|

| | Chine / réserve d'or / file de suivi |    |

| | Message | Auteur |

|---|

Chine / réserve d'or / file de suivi Chine / réserve d'or / file de suivi

par marie Ven 24 Avr 2009 - 16:20 | |

| réserves d'or chine : 1049 tonnes d'or en avril 2009comme vous le savez la chine annonce officiellement un quasi doublement de ses réserves d'or depuis mars dernier les stocks d'or de la Chine passent de 600 Tonnes d'or en mars contre 1049 tonnes d'or, now m'est avis que les statistiques des réserves d'or fournies par WGC étaient volontairement souestimés et que ces achats d'or, par la Chine ne datent pas d'hier, mais de 2003 .... encore une fois, bravo au WGC pour ses statistiques bidonnées réserves d'or des banques centrales / statistiques   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par marie le Lun 30 Mar 2015 - 21:05, édité 4 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   |  Excellentissime ! Excellentissime !

par phv Sam 25 Avr 2009 - 5:15 | |

| Si la Chine commence à syphoner 500 tonnes d'or+ par an, c'est absolument EXCELLENTISSIME pour le cours de l'or:

Vu les réserves de Cash sans valeur réelle dont elle dispose, il y a fort à parier que cet "effort" se poursuivra, voire augmentera pour quelques années encore...

jusqu'à ce qu'il n'y ait plus d'Or du tout à extraire...

(15 à 20 ans MAXIMUM aux rythmes de consmmation actuels, et 40 ans Maxi aux rythmes de production actuels...) |

|

Barreur

Inscription : 02/03/2009

Messages : 245

| |   |  Re: Chine / réserve d'or / file de suivi Re: Chine / réserve d'or / file de suivi

par g.sandro Sam 25 Avr 2009 - 9:09 | |

| Oui, on a souvent évoqué le dilemme de ce piège que constituent ses pléthoriques réserves de change dont elle ne peut pas vendre 1% sans dévaluer de fait les 99% restants.

il semble que l'urgence de sortir du Dollos va se préciser et que niqués pour niqués, les noich vont tenter d'en convertir un max, pas trop vite quand même pour ne pas se tirer une balle dans le pied, mais à un rythme inédit quand même àmha...  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14452

| |   |  Re: Chine / réserve d'or / file de suivi Re: Chine / réserve d'or / file de suivi

par marie Lun 27 Avr 2009 - 23:23 | |

| nombreux développements sur midas ce soir .. bien entendu vous aviez tous remarqué que ces 450 tonnes d'or supplémentaires viennent seulement maintenant d'etre déclarées... alors qu'il s'agit d'achats initiés depuis 2003 .. et que le Gata suivait avec l'un de ses correspondants privilégiés, surnommé stalker ( littérallement : harceleur" ) ce qui est certain, c'est que les chinois ont une bonne raison pour faire cet "aveu", ici et maintenant pour cause de longueur du post, je vous mets lien de 2 news, puis les commmentaires off du midas .. http://www.financialpost.com/news-sectors/story.html?id=1530063puis sur Midas www.lemetropolecafe.comNow from a fellow Café member… Hi Bill, Doing some maths on the STALKER purchases, $6.8 billion at US$414 per troy ounce comes to 510 tonnes. This purchase alone is more than what the Chinese govt just announced (454 tonnes), and it was completed in Jan 2004. Do you know if the various purchases STALKER made were all for accumulation, or does STALKER trade gold for China? It would be interesting to know what the net accumulation was since 2003. According to Hu Xiaolian, head of the State Administration of Foreign Exchange, the purchases were from scrap and domestic supplies. Maybe China hasn't even included any of the STALKER gold in its official reserves yet! Regards, Alex P Key points to keep in mind… *Alex is right on about what the Chinese buying numbers added up to in late 2003 and in 2004 … and that they are slightly greater than the new "official" Chinese gold reserve number. *Again, a special thanks to our STALKER source, who gave the GATA camp the inside scoop about what the Chinese were up to more than five years ago. *It cannot be a fluke that the numbers we received so many years ago are so close to what the Chinese just produced as their new reserve so many years later. *Veteran Café members will recall that we initially identified the STALKER as the "gold buying GROUP," meaning there was to be more than one buyer and that there would be different strategies for each … some would trade gold, some would not and just accumulate. *Therefore, it is very easy to account for more than the announced 454 tonnes, which may result from just one of the GROUP’s accumulation. *There is some discrepancy whether the 454 tonnes was accumulated from the domestic market, or bought in the open market. Our camp knows that it was bought on the open market as we laid it out way back when what was going on. It makes sense that the Chinese would say they bought their gold from domestic sources as they do not want to directly confront the US on the gold issue. We know for a fact that the Russian Central Bank knows all about GATA and our findings, as they said so publicly at an LBMA conference years ago in Moscow. If the Russians know what GATA knows, so do the Chinese. They have to understand to what extent the US has gone to in order to suppress the price, meaning the US quietly wants as low a gold price as possible. Therefore, the Chinese don’t want an open confrontation about buying the stuff, which surely is in direct contrast to US wishes. That is not to say China didn’t ALSO accumulate gold reserves from their domestic production, which would make their true gold holdings a fair amount higher. *The gold the Chinese purchased back then was secured at the time, but had to be delivered over a period of time so as not to disrupt the market. *As my colleague Chris Powell has stated for a decade, it is easier to find out how to make a nuclear bomb over the internet, than it is to get the right scoop on what is what in the gold world. Some examples… There has been no true accounting for the massive amount of gold lent out by western central banks that is no longer in their vaults, yet the mainstream gold world acts as if the central banks still have 30,000 tonnes of gold when, in reality, they have less than half of that left. More than two years ago the IMF requested the central banks differentiate between gold reserves and gold out on loan, or swapped. To my knowledge the central banks have not complied with that request. The US is beyond hypocritical about our gold. The Fed and Treasury continue to say that our 8100+ tonnes are still just sitting in our vaults. YET, they won’t conduct a truly independent audit of those reserves and they won’t answer FOIA requests without holding back, or redacting, material that has been requested. *Keeping in mind the lack of disclosure by western central banks, who knows what the Chinese really have in reserves, except that it is at least 1054 tonnes. *Unlike the West, the Chinese think much longer term. What the US is doing from a fiscal standpoint, and the way our major investment houses have brought on financial/economic chaos in America, has them scurrying from us as discreetly and fast as possible. One of those ways is to accumulate as much gold at these cheap prices as possible. The odds they will continue buying are more than HIGHLY probable, which is extremely price supportive. *And finally, there surely was a reason the Chinese made this disclosure at this point in time. It was a shot across the bow to the US for sure. What the exact ramifications are is hard to say. Perhaps this says it all: http://www.google.com/hostednews/afp/article/ALeqM5hOLJdmg2yC8VdSy8W_qYEtOb5G0w  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par marie le Ven 7 Oct 2011 - 13:57, édité 1 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   |  Re: Chine / réserve d'or / file de suivi Re: Chine / réserve d'or / file de suivi

par marie Lun 27 Avr 2009 - 23:57 | |

| suite www.lemetropolecafe.comChina Gold Purchase and IMF China and gold… Bill, The Wall Street Journal ran an article on the China gold purchase on Friday titled "Buying quietly, China raises gold reserves to 1,054 tonnes" by Alfred Cang and Tom Miles / Reuters http://www.livemint.com/articles/Authors.aspx?author=Alfred%20Cang%20and%20Tom%20Miles%20/%20Reuters&type=wa. The piece has the following sentence:

Several gold market participants said they thought China had bought on the international market, helping to absorb hundreds of tonnes sold off by central banks and IMF in recent years.

Funny, but I did not know that the IMF had sold hundreds of tonnes of gold since 2003. As a matter of fact, the IMF has been threatening to sell 400 tonnes of gold since at least 2003 but has reported no such sale themselves. China on the other hand does not have to resort to threats, but actually took action and bought gold. Not only that but China was smart enough to buy first and announce afterwards as opposed to the pathetic IMF. Regards,

Bryant… Andy…All,

In my view, the most important development in the gold market, hands down, has been China’s purchase of gold reserves over the past five years, which was finally acknowledged yesterday per the below article. To the world at large, this comes as a "big surprise", but not to anyone that has been following the gold market with any kind of diligence.The GATA, or Gold Anti-Trust Action Committee, camp has KNOWN that China has been buying all these years, but the rest of the world (media, Wall Street, etc.) instead chose to listen to the lies and propaganda espoused by Western governments, led by the U.S. of course, and the dubious "World Gold Council" (WGC). The WGC is an industry trade organization which is possibly the worst advocate of its own in the history of business, and frankly given its huge representation by Cartel leader Barrick Gold many have had serious doubts about its intentions. Instead of exposing the obvious manipulation which has resulted in dramatic production declines and massive operational losses by its members, the WGC has spent its time marketing jewelry, which in essence is immaterial to the gold market compared to investment demand. Moreover, this news proves, without a doubt, that the WGC’s pathetic supply/demand charts have been hopelessly wrong for years, as they have constantly, massively understated demand and overstated supply because of their refusal to acknowledge unreported official sector selling (read: illegal, double-counted leasing by the U.S., British, and other Western Central Banks) and massive, unreported official sector buying from China.According to Chinese officials, the 600 tonnes of gold reserves on their books for decades has actually been increased to 1,054 tonnes since 2003, making them the fifth largest holder in the world (or sixth if you believe the ETF GLD owns what it says it does, which I emphatically do not). And they are probably much closer to #1 than even these statistics note, as CLEARLY the names ahead of them on that list (most notably the #1 USA) have surreptitiously leased out substantial portions of their reserves in the name of blatantly suppressing the gold price, the linchpin of the "strong dollar policy" the Treasury and President’s office have been espousing for years.The Chinese gold buying announcement is tremendously important to the gold bull case on so many levels, including:1. Completely validates GATA’s decade-long assertions that the gold price is manipulated by illegal selling/leasing of Central Bank reserves, led of course by the U.S.. These nations haven’t materially changed their "official gold reserve" numbers for decades, yet the ONLY WAY China could have found gold in such size without driving the price up to $1,500-$2,000/oz is from buying this illegally sold/leased gold.2. In turn, proves that official Central Bank gold reserve numbers are completely useless, fraudulent, misstated, etc. (choose your terminology), and forever to be mistrusted. And that includes the IMF "gold reserves" as well, which are also unaudited and poorly accounted for, the large part of which supposedly comes from "pledges" of gold from the reserves of member nations such as the U.S. and Britain.3. In turn, proves that if the IMF actually has any gold to sell, it will be consumed at one fell swoop by other Central Banks before it even hits the markets, likely by China but probably with competition from Russia (which has also been increasing its official gold reserves), India, Arab nations, and others. Moreover, unlike the U.S., most European nations have long historical understandings of the powers of gold, and are more likely to be buyers than sellers in this environment. The Central Bank Gold Agreement (CBGA), which establishes yearly quotas on member sales, is not even going to come close to reaching its quota this year, with Germany, the supposed #2 holder of gold after the U.S., last year officially stating that it is no longer going to sell ANY more gold.4. Proves, once and for all, that the propaganda espoused by the U.S. and British governments that gold is a "barbarous relic" is pure BS. China has more money than any country on earth, and they are using substantial portions of it to move into "real money", gold (and probably silver). History says that "he who owns the gold has the power", and it will be no different this time, I ASSURE you. 5. "Unofficial" publications from China cite government officials stating the goal of reaching gold reserves of at least 5,000 tonnes. And now that we know they actually are buying, you can be sure they will get there, which will easily cause gold prices to at least double on their own, exclusive of any other market factors, of which there are many. Remember that officially the U.S. and other Western Central Banks (excluding idiot Britain, whom under their genius PM Gordon Brown sold more than half their gold back in 1999 at $250/oz) hold roughly 30%-35% of their currency reserves in gold (excluding the huge amounts that have been surreptiously/illegally leased), while China, even after this revelation, still holds just 2% of its currency reserves in gold. In fact, nearly all the Eastern nations are in the 1%-2% camp, and they have all the money, not to mention that the majority of their reserves, thanks to the end of the gold standard in 1971, are sitting in listing, cancerous U.S. dollars, as well as massively overvalued U.S. Treasuries, which at this moment look to be on the verge of massively breaking down.In conclusion, DO NOT underestimate the importance of this news, it is of tantamount importance!Protect yourself!

Andy  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par marie le Mar 28 Avr 2009 - 0:39, édité 1 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   |  Re: Chine / réserve d'or / file de suivi Re: Chine / réserve d'or / file de suivi

par marie Mar 28 Avr 2009 - 0:07 | |

| suite du midas sur l'annonce chinoise

j'aime bien la régle d'or exposée par Mike ( surlignée en rouge dans le texte ).. et si on prend en compte les chiffres réels et non ceux falsifiés du WGC, la chine est amah bien mieux place que 5éme détenteur d'or ..

Mexico Mike…

Queen attacks King's Bishop pawn

Hi Bill!

Statesmanship can be a lot like high level poker or chess. When you make a move you do so for a reason, and you must always be thinking several moves ahead. To appreciate the significance that the Chinese have come out and announced they are adding to their bullion reserves, we must think about the message they are sending. There is no requirement for China to disclose what they are doing behind the scenes. They have been active for several years, at least back to 2003. And I doubt that China has chosen to suspend buying and therefore it would be in their interest to continue in stealth mode.Yet they announce this news now. Why?

To put this into context, we should be aware that China has demonstrated similar political gamesmanship in the past, by making statements either directly or through connected intermediaries, that have sent shockwaves through the market. This kind of behaviour tends to get the attention of the US with abrupt consequences. For example, we should recall how highly placed individuals have made comments to chastise the US administration for irresponsible fiscal policy recently, and late last year there was some sabre rattling about diversifying out of the US Treasury bonds that comprise the bulk of Chinese Forex holdings. In each case it is necessary to point out that this type of commentary is not generated from random outburst but instead is a carefully considered gambit that was approved at the highest levels, and desired to achieve specific results. And in each case there was a violent market reaction and an immediate response from the US administration to appease China.

So when we get an official statement that China is adding to its gold, one may speculate that the phones are ringing off the hook with high level diplomacy in response. I doubt that the news was geared to put an end to the gold price manipulation since it has obviously served the interests of China to buy so cheaply. Think of how any official statements in years past that China was planning to buy more than 400 tons would have triggered higher prices, offsetting the propaganda value that the Cartel employs to pre-announce large gold sales. However with this announcement we see a reaction of higher gold and a lower dollar nonetheless so it was obviously calculated to achieve other results behind the scenes.

I do not believe China has any hostile ambitions towards the US or a desire to destabilize the market. The country simply has too much invested in US dollar assets and through its trade relationship with the US to create a meltdown. But let us never forget the golden rule: He who has the gold makes the rules. Now that China is the 5th largest gold reserve country, and sure to continue building its gold reserves, they are basically starting to flex their muscles in terms of the clout they now have in determining world economic policy. And that is where I believe this 'message' from China is sure to resonate.

Investors should not underestimate the importance of this revelation. The majority of commentary in the west with regards to gold would lead one to believe it is either highly speculative and therefore unworthy of participation by the average investor, or that it has reached unsustainable price levels and is dangerous to own. The action by China would debunk both of these myths. The willingness to buy all the way through this bull market is driven by a concern over the sustainable value of the dollar, and that should be a concern for all investors in the west.

And how sharp is the contrast now between the economic policy decisions of China and Britain? These two countries have seen their domestic economies move in opposite directions, and one is a buyer of gold, while the other was a seller. The transfer of leadership is more apparent than ever just on the basis of this observation.

I do not pretend to have any insight into what motivated the Chinese to send a clear message. It could be concern regarding the pending further debasement of the dollar in the next round of financial bailouts. It could be to express dissatisfaction from the outcome of the G20 conference and the lack of progress to install some form of balance in the continuance of the dollar as the world reserve currency. It may be related to the pending breakdown in the bond market, where China is still expected to buy a lot of that paper and continue subsidizing the US deficit, and perhaps would want to see some higher yield to compensate for the abysmal underlying fundamentals. All I can state for sure is that this message is being read loud and clear such that even the dimwits in the current administration will fall into line.

This is the new world economic reality. For 60 years the United States has driven world policy and at that era is coming to an end. At any time, China could collapse the economy of the west, just by making a formal statement that it was dishoarding dollars and buying gold. Instantly the US dollar would collapse, gold would go ballistic, and hyperinflation would devastate the economic landscape. China could easily buy up every ounce of gold for sale on the planet, and drive prices to levels even the most delusional gold bull could not imagine, if they chose to do so. I do not see this happening, but the fact that it could is reason enough to illustrate the clout that China now has on the world stage. The corrupt influences within the

current US administration must be restrained and some form of responsible policy much be adopted to allow for a smooth transition. I doubt that the rest of the world is going to put up with the irresponsible financial policy much longer, or allow this administration to grandly write cheques it cannot cash.

We should all be on notice that if the emerging economic superpower of the world is buying gold to protect its interests, then it makes sense for investors to adopt similar measures.

Cheers!

MexicoMike

Bill H:

CHINA

To all; news emerged Friday that China has accumulated 454 more tons of Gold. They had 600 tons back in 2003 and announced no change since then, until this past Friday. China has been trotting the globe over the past year, buying up resource companies at breakneck speed. They know, the U.S. knows, for that matter the whole world knows that China must divest and diversify their Treasury holdings if they don't want to be left holding a fiat bag of air that has no value.

At some point, China will "pull the plug" on the global financial system that has been built on debt that is payable in a currency that has no value, this much is sure. The only variable as I see it is time. When do they pull the plug? I have no idea, all I know is that once the plug is pulled, financial time will stop and freeze up for some unspecified period. This will be "revaluation" time. This will be the period of time where 50 years of false and ever more false values get re-priced to reality. Is a pro athlete worth $10-20 million per year? Land at $300 per sq. foot? Or how about copper at $2 per pound? Is a cup of coffee at the local store worth 50 cents, or $10? This will all be sorted out and the chips will fall as they may, the cow chips, well, they will hit the dirt, the blue chips, they will be made of Gold. The point is, everything will be re-valued, everything! Regards, Bill H….   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   |  Re: Chine / réserve d'or / file de suivi Re: Chine / réserve d'or / file de suivi

par marie Mar 28 Avr 2009 - 22:40 | |

| lui aussi pense que la chine a acculumulé bien plus que les 1045 Tonnes d'or qu'elle déclare officiellement aujourd'hui, dans ses réserves d'or .. entre WGC qui surestime les réserves d'or des banques centrales occidentales qu'elles ont la grâce de double compter ( en ne déflaquant pas leurs prêts de leurs réserves ) .. et les chinois ( et sans doute les russes ) qui sousestiment leurs stocks d'or..  http://www.gata.org/node/7392 http://www.gata.org/node/7392J.S. Kim: Central banks are full of disinformation on gold Submitted by cpowell on 05:53AM ET Tuesday, April 28, 2009. Section: Daily Dispatches8:48a ET Tuesday, April 28, 2009 Dear Friend of GATA and Gold: In commentary posted today at Seeking Alpha, market analyst J.S. Kim, editor of the SmartKnowledgeU investment letter, notes the disinformation distributed about gold by central banks. Kim speculates that China's announcement last week that it has accumulated 1,054 tonnes of gold reserves is disinformation too -- that China actually has accumulated much more gold than that. Kim's commentary is headlined "World Gold Markets: How Lack of Transparency Translates into Poor Analysis" and you can find it at Seeking Alpha here: http://seekingalpha.com/article/133504-world-gold-markets-how-,br>lack-of-transparency-translates-into-poor-analysisCHRIS POWELL, Secretary/Treasurer Gold Anti-Trust Action Committee Inc.   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par marie le Ven 7 Oct 2011 - 13:59, édité 1 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   |  Re: Chine / réserve d'or / file de suivi Re: Chine / réserve d'or / file de suivi

par marie Lun 18 Mai 2009 - 16:26 | |

| la chine continue d'acheter des t bonds .. et la presse financiére d'en faire une analyse d'une naiveté qui dépasse l'entendement .. pourtant les tbonds us, forts prisés des BC.. et bien que vil papier Q.. sont, compte tenu de ce fait de parfaits collatéraux.. qui permettent à la chine d'acheter mat 1eres et précieux .. c'est si compliqué que ça d'y penser.. au lieu de faire des analyses bidons?  bref ci dessous in extenso, le papier de A Douglas, du bon sens .. rien que du bon sens ! http://www.gata.org/node/7428 Adrian Douglas: Have China watchers never heard of a decoy?Submitted by cpowell on Sun, 2009-05-17 18:08. Section: Daily Dispatches By Adrian Douglas Sunday, May 17, 2009 What amazes me is how financial journalism is at the level of sixth grade in terms of analytical thinking. Even so-called market analysts are not much better. GATA put out a dispatch today citing this Agence France-Presse article published by the Sydney Morning Herald in Australia, "China Keeps Buying U.S. Bonds Despite Concerns": http://news.smh.com.au/breaking-news-world/china-keeps-buying-us-bonds-d...This article is a prime example. It reports that China was recently expressing grave concerns about its massive U.s. bond holdings is still buying more such bonds. The simpletons in the press and financial world don't have a clue. What are these sleuths looking for? A $500 billion sell order posted with a New York broker on some rainy Monday morning? Have they never heard of a decoy? The U.S. Treasury reports each month on foreign holdings of U.S. Treasuries. The Chinese would have no more than 30 days to dispose of almost a trillion dollars in Treasury debt before their selling would be public knowledge. Do these China watchers seriously think that the China's diversification strategy is going to involve unloading U.S. debt on the debt market? You don't have to dispose of an asset to realize its cash value. Didn't these people learn anything from the mortgage crisis? For bankers the best collateral in the world is U.S. Treasury debt. That is likely to change soon, but if we deal with the facts of today, the Chinese are holding what bankers perceive is the most liquid and highest-quality collateral. Do you think that this characteristic of U.S. debt has escaped the notice of the Chinese? I would bet that the Chinese have been busy using their Treasury debt as collateral against FIXED-interest-rate loans. They will have used this money to buy real assets. We know they have bought at least 454 tonnes of gold. They are importing 70 percent more copper than they consume. They are filling up a strategic petroleum reserve. They have been going around the world making deals for raw materials and acquisitions of small-enough companies that they fly under the radar. (The Chinese learned their lesson from trying to buy Unocal.) The interest rate on these fixed-rate loans will be partially offset by the interest paid on their U.S. bonds. When the bonds go tapioca, the Chinese will have two options. They can sell some of the assets they bought but at prices much higher than what they paid and so pay off the loans with worthless dollars, or they can simply default and lose their collateral of now-worthless U.S. bonds. Just to obfuscate what they are doing, they make some complaints about U.S. debt one day and then buy some more a few weeks later. Financial journalists should read the biography of Jesse Livermore to know how you can fool even the best traders. The Chinese have a $300 billion sovereign wealth fund. If that is properly positioned in commodities, it alone will hedge China's entire bond portfolio. The notion that the Chinese have accumulated this massive U.S. debt portfolio and only now are wondering what to do about it is so naive it doesn't warrant serious consideration. I have dealt with Chinese in business and they are the sharpest knives in the drawer. My guess is that China has already diversified most of its dollar holdings. Now, like magicians, the Chinese keep the eyes of the China watchers fixed on the hat, because we all know that is truly where the magician has hidden the rabbit, right? The Chinese have no interest in collapsing the U.S. Treasury market, but if you think that the Chinese strategy to protect themselves against such an eventuality is to sit tight, buy more, and keep their fingers crossed that everything will work out fine, then you shouldn't go out in public alone. The Chinese have vault-loads of intrinsically worthless Treasury bonds that they no doubt have used as collateral to buy intrinsically valuable assets. In contrast, Western central bankers had vault-loads of gold they have loaned or sold to buy intrinsically worthless interest-bearing government debt. I bet Confucius would have had something to say about that. ---- Adrian Douglas is editor of the Market Force Analysis letter (http://www.marketforceanalysis.com), which uses proprietary methods of determining market turning points. Subscribers receive bi-weekly bulletins. He is also a member of GATA's Board of Directors.  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   |  Les chinois, l'Or, les DTS ... Les chinois, l'Or, les DTS ...

par menthalo Ven 26 Juin 2009 - 19:29 | |

| Li Lianzhong, cela se prononce comme ça s'écrit, à défaut appelez le Li ... un chinois sur 5 s'appelle Li .... Donc Li, qui dirige le département de recherche économique du Parti ( PCC) , dit que la Chine devrait utiliser 1,95 trillons de US$ de ses réservesde change pour acheter des matières premières (energy and natural assets). Dans le forum Gold d'un Salon international, il pose la question : "Devrions nous acheter de l'or ou des Obligations du Trésor américain ? Les US impriment du dollar massivement, et au vu de cette tendance et en se fiant aux lois de l'économie, il n'y a pas de doute que le dollar va chuter. Donc l'Or devrait être le meilleur choix" Il n'y a pas de doute que Li énonçait là la Ligne officielle du Parti. Le débat fait rage en Chine sur la manière de se protéger d'une érosion du $ et des T-Bonds US. A cette fin, la Chine a annoncé qu'elle achèterait pour 50 Milliards de $ de DTS, l'unité monétaire internationale du FMI. Même si la Chine a accru ses réserves d'or de 600 à 1054 Tonnes ces dernières années, le pourcentage de l'or dans les réserves de la BCC a diminué étant donné l'accroissement massif des devises étrangères provenant du commerce international. Li, citant la part de l'or dans les réserves de la France, de l'Italie, de l'Allemagne ou des Etats Unis, a affirmé que les 1,6% d'or dans les réserves chinoises était très nettement insuffisants. Si le Yuan doit devenir une monnaie internationale et devenir une monnaie de réserve, la Chine a besoin de plus d'or pour asseoir sa monnaie. A terme, le Yuan devrait faire partie du panier de monnaie du DTS à hauteur de 20%

La recomposition du panier constituant le DTS aura lieu en 2010. source: http://www.cnbc.com/id/31535631Traduction menthalo ... qui s'est permis de sauter quelques passages Replaçons ces informations dans un plan d'ensemble 2010 révision du DTS du FMI rapprochez cet article de cette rumeur sur les ambassades US recevant des liasses de $ à changer en monnaies locales pour se constituer une trésorerie de DOUZE MOIS... été 2010 Faillite du du dollar cet été... un épisode zimbabweén de douze mois... puis nouvelle monnaie pour l'Union Nord Américaine, accouchée dans la douleur, l' Amero, qui devrait être comme le Yuan backé par l'Or ... mais bien sûr aussi par l'Argent, comme chacun sait, avec un nouveau ratio abracadrabantesque et supercalifragilistic de 1/10   vous risquez d'entendre cette ritournelle un certain nombre de fois voir éventuelles différences sur marketwatch http://www.marketwatch.com/story/chinese-official-urges-buying-of-gold-us-land |

|

Piano bar

Inscription : 28/04/2009

Messages : 608

| |   |  Dragon's Hoard: de l'influence de la Chine sur le marché de l'or Dragon's Hoard: de l'influence de la Chine sur le marché de l'or

par menthalo Sam 27 Juin 2009 - 13:56 | |

| June 25th, 2009 Dragon's HoardBy Michael Kosares (0 comments) In one fell swoop, China profoundly alters gold market synergy. "We've got a situation where Geithner is smiling and has no choice but to stress the credibility and stability of the US financial and economic system, while the creditors [such as the Chinese] smile back and say they believe him, while at the same time giving hand signals to their reserve managers to get rid of these things [U.S. Treasuries]." (Neil Mellor, Bank of New York-Mellon)

When China recently expressed its interest in purchasing $80 billion in gold (about 2600 tonnes), it profoundly altered the gold market's long-standing synergy in three significant ways:  First First, it used to be that the threat of central bank gold sales would damage market sentiment. Now the threat of significant sales has been met with the threat of significant purchases. Though the dragon hoard depicted by our good friend, Ed Stein is not yet a reality, China can back its desire to own gold with plenty of cold hard cash. At nearly $1.4 trillion in dollar-based assets, and almost $2 trillion in total reserves, $80 billion would consume a paltry 6% of China's dollar reserves. At the same time 2600 tonnes translates to roughly one-third the U.S. gold reserve -- a significant ambition by any measure. To give you an inkling of how this new synergy might work, when the International Monetary Fund announced recently it would like to sell about 400 tonnes of gold, China joined India in publicly pressing the IMF to sell its entire 3200 tonne hoard. On that news the gold market, which had been in a slow slide as a result of the IMF's announcement, turned and took another run at the $1000 mark. Second, by becoming gold's most prominent champion, China mounts an aggressive defense of its domestic gold mining industry, and by proxy the rest of the industry as well. Few people know that over the last few years China has quietly become the world's leading gold producer. Most of that production never leaves China's borders, but goes instead to the national reserves as a hedge against its currency holdings. China, by the simple expedient of defending its own interest, accomplishes much for the gold mining industry as a whole. By posing as a gold buyer of last resort, ready, willing and able to scoop up any sizable offer, China may have very well put a floor under the market price, though we are too early in the game at this juncture to predict what that price might be. There is no question, however, that China has put a floor under long termgold market expectations. One would have to go back to the first Central Bank Gold Agreement in 1999, which strictly limited the sale and leasing of central bank gold, to find an equivalent organized effort in defence of the long term price trend. Many feel that the original CBGA launched the current bull market in gold, and time will tell whether or not China's bold entry onto the gold scene will launch its second leg. Third, by elevating gold to prominence in its national reserves, China lays the groundwork for the yuan's future use as a prominent reserve currency. There is little doubt that China would like to make the yuan the currency of choice in the East and a strong measure of gold in its reserves would do much to enhance that possibility. For a comparative history, one would have to go all the way back to the late 1960s and the time of French president Charles DeGaulle. "The Last Great Frenchman" thought it best to hedge the national interest and elevate its future economic prospects by purchasing gold. A substantial amount of metal subsequently left U.S. coffers for European national balance sheets including that of France. DeGaulle was later vindicated when gold rose twenty five times in dollar terms over a short ten year period from $35 an ounce to $875 (1971 to 1980). Some of that same gold would later play a key role in the establishment of the European Union, the European Central Bank and the euro, Europe's currency. China, by its recent actions, appears to have similar intentions both in terms of gold and the yuan. __ In one fell swoop China has done much to alter the standing gold market synergy. When Congressman Mark Kirk announced China's desire to purchase gold during an interview with Fox News' Greta van Sustern, he noted "across across the board - in private - substantial, continuing and rising concern." Chinese leaders, he added, were sharply critical in private of the US Federal Reserve's policy of "quantitative easing," the modern equivalent of printing money. Kirk went on to say that rising concerns about the dollar and anticipated inflation had prompted China to: "[fund] a second strategic petroleum reserve and they plan to buy $80 billion worth of gold. . . Both of those investments only make sense if you expect significant dollar inflation." In the years to come, China will continue to steadily build its gold reserves through domestic production. It will also attempt to purchase whatever gold it can on the world market through official sector purchases or whatever additional means it finds at its disposal. In the process it will become the fire -breathing dragon in the gold market's living room - ubiquitous and formidable, a presence that cannot be ignored. At the same time, it will find itself in stiff competition for the available physical gold with an international public which harbors the very same concerns for their own portfolios that Chinese officials expressed to Representative Kirk. Few among gold's growing legions would disagree with China's logic, or its now publicly voiced desire to hedge a potentially disastrous collapse of the dollar. http://dollardaze.org/blog/ |

|

Piano bar

Inscription : 28/04/2009

Messages : 608

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   |  Re: Chine / réserve d'or / file de suivi Re: Chine / réserve d'or / file de suivi

par Imhotep Ven 24 Juil 2015 - 11:14 | |

| Intéressant point de vue de James Rickard à ce propos. Attention, ça risque de piquer les yeux des goldbugs que nous sommes ... http://dailyreckoning.com/why-most-gold-bugs-and-bloggers-are-dead-wrong-about-chinas-gold/ - Citation :

- It also means that China can have gold but can’t talk about it. In order to “join the club,” China must play by club rules.

The rules of the game say you need a lot of gold to play, but you don’t recognize the gold or discuss it publicly. Above all, you do not treat gold as money, even though gold has always been money.

The members of the club keep their gold handy just in case, but otherwise, they publicly disparage it and pretend it has no role in the international monetary system. China will be expected to do the same. It’s important to note that China will not act in the best interests of gold investors; it will act in the best interests of China.

Si tu es prêt à sacrifier ta liberté pour te sentir en sécurité, tu ne mérites ni l'une ni l'autre.En matière de complots, il y a deux pièges à éviter : le premier, c'est d'en voir nulle part ... et le second c'est d'en voir partout.A la bourse tu as deux choix : t'enrichir lentement ou t'appauvrir rapidement. Si tu es prêt à sacrifier ta liberté pour te sentir en sécurité, tu ne mérites ni l'une ni l'autre.En matière de complots, il y a deux pièges à éviter : le premier, c'est d'en voir nulle part ... et le second c'est d'en voir partout.A la bourse tu as deux choix : t'enrichir lentement ou t'appauvrir rapidement.

J'ai dépensé 90% de mon fric en filles, boissons et bagnoles. Le reste je l'ai gaspillé |

|

Chef cuistot

Inscription : 26/09/2011

Messages : 1558

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14452

| |   |  1948 tonnes d'or au 30 septembre 2019 1948 tonnes d'or au 30 septembre 2019

par marie Mar 8 Oct 2019 - 16:44 | |

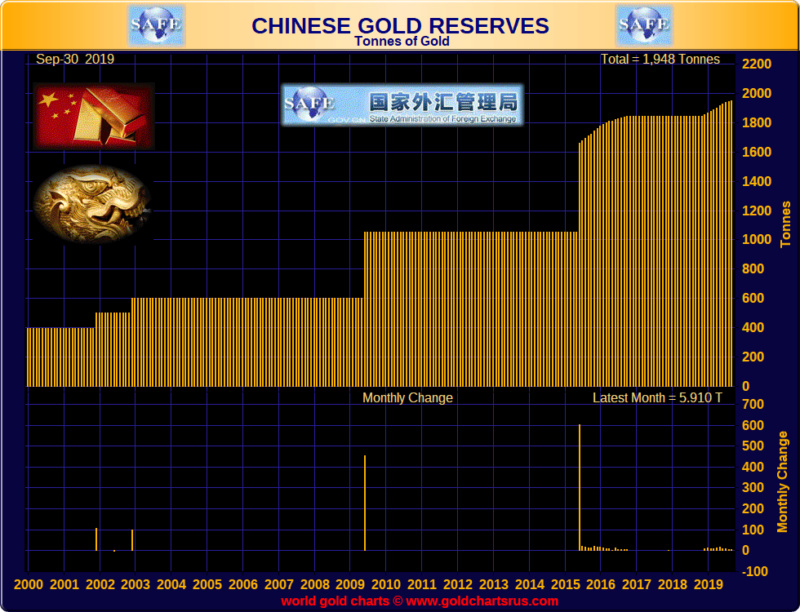

|

réserves d'or de la Chine : 1948 tonnes d'or au 30 septembre 2019

achat de 5.61 tonnes en sept 2019    Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20139

| |   | | |

| |   | |

Sujets similaires |  |

|

| Page 1 sur 1 | | | | Permission de ce forum: | Vous ne pouvez pas répondre aux sujets dans ce forum

| |

| |

; | |

Hardinvestor

Hardinvestor

Hardinvestor

Hardinvestor

» fondamentaux de l'argent métal / décryptage de la désinformation

» Les Podcast et interviews de David Brady, Sprott, Rick Rule, Katusa, Bix Weir, etc...SILJ (Hardin mini-fonds Silver Juniors et Royalties)

» a quoi joue la Russie ..

» Alain Juillet (que je découvre) une capacité d'analyse et de synthèse en raréfaction.

» Argent (SILVER) / analyses techniques

» ALERTE: Les signaux d'achats se multiplient sur un nombre important de mines d'Or et d'Argent

» Auplata / ALAUP puis ALAMG : fil de suivi

» 1984 est là ! Nouvelles technologies de flicage des citoyens comme Indect, pire qu'hadopi et ACTA combinés