YORK (Reuters) - A buying spree in the popular American Eagle bullion coins appears to have depleted inventory of major North American coin dealers, contributing to supply fears and sharply higher gold prices on Thursday. Coin dealers in the United States and Canada said buying of gold coins and other bullion products has soared since last week as gold prices tumbled to near a nine-month bottom. Blanchard and Co., one of the largest U.S. retail dealers of rare coins and precious metals, said the American Eagle and American Buffalo one-ounce gold coins -- novel items among collectors and investors -- are currently sold out. "Nobody has the Eagles or the Buffalos right now. We bought 2,000 ounces late last week, and those were the last 2,000 ounces that we can find in the marketplace," said David Beahm, vice president of New Orleans-based Blancard. "If we don't have them, nobody has them," Beahm said. According to a Thursday report by the Wall Street Journal, the U.S. Mint told dealers it was temporarily suspending all sales of the American Eagle coins due to depleted inventory and unprecedented demand. Michael White, a spokesman of the U.S. Mint, did not return calls for comment. Meanwhile, Canada-based dealer Kitco also said demand for gold bullion coins has increased significantly in recent days. Kitco's Senior Analyst Jon Nadler said American Eagles are still in stock even though delays in supply and shipping of all bullion products could be possible due to high demand. On Thursday, spot gold was up more than 3 percent to $837 an ounce, while U.S. gold futures for December delivery scaled a one-week high at $845 an ounce. George Gero, vice president of RBC Capital Markets Global Futures in New York, cited the gold coin shortage for Thursday's gold rally. |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Mer 27 Aoû 2008 - 15:44 | |

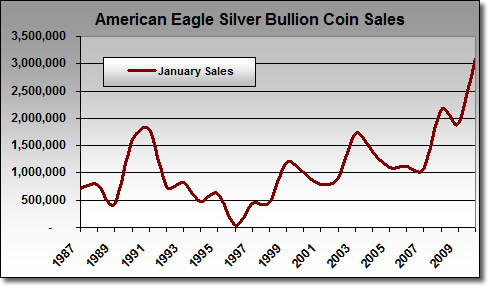

| US Mint vendait 3 fois plus d'or en 1998-1999 qu'à présent .. et pourtant pas de pb, ni de rationnement, bizzarre , bizzare ! dis donc, sacré pic de ventes en 1998-1999 2000, juste sur le point bas du cours spot .. smart money? attention, ne pas comparer ces stats qui sont données mois par mois et en onces ( voir légende du graphe, à droite )avec les totaux de chiffres de vente annuels en unités vendues , que vous pouvez trouver sur le site d'us mint

source www.lemetropolecafe.comAnd how about this good point from Australia’s Nick Laird… Hi Bill The chart shown here makes one wonder why the US Mint can't handle the volume of sales. Back in 1998-99 they were selling 3 times the quantities today & never a whisper on rationing. Cheers Nick

Dernière édition par marie le Jeu 1 Avr 2010 - 15:37, édité 3 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Jeu 25 Sep 2008 - 23:25 | |

| nouvelle suspension temporaire d'us mint, cette fois ci pour les gold american buffalo Sept 25 (Reuters) - The U.S Mint said on Thursday it was temporarily suspending sales of American Buffalo 24-karat gold one-ounce bullion coins as strong demand depleted its inventory. In a memorandum to all American Buffalo authorized dealers, the U.S. Mint said it would work to build up its inventory to resume sales shortly. pour info, ci dessous un commentaire interessant de Dantec13, sur cette news : - Citation :

- La différence avec les american eagle, c'est le titrage.

Les american eagle sont en 916,7/1000, les american buffalo en 999,9/1000.

Autre détail important, les american eagle sont frappées en fonction de la demande, et les american buffalo sont limités à 300.000 exemplaires. donc..on doit comprendre que, les us physical investisseurs ne trouvant plus de gold eagles chez us mint ( voir plus haut dans la file ) .. ont vidé les stocks de american buffallo, ceci étant plus titrés en or que les précédents... donc forcément plus chers ..  |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Mer 8 Oct 2008 - 1:33 | |

| US Mint halts some American Eagle coin production

http://africa.reuters.com/wire/news/usnN07435260.html

By Frank Tang NEW YORK, Oct 7 (Reuters) - Unprecedented demand for precious metals and volatile markets forced the U.S. Mint to cease production for the half-ounce and quarter-ounce popular American Eagle gold coins for the rest of this year and to supply other bullion coins on an allocation basis. "Due to the extreme fluctuating market conditions for 2008, as well as current market conditions, gold and silver demand is unprecedented and the demand for platinum is unusually high," the U.S. Mint said Monday in a memorandum to its authorized coin dealers. "The U.S. Mint has worked diligently to attempt to meet demand, however, blank supplies are very limited and it is necessary for the U.S. Mint to focus remaining bullion production primarily on American Eagle Gold one-ounce and Silver one-ounce coins," the Mint said. The Mint said it would continue to supply one-ounce American Eagle gold coins and one-ounce American Eagle silver coins on an allocation basis to coin dealers. For half-ounce and quarter-ounce American Eagles, the Mint said that inventory was depleted last week and no more coins would be produced for the rest of 2008. In addition, the Mint said it would produce 1-10th ounce Eagles based on current coin blank supplies, but would cease production for the rest of this year once the remaining inventory was depleted. Produced from gold mined in the United States, the 22-karat American Eagles have been novel items among collectors and investors since their introduction in 1986. Each coin has a face value of $50 but it is sold by authorized dealers at a premium to the price of gold. AMERICAN BUFFALO, AMERICAN EAGLE PLATINUM The Mint said it would continue to supply 24-karat American Buffalo one-ounce gold coins based on current blank supplies, but would halt production once the remaining inventory was out. The Mint had suspended sales of the Buffalos in late September due to strong demand and inventory depletion. Similarly, the Mint said that all denominations for American Eagle platinum bullion coins were depleted last week, and it would halt production for the rest of the year once the remaining inventory was depleted. Coin dealers from the United States to Canada have recently reported a surge in buying of bullion coins. Gold has soared as much as $200 in the last 30 days as panic investors flocked to gold as a worsening global financial crisis prompted people to seek a safe haven. -END- ****************** et un point interessant.. http://www.investorvillage.com/smbd.asp?mb=4245&mn=329637&pt=msg&mid=5811398 |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Mer 5 Nov 2008 - 1:48 | |

| reprise des BUFFALO..

lol quel hasard du calendrier !! US Mint annonce donc la veille des élections, qu'elle reprend la production des Buffalo gold, celle des gold eagle ayant repris dès le 26 oct

le communiqué précise en outre que les Buffalo seront réservé aux acheteurs professionnels

*********************************

Date: 04/11/2008 @ 00h07

Source: AFF France

USA: la Monnaie reprend la vente d'une pièce d'or temporairement épuisée

WASHINGTON, Nov 3 (Thomson Financial) - La Monnaie des Etats-Unis a annoncé

lundi qu'elle reprenait la vente de sa pièce d'or "Bison américain" 2008 d'une once dont les stocks avaient été épuisés en septembre par suite

d'une demande trop forte.

Les commandes seront malgré tout limitées et réservées aux acheteurs

professionnels agréés, a précisé la Monnaie dans un communiqué.

En or 24 carats, les pièces "Bison américain" sont proposées à la vente à

1.059,95 dollars. D'une valeur faciale de 50 dollars, elles sont frappées côté

face d'un profil d'Indien et côté pile d'un bison.

La Monnaie avait suspendu leur vente fin septembre en indiquant ne plus être en

mesure de répondre à la forte demande des investisseurs en quête de placements

sûrs à la suite de l'effondrement des marchés financiers. Elle avait alors

indiqué qu'elle ferait tout pour reconstituer ses stocks le plus vite possible.

La Monnaie a repris dans les mêmes conditions le 27 octobre la vente des pièces

d'or de sa série "Aigle américain" d'une once, dont elle avait dû suspendre les

ventes à la mi-août pour cause d'une "demande sans précédent".

La chute des Bourses mondiales a provoqué un mouvement de repli des

investisseurs vers les valeurs refuge comme l'or ou les bons du Trésor. |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  et ça continue de plus belle et ça continue de plus belle

par marie Ven 27 Fév 2009 - 0:56 | |

| et ça continue de plus belle sur la D de physique, à nouveau des pénuries sur le gold .. ce qui incite évidemment nos suspects habituels à agir de toute urgence, avec un raid sur le cours du papier .. histoire de montrer que cet engouement, c'est du flanc .. manque de bol .. non seulement le largage escompté n'a pas lieu, mais la D reste tjs aussi forte ... en s'accentuant ( logiquement ) avec la montée des cours car une des caractéristiques de la D "investissement" c'est qu'elle monte avec le cours ..en s'autoalimentant .. et que toutes chose égales par ailleurs ..elle a encore beaucoup de chemin à parcourir, jusqu'au top FINAL  http://www.gata.org/node/7203 http://www.gata.org/node/7203 |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Dim 15 Mar 2009 - 15:36 | |

| Us Mint suspend à nouveau la production de nombreuses pièces d'or et d'argent http://goldandsilverblog.com/us-mint-suspends-production-of-more-gold-and-silver-coins/ voir également le message us mint en page accueil | American Eagle Gold Uncirculated Coins |

Production of United States Mint American Eagle Gold Proof and Uncirculated Coins has been temporarily suspended because of unprecedented demand for American Eagle Gold Bullion Coins. Currently, all available 22-karat gold blanks are being allocated to the American Eagle Gold Bullion Coin Program, as the United States Mint is required by Public Law 99-185 to produce these coins “in quantities sufficient to meet public demand . . . .”

The United States Mint will resume the American Eagle Gold Proof and Uncirculated Coin Programs once sufficient inventories of gold bullion blanks can be acquired to meet market demand for all three American Eagle Gold Coin products. Additionally, as a result of the recent numismatic product portfolio analysis, fractional sizes of American Eagle Gold Uncirculated Coins will no longer be produced. |

cliquer ici |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Mar 8 Déc 2009 - 23:19 | |

| à nouveau des restrictions chez us Mint .. c'est d'autant plus curieux, si l'on considére le gold coin act .. qui autorise l'utilisation des réserves des usa , s'il ne se trouvait pas assez d'or à acheter sur le marché au cours du spot .. diable ..  par ailleurs, et c'est quasi systématique .... A CHAQUE FOIS que ces pbs de pénurie de physique, surgissent .. on adroit à un raid sur le spot .. www.lemetropolecafe.com Dave from Denver hits the nail on the head… Tuesday, December 8, 2009An Obvious Question About The U.S. Government Gold Stock Goes Begging Given the "robust" inventory of 100 oz. gold bars being reported by the Comex, how on earth is it possible that the U.S. has to keep suspending production of gold eagle and gold buffalo coins due to "a shortage of supply of gold?" The U.S. Mint announced yesterday that it is suspending production of 1 oz. gold eagles and buffalos for the balance of 2009. This is, I believe, the third time this year the Mint has suspended production:

"U.S. Mint now suspends all one ounce gold coin sales due to shortage of physical gold"

Here's the article link: U.S. Supends Gold Eagle/Buffalo ProductionAs a matter of fact the Gold Bullion Act of 1985 authorizes the U.S. Mint to use U.S. Government gold reserves if necessary:<BLOCKQUOTE> In the absence of available supplies of such gold at the average world price, the Secretary may use gold from reserves held by the United States to mint the coins issued under section 5112(i) of this title. The Secretary shall issue such regulations as may be necessary to carry out this paragraph".</BLOCKQUOTE> It would seem that if the United States has 8100 tons of gold, as reported by the Federal Reserve and U.S. Treasury, then there should NEVER be a shortage of gold with which to mint coins. What gives?

Here is the complete text of Gold Bullion Act of 1985: Where's Our Gold Coins?Again, inquring minds want to know, where is all the gold? How come the U.S. Mint didn't foresee the same shortage everyone else in the market has been seeing and make sure that it had plenty of production blanks to meet demand? If the Comex supposedly has 9 million ounces of 100 oz. bullion bars, the Mint should have been able to take delivery of some of that gold in order to meet its legal obligation to produce gold coins in an amount that meets demand. How come the U.S. Mint is not using U.S. Government gold reserves, as per the law?

Something smells fishy here, and I think we all know what it is: the physical supply of gold is extremely tight, the paper shorts in gold (Comex, GLD, LME, etc) are in big trouble and the price of gold is now at the mercy of the physical market. I would suggest this situation is one of the primary reasons that the Federal Reserve and its supporters in Congress are going to any lengths to derail efforts to force an independent audit of the Fed, which would include a physical audit of the gold it supposedly holds. |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Record absolu de vente de silver eagle en Janvier 2010 Record absolu de vente de silver eagle en Janvier 2010

par menthalo Lun 25 Jan 2010 - 12:17 | |

| SourceUS Mint Silver Eagle Sales Top 3 Million, Best Ever January

US Mint American Silver Eagle sales have already scored their best ever January. Who would have thought? After all, there is still a full week left in the month. On top of that, the bullion coins are rationed, they were unavailable for seven days, and U.S. silver futures tumbled 8.1 percent last week (6.7 percent in London).

Yet, January 2010 is now in the history books. It is the best starting month of a year for the series that dates back to 1986. Despite all the aforementioned obstacles, authorized buyers scooped up 3,090,500 Silver Eagles from the United States Mint as of Friday, Jan. 22.

January is a traditionally strong month for these always popular coins, with over one million in sales registered in all but two years since 1999. Making this year’s three million plus start all the more impressive is the fact that even reaching the two million mark would have been historical. That happened only once before in Jan. 2008.

Why the big run-up? In short, availability and pent-up demand. Normally the Mint begins striking newly dated eagles in December to have them ready for the market in January. However, with little or no inventory in reserve coupled with unprecedented demand, the Mint was in a predicament. It made a decision in November to keep striking 2009-dated eagles through to the end of the year, hoping to build up enough of a supply to carry over until replaced by the 2010s.

That supply ran short. The Mint told its authorized dealers on Dec. 22 that it would begin selling 2010-dated eagles on Jan. 19 in an allocated, or rationed process. As happenstance would have it, its 2009 inventory was completely depleted on Jan. 12 after selling 367,500 for the month. Buyers had to wait an entire week to place orders. And while silver prices moved narrowly during that time frame (before falling off a cliff a few days later), that week of unavailability created its own buzz — especially for those who desired to own or sell newly dated eagles.

Demand for the 2010s was immediately apparent. 2010 Silver Eagle sales exploded as buyers quickly grabbed 2,480,000 within the first 48 hours. In that short time, the Mint sold over 8.6 percent of the total it had in all of 2008 — which was a record-breaking year for the series. And despite silver prices diving between last Wednesday and Friday, or perhaps because buyers were getting in on a perceived dip, another 243,000 left US Mint doors.

The Mint does not sell bullion eagles directly to the public, but instead to a small group of authorized purchasers who in turn resell them to precious metal providers, investors, dealers and collectors. These coins do not have a mintmark, unlike their numismatic counterparts.

For more information about this year’s bullion coin, to include specifications and design details, visit the coin information page: 2010 American Eagle Silver Bullion Coin.Là aussi, il y a déconnexion totale entre le marché du physique et les cours officiels . Sur Paris, c'est difficile de trouver des pièces en ce moment.   |

|

Piano bar

Inscription : 28/04/2009

Messages : 608

| |   |  Re: US mint: file de suivi des ventes gold et silver eagle Re: US mint: file de suivi des ventes gold et silver eagle

par marie Mer 27 Jan 2010 - 0:47 | |

| hey oui, silver est vraiment un marché spécial..rires .. plus la D augmente, plus le cours officiel baisse .. mais non, c'est pas un marché manipulé ..  record de Demande silver eagles depuis 1987 ( voir graphe posté par Menthalo, juste au dessus) : 3 millions record de Demande silver eagles depuis 1987 ( voir graphe posté par Menthalo, juste au dessus) : 3 millions et en plus, la Mint vient de rationner sa production ...un bon moyen de remettre au pas une Demande trop importante .. excellents commentaires de Bill H sur www.lemetropolecafe.com Bill H:

Hey CFTC, does this help your investigation into Silver?http://www.coinnews.net/2010/01/24/us-mint-silver-eagle-sales-top-3-million-best-ever-january/

To all; the above link gives us the number of Silver Eagles sold over only 2 weeks time in Jan.. So far the 3 million coins sold is a record for January but occurred with only 2 weeks of sales since the mint closed its doors for a week. But wait, the price of Silver is down 10% in just the last 5 trading days! I wonder how Gary Gensler at the CFTC plans to whitewash this little tidbit of supply/demand information?

Talk about BLATANT MANIPULATION by the COMEX paper hangers, it doesn't get much more obious than this! The mint could not meet demand last year and has so far rationed supply for the first 3 weeks this year, yet the price goes down? Just how is this explained? COMEX participants know. The CFTC has to be totally brain dead if they don't know. Heck, EVERYBODY knows! NY and London have been flooding the markets with paper contracts and depressing the price of Gold and Silver for years with the blessing of regulators. In my opinion, these contracts are not worth the paper and ink used to print them.

I wish the COMEX, Goldman /Morgan or some other member of the PST (price suppression team) would step up to the plate and sue me or someone else who is spouting the truth and claim libel or slander. Can you imagine the amount of dirt that would be dug up during discovery? Instead, it's always "they're conspiracy nuts" or complete silence because bullies can't stand up to the truth. PLEASE someone who is far more intellectually superior to me PLEASE explain how mine supply and inventories can drop while demand increases and the price go down!!! I don't care what anyone says, the CFTC has had more than ample time to do this investigation into Silver. I have absolutely ZERO hope that they are or will do their jobs and prevent manipulation and fraud in precious metals.

In my opinion the whole thing is a SCAM! Did you hear that COMEX? GOLDY? MORGAN? ETF's? You are manipulating the market plain and simple! THERE, I said it and put it in writing! NOW PLEASE SUE ME TO SHUT ME UP!!! If I am so wrong and we have "free" markets then do your duty and SUE, SUE, SUE!!! My guess is there are 1,000's of pissed off lawyers that would LOVE to get into the discovery process and probably PAY ME to represent me because this is how Attorney Generals are made! Paper Silver contracts outstanding outnumber ounces available for delivery by a minimum 10 to 1 ratio. How is this not FRAUD?

All I can say is if you want Silver buy the real stuff so you know what you have. Any contract with anyone purporting to have Silver behind it is suspect at best and probably fraudulent at worst. OK, sorry for the rant but enough is enough! Regards, Bill H. |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  nouveau record de ventes nouveau record de ventes

par marie Ven 13 Jan 2012 - 16:11 | |

| US mint annonce un nouveau record de ventes de gold et silver eagles pour le 3 janvier 2012 la demande de physique explose www.lemetropolecafe.com Bill H:

Once again...

To all; once again... paper supply brings out physical demand! The U.S. mint announced that January sales of Gold AND Silver Eagles surged to near record levels in "the first days" of the month. The "first days" being by January 3rd which by the way was THE 1st business day of the month. Yes, Silver Eagle sales were higher than ANY full month except for Jan and Sept. of last year and the first month of sales back in 1986! And we are to believe that this was ALL done in one business day? No, the sales were actually logged in Dec., you remember that don't you? Dec. saw both Gold and Silver prices trashed and supposedly investors were regurgitating their positions because as Dennis Gartman said, "the Gold bubble has popped and now in a bear market". Yes, AGAIN...just like May for Silver and Sept. for Gold of last year, the "price" collapsed while demand exploded higher. I don't know what planet anyone else lives on but I payed good money to attend a university where they taught me that prices go down because of marginal selling and up because of marginal buying. Of course these sales were reported by the mint as "January sales" but you must understand that "they" think we are stupid. "They" did not want to report ALLTIME RECORD SALES for Dec. while another arm was trashing the price, that would not add up now would it? No, instead they report a monthly record that was all ordered and purchased in just one day BEFORE the close of business that day! I guess "they" figured that "we" are so stupid that we couldn't put 2+2 together? <p>Do you now see that last month's bullshit hammering of price was done with paper contracts as the real physical metal was being gobbled up? Do you see WHY it will be so hard for Sprott to actually source 50 million ounces of Silver that must be of the "real" variety as opposed to worthless paper contracts stating that they "really really really will deliver the metal"? Hellooooooooooooooooooooooooo...CFTC...are you watching? Did you see AGAIN that you are presiding over a tail market that is wagging the physical dog's body? Do you not see that paper levered at least 100 to 1 at a minimum is making "price discovery"? ...and how is your 4+ year "investigation" into the Silver market going? Anything yet? No, we didn't think so. You see, the |CFTC is really stuck, just another "damned if you do, damned if you don't" scenario. They surely cannot admit the truth that these markets are a fraud because they would start a run on supposed inventories. They also cannot give a clean bill of health because when it all blows up, well, they were already on record telling the world that "all is well. Besides, even an illiterate monkey can see the manipulation" so why beat a dead horse, right?! So here we are, sitting, waiting, watching and being irritated by the obvious lies churned out by the paper markets. But sitting, waiting and watching what? Simple, simple, simple, until the last dregs of supply run out or physical demand "demands" delivery to the point of a default. Or of course, as I wrote in the earlier "PSLV" piece, until a billionaire steps up with a measly paper order and asks for delivery that cannot be filled. It really is this simple folks. The paper suppression schemes have for 15 years enhanced the real physical demand, slowly at first and now with a force that will turn into a buying panic. This is not rocket science, this is pure street logic that an 8th grade dropout couldn't miss. It is so funny to me to watch CNBC trot out "experts" who spout the stupidity that Gold and Silver are "oh so risky". I wouldn't trust these "experts" at bagging groceries! Regards, Bill H. |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  graphe ventes silver eagle LT graphe ventes silver eagle LT

par marie Mer 13 Juin 2012 - 23:20 | |

| graph mensuel des ventes de silver eagle depuis 1990 , exprimées en onces avec la moyenne mobile 12 mois en blanc  US Mint updates Juin silver ventes : 1,121,500 oz. et pour les gold eagles :  US MINT: update juin 2012 : 18,500 oz / 23,500 coins. source |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  US mint a vendu 74 fois plus de silver eagle que de gold eagle en juillt et aout US mint a vendu 74 fois plus de silver eagle que de gold eagle en juillt et aout

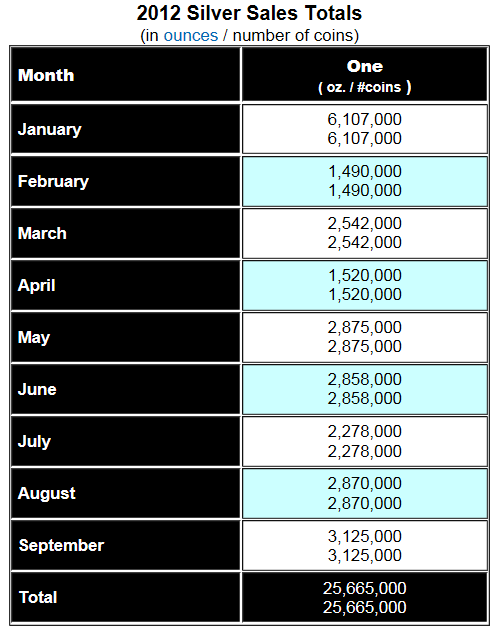

par marie Ven 7 Sep 2012 - 18:01 | |

| us Mint a vendu 74 fois plus de silver eagle que de gold eagle en juillet et aout : on parle bien d'onces et pas du nb de pièces, évidemment Imaginez un peu le potentiel que ça donne pour le ratio or /argent ! - Citation :

-

The US Mint sold nearly 75 times more Silver Eagles than Gold Eagles in August, for the 2nd consecutive month!

The Mint sold 74.6 times the amount of silver than gold in July, and 73.5 times the amount of silver than gold in August.

Physical silver sales simply cannot continue to be 75 times gold sales when the natural in-ground mining ratio is now 8-1 (2011 world average).

If these sales trends continue (and we are currently seeing even more extreme silver/gold sales ratios at SD Bullion), eventually the free market supply and demand fundamentals will see silver EXPLODE IN VALUE RELATIVE TO GOLD.

The Mint’s sales totals are in line with what we have experienced at SD Bullion over the past month, as silver sales volume is markedly increased across all products since silver cleared $28 to the upside bringing some life and hope back to silver investors.

Look for the Mint’s silver eagle sales to continue to pick up as this next bull rally continues. We expect the Mint’s 2013 sales to likely surpass the 40 million ounces sold in 2011 and set a new record.

voir également les tableaux de statistiques source |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  explosion des ventes silver eagle, ce week end explosion des ventes silver eagle, ce week end

par marie Mar 25 Sep 2012 - 18:09 | |

| explosion des ventes silver eagle, ce week end ==> d'après les stats de US MINT, les ventes de silver eagle ont augmenté de 1 millions d'onces, ce week end passant de 2.190.000 à 3.125.000 à la dernière mise à jour excepté janvier 2012, sept sera donc le plus gros mois de l'année !  source source |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Sprott / l'argent va exploser à la hausse Sprott / l'argent va exploser à la hausse

par contact.lecteurs Dim 7 Oct 2012 - 17:23 | |

| - Citation :

Bonjour,

Un article de Sprott sur l'explosion de l'argent à

venir. Il y a autant d'échanges en dollars sur l'or que sur l'argent physique.

Sachant que la moitié de la production d'argent dans le monde est destinée à

l'industrie et n'est pas recyclé.

""The ratio of sales in dollars of silver to gold is now one-to-one. The mint sells as

many dollars of silver as dollars of gold. The price is 50-to-1, which means

they are selling 50 times more volume than gold."

A chaque point bas (ratio 1) l'argent à fait par 3.

L'objectif de Sprott : 100 $ pour le silver

http://www.mining.com/silver-is-screaming-that-it-has-to-go-up-eric-sprott-55782/

J'ai rajouté le graphe du ratio

Gold/Silver ( en rouge ) sur celui du ratio des ventes Silver/Eagle Vs Gold Eagle,

les 2 courbes collent.

Manu |

|

Staff

Inscription : 16/03/2005

Messages : 347

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  ratio silver /gold eagles toujours supérieur à 50 ! ratio silver /gold eagles toujours supérieur à 50 !

par marie Mar 23 Oct 2012 - 19:11 | |

| ratio silver /gold eagles vendues toujours supérieur à 50 ! , ce qui est insoutenable avec le ratio de production silver / gold de 9 pour 1 - Citation :

- The US Mint’s frantic silver sales pace continued over the weekend, as the Mint reported 430,000 ounces of silver sales over the weekend on Monday. Perhaps more importantly, the US Mint Silver eagle to US Gold eagle sales ratio continues to exceed 50 to 1, a pace that is simply unsustainable with a current mine ratio of 9 to 1.

source |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

| |   | |

Sujets similaires |  |

|

| Page 1 sur 2 | Aller à la page : 1, 2  | | | | Permission de ce forum: | Vous ne pouvez pas répondre aux sujets dans ce forum

| |

| |

; | |

Hardinvestor

Hardinvestor

Hardinvestor

Hardinvestor

» COMSTOCK MINING Inc. (NYSE : LODE) Fil dédié:

» WORLD WAR III ? je suis vert de rage d'ouvrir ce fil dédié, on serre les miches: on commence avec Gerald Celente

» Les Podcast et interviews de David Brady, Sprott, Rick Rule, Katusa, Bix Weir, etc...SILJ (Hardin mini-fonds Silver Juniors et Royalties)

» Uranium /minières uranium

» a quoi joue la Russie ..

» TREASURY METALS PFS publiée edit: *NB: TML est devenue NEXTGOLD (NXG)

» Wheaton précious metals/ WPM

» Comment l'Union européenne nous prend pour des imbéciles