|

| | Bons du trésor US /détenteurs étrangers |    |

| | Message | Auteur |

|---|

Bons du trésor US /détenteurs étrangers Bons du trésor US /détenteurs étrangers

par marie Sam 12 Mar 2005 - 19:23 | |

| détenteurs étrangers de Bons du trésor US c'est le moment de regarder ça de plus près pour commencer ce graphe tres parlant ! ( courtoisy of http://www.financialsense.com/ )  aprés les déclarations ( immediatement démenties    ) de la coree du sud , de la chine et du japon sur leur volonté d'arbitrer leurs monstrueuses réserves de $ , Norcini fait le point de la situation ... -on amorce un élargissement du spread entre les taux 2ans et les taux 10 ans .. l'inflation déniée jusqu'à present , serait de nouveau prise en compte par les traders ..qui jusqu'à présent , et contre toute réalité économique, prenaient en compte le scénario déflation vendu par Greeny - break out du rendement des obligations 10 ans .. qui confirme ce changement de perception des" bonds vigilants " article assez ardu mais extrement important pour nous .. ds la mesure où des taux d'interêt en hausse SONT le signal attendu pour le départ et l'envolée des cours de l'or .. et valident notre scénario inflationniste source :Annotations On The Bond Market   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par marie le Mer 19 Oct 2011 - 18:40, édité 7 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Mousse

Inscription : 17/03/2005

Messages : 21

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  l'or et les bons du trésor US / dégagements massifs des fonds étrangers l'or et les bons du trésor US / dégagements massifs des fonds étrangers

par marie Sam 15 Oct 2011 - 14:47 | |

| le graph de LT démarre en 2004, et c'est édifiant !! Comme on peut se demander où se réinvestissent ces fonds étrangers qui larguent les bons du trésor US, Rich dessine un graph permettant de visionner en parallèle, le cours de l'or . à chaque point bas du graph t bonds, correspond un creux des cours de l'or  , ce qui nous promettrait une très jolie jambe de hausse sur les cours de l'or www.lemetropolecafe.com RG: <p>

Bond Outflow suggests a monster move is rattling down the pipes,..

Bill, Fascinating graph courtesy of zerohedge.com showing the recent record outflow of treasurys from the Feds custodial account by ‘Johnny Foreigner’: Foreigners Dump $74 Billion In Treasurys In 6 Consecutive Weeks: Biggest Sequential Outflow In History Whole article can be found at http://www.zerohedge.com/news/foreigners-dump-74-billion-treasurys-6-consecutive-weeks-biggest-sequential-outflow-historyThought it would be interesting to graph this against the price of gold to see if there was any correlation, (I must caveat that with limited data, the comparison was patched as best as possible from cut and paste techniques), However I think you’ll agree the results are quite startling: The blue line highlights the occasions when the Bond Flow first goes negative (I have included almost every occasion of this event excepting where the outflow has been negligible, or is already part of a recent outflow setup), Whilst not an absolute, there is clearly a very strong correlation between when the Bond Flow turns negative and a low/postceding rise in the price of Gold, Clearly on such occasion, it would have almost always proved to be a very suitable point to acquire more metal, Given the enormous outflow recorded of late, it is only reasonable to suggest we are on the cusp of a major move north for the yellow metal, As after all, the only other time when there was such an exaggerated outflow of bonds was in circa September 2007, just before we witnessed Gold rise some 40+% in the space of 6 months! This correlation above, backs up my recent COT analysis, where the Commercial set up is also at bullish record extremes, suggesting that we may very well be on the cusp of ‘A Big One’! Very best, Rich (Live from 'The Bridge of the Silver Rocket Ship')   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  nouveaux dégagements des T bonds US nouveaux dégagements des T bonds US

par marie Jeu 16 Fév 2012 - 13:38 | |

| les dernières statistiques viennent de sortir et c'est édifiant ! www.lemetropolecafe.com Bill H:

No problem here...please move along.

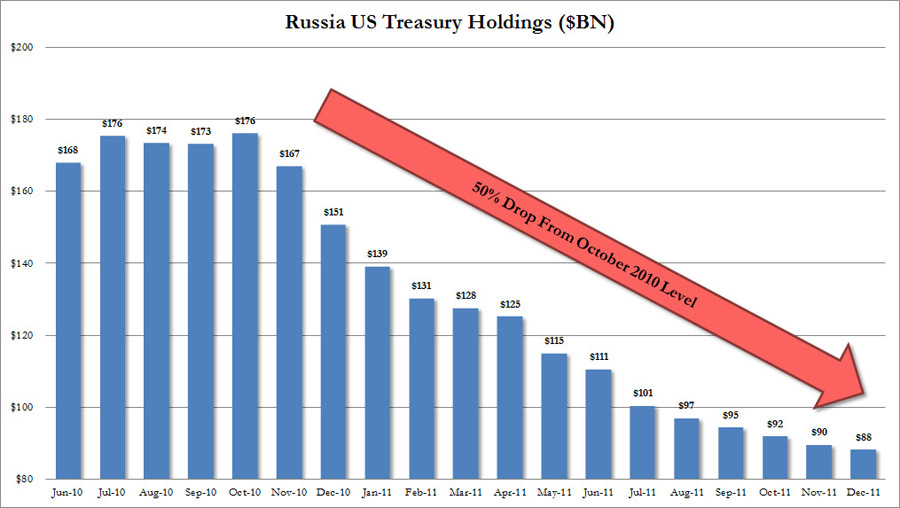

To all; the latest TIC (Treasury International Capital) data was released this morning http://www.treasury.gov/press-center/press-releases/Pages/tg1420.aspx . It shows that foreign private and official investments in Treasuries were a negative $21 Billion in Dec.. When broken down by country, China has dumped nearly $75 Billion since July of last year and Russia cutting their exposure by $90 Billion (half of their entire position) in little over 1 year. If you go back 1 year, that pretty much seems to have been the "peak" of foreign Treasury holdings and you must go back 3 years or so to see any real aggresive buying. It does make sense when looked at from a "common sense" standpoint. It was 3 years ago when the first "official" $ Trillion deficits had been announced for the previous year. Foreigners were basically scared away from recycling their Dollars gained through trade, back into Treasuries.

Over the last year, The Teasury has needed to borrow $1.3 Trillion to fund their spending and has increased the amount they are "allowed" to borrow by $2.1 Trillion. To cut to the chase, THIS amount of money was/is simply not available from the global savings pool, even if it were, investors "chose" to invest elsewhere. But not to worry, The Fed simply stepped up and bought whatever Treasuries could not be sold! They did this of course at ridiculously nonexistent interest rates that exist because of their own doing! Meanwhile, I believe it was Monday that the President's own number crunchers announced that they believe the budget ceiling will need to be raised again, 2 months before the election. Do you get the picture? No one wants our "exports" anymore but no problem, we will manufacture new money to buy the old money and do this forever and ever. No problems here.

Meanwhile, Greek 2 yr bonds have taken out 200% yields on the upside and have a massive interest payment due (that they cannot pay) on March 20th. Whether they borrow more (if they can) to make payment, don't make payment or flip the Eurozone the bird, it does not matter. No "official" default can be recognized,...ever! An "official" and "recognized" default would drain all the water from the derivatives pool and the truth would be seen, EVERYONE is naked and NO ONE has a bathing suit on except for the old fogey and the Indian woman in the far corner. Forget about the fact that no derivatives anywhere can perform, you don't even have to look into the future either, all you need to do is look at what has happened over the past year(s). The U.S. Treasury itself has not attracted enough "independent" capital to "balance its' books", why would anything else, anywhere, still be solvent?

But no, just watch CNBC (the fantasy channel) and no mention of reality here. They want you watch Apple hit $500, follow Zynga and drool about Facebook coming out. Do you see? The issuer of the world's reserve currency is printing money to lend to themselves so that they can print more money while pointing their fingers at some pissant European country to distract attention away from themselves. ...And this has worked like a charm...so far! They (TPTB) might even be able to hire a few supertankers (I hear they are available and will pay you to use them) to transport bushels of Dollars to Athens to arrive before March 20th deadline. CNBC (Certainly Nothing Bad Channel) could even cover the unloading of the pallets, the markets might even cheer when allof the pallets arrive safely. Market reaction to everything is now completely muted (controlled) while the economic numbers are not even close to believeable in any way. "Wag the Dog" ring a bell? It has all become a wild fairy tale with nothing based on reality,...but as I said before...it has worked...so far! No problems here either, please move along. Regards, Bill H.

-END-  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: Bons du trésor US /détenteurs étrangers Re: Bons du trésor US /détenteurs étrangers

par marie Jeu 16 Fév 2012 - 14:09 | |

| et chez Dave http://truthingold.blogspot.com/2012/02/linsanity.html - Citation :

- The other bubble that is starting to lose air is the Treasury market bubble. I've been commenting for quite some time that eventually China/Asia is going to start aggressively reducing its exposure to U.S. Treasuries. Of course, like everything else I was a bit early. But over the last year China has reduced its exposure by $60 billion. This is exceeded only by Russia's dumping $63 billion. Of course, Russia has cut its exposure by nearly 50% in the last 12 months. Eventually we'll see China show a 50% reduction as well. But that would mean selling over half a trillion in Treasuries. The question is, how will the Government finance its massive projected spending deficit (i.e. the debt ceiling is already going to be breached two months earlier than originally projected back in September per Obama AND per this blog way before Obama admitted it) if China reduces its investment in Treasuries by over half a trillion? If you want that answer, see the opening quote.

A lot of analysts/bloggers have said in the past that even though China may show an occassional month to month reduction in Treasury holdings, they are likely replacing these sales by buying them through UK banks. Not to lift my leg on this view, which I never placed credence in anyway, but China unloaded a massive $30 billion in December and the UK banks unloaded another $9 billion...LINK The fact of the matter is that, given that interest rates are at historical lows and have nowhere to go but up - which means that Treasury bond prices have nowhere to go but down - the sane, rational investor would logically not want to own any Treasuries except maybe T-bills. The question is, where do you put your money? Again, see the quote at the top of the page. et comme les graphes valent mieux qu'un long discours Russie  Chine:  http://www.zerohedge.com/news/russia-dumps-treasurys-14-consecutive-months-china-slashes-holdings-lowest-over-year http://www.zerohedge.com/news/russia-dumps-treasurys-14-consecutive-months-china-slashes-holdings-lowest-over-year et la Chine, de déc 2010 à déc 2011  China is still the largest foreign holder of U.S. bonds. But it has pulled back over the past year. That could be a concern. http://money.cnn.com/2012/02/15/markets/thebuzz/index.htm  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  et encore un très gros délestage de la chine : 118 milliards de bons du trésor Us, vendus et encore un très gros délestage de la chine : 118 milliards de bons du trésor Us, vendus

par marie Ven 2 Mar 2012 - 0:25 | |

| Chine : chute de 9.3% des avoirs bons du trésor us entre septembre et décembre 2011, avec le plus gros de la chute sur le mois de décembre ( statistiques du trésor us ) soit 118 milliards $ en moins sur l'exercice 2011 la chine ne se contente plus de ne pas acheter les T bonds US, elle les vend ... et pas qu'un peu le fameux "je te tiens par la barbichette, tu me tiens par la barbichette", dont on nous a rebattu les oreilles, pendant des années, pour argumenter que : "jamais au grand jamais" , la chine vendrait les t bonds us ils ont autant besoin des US que les Us ont besoin d'eux , blablabla, etc etc " ne fonctionne plus ... du tout ! http://www.breitbart.com/article.php?id=CNG.b5464165d36eca1664a16609b6c45115.a61&show_article=1Contrairement aux "prédictions" des ânes à listes adeptes de la "barbichette", non seulement la Chine devient un vendeur confirmé des bons du trésor Us, mais elle devient aussi ( étrange coincidence  ) un acheteur confirmé d'or métal. bon ... heuresement qu'on ne compte pas sur eux .. hein ... et qu'au contraire, on défend des arguments et des scénarios totalement différents ... et qui font ( malheuresement ) leurs preuves . Je dis bien malheuresement, puisqu'anticiper le pire , n'est pas le souhaiter ... mais si le pire doit arriver ... et c'est le cas autant l'avoir anticipé et s'y être préparé !    ************ Commentaires très interessants et toujours aussi humoristiques de Bill H sur cette news, tombée hier 29 fév 2012 , en plein speech Bernanke et raid baissier sur nos métaux favoris www.lemetropolecafe.comBill H:

China sells $118 Billion of U.S. Treasuries.

To all; the above link was reported yesterday (remember? the day Gold got hit for $80+ in the span of a couple hours?). China, our largest creditor (except for the Federal Reserve) has reduced their U.S. Treasury holdings over the final quarter of the year by about $118 Billion, the majority of it in Dec.. Does this seem a little strange to you? It does me! Our largest creditor is no longer buying, not even holding, they are SELLING our debt. They are selling our debt at a time where our borrowing needs are not decreasing, at best holding steady and most probably going to increase especially when, not if, interest rates begin to rise. Did you hear about this yesterday from CNBC? Today? No, I didn't think so. I didn't think so because it is definitely NOT good news. It is not good news for Treasuries, it is not good news in general for interest rates. It is definitely not good news for the Dollar either because I am sure that the Chinese did not sell their Treasuries for "Dollars" to put into a vault or under their mattresses. No, the Chinese have been and are scouring the planet in search of raw materials and are spending their Dollars on these projects and purchases. Truth be told, this news was only good news for one sector and one sector alone, commodities! But no, yesterday we were forced to watch the show of all shows. Ben Bernanke was testifying while Ron Paul was holding up THE only real coin of value in the Congressional chambers, the ISDA pronounced Greece not in default and thus no CDS trigger event (1 yr rates are pushing 1,000%, a 10 baggers dream!) and to top it all off...the ECB plunked down $1/2 Trillion into the system to "save us" again. And ALL of this was supposed to be bearish news for the metals? Good thing this Chinese news didn't make the rounds, as bearish (sarcasm) for Gold as this is, we could have seen a $200 day! I was really really concerned last night after the market closed, I thought I had lost a boatload of money yesterday. I feared that the talking goat heads on CNBC might be right, the Gold bubble was popping and I was going to be left broke and destitute. So this morning I called my my vault and wanted an inventory by weight, I counted the few measly coins I have on hand and then started counting mining shares. I even called a couple of the mines and talked to shareholder relations and asked them if they had any overnight thefts of dore or ore, and whether or not any corrections were made to their 43-101's. Much to my surprise, it was all still there! My vault confirmed everything to the ounce, my coins seemed to be exactly like the last time I checked them (when I also got scared), the ink on my mining shares was not altered or bleeding and no thefts had occurred at any of the mines. In fact, a couple of my juniors actually FOUND more ore bearing material yesterday! Phew! Boy am I glad that's over, I even lost a little sleep! OK, so I didn't do any of this but you get my point. China, our largest creditor is now a confirmed seller of our recently re rated debt, they are also a confirmed BUYER of Gold. So we are supposed to believe that the news yesterday was Dollar bullish and Gold bearish? Is there ANY news that can be Dollar bullish? No, I mean really, is anything that comes out of Washington bullish for the Dollar? Mathematically (here we go again with that pesky logic stuff), there is no, and can be no, policy that is bullish for the Dollar. Mathematically we are already over the edge and past the point of no return, the existing debt CANNOT be paid off in Dollars with existing values. They must be cheapened ...or in other words devalued. Me thinks they might have tried to put a fast one over on us yesterday, but I'm just guessing. Regards, Bill H.   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  LOL, en 1998 je prévoyais exactement ça et je passais pour un demeuré LOL, en 1998 je prévoyais exactement ça et je passais pour un demeuré

par g.sandro Dim 4 Mar 2012 - 2:01 | |

| LOL, en 1998 je prévoyais exactement ça et je passais pour un demeuré   - Citation :

- the Chinese have been and are scouring the planet in search of raw materials and are spending their Dollars on these projects and purchases.

Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

| |   | |

Sujets similaires |  |

|

| Page 1 sur 1 | | | | Permission de ce forum: | Vous ne pouvez pas répondre aux sujets dans ce forum

| |

| |

; | |

Hardinvestor

Hardinvestor

Hardinvestor

Hardinvestor

» COMSTOCK MINING Inc. (NYSE : LODE) Fil dédié:

» WORLD WAR III ? je suis vert de rage d'ouvrir ce fil dédié, on serre les miches: on commence avec Gerald Celente

» Les Podcast et interviews de David Brady, Sprott, Rick Rule, Katusa, Bix Weir, etc...SILJ (Hardin mini-fonds Silver Juniors et Royalties)

» Uranium /minières uranium

» a quoi joue la Russie ..

» TREASURY METALS PFS publiée edit: *NB: TML est devenue NEXTGOLD (NXG)

» Wheaton précious metals/ WPM

» Comment l'Union européenne nous prend pour des imbéciles