|

| | ratio Or-Argent / ratio gold-silver : file de suivi technique |    |

| |

| Message | Auteur |

|---|

1 article très interessant auquel je souhaite néanmoins mettre 1 turbo 1 article très interessant auquel je souhaite néanmoins mettre 1 turbo

par g.sandro Mar 5 Oct 2010 - 0:00 | |

| - Citation :

J'ai souvent expliqué que je considère les marchés comme des balanciers qui oscillent entre les prix extrêmement dévalués et des prix de Mania surcotés, le ratio or / argent médian est 15/16...venant de 84, un retour au deçà du médian est plus que probable, et pourquoi pas 5/6 ?

Et après tout, si l'extrême était de plus de 5 X le ratio médian de 15/16, pourquoi l'extrême inverse ne tomberait il pas à moins d'un cinquième du ratio médian?

15.5 :5= un peu moins de 3...      Dans l'article qui suit, Lorimer Wilson, que je ne connais pas, réalise un travail remarquable, MAIS, selon moi, il omet une donnée fondamentalement ...fondamentale...je m'explique:

Le présent développement n'a pas d'autre prétention que celle de vous alerter sur la propension à s' auto-censurer qui caractérise même les plus " "désinhibés" après une aberration historique pourvu qu'elle ait été suffisamment durable pour décaler les points de référence

Ainsi que je l'ai dit et redit ici, tout l'or extrait depuis que l'histoire s'écrit existe toujours et a seulement changé de mains au fil des siècles...Mais comme vous le savez tous désormais, l"inventaire du stock pile d'argent métal , qui, fut un temps, était pléthorique, lui aussi, a été détruit, c'est Ted Butler qui, le premier, je crois, nous a démontré que si, sous terre, le ratio de rareté relative est bien de 15, il n'en est rien "above ground" ...

L'argent métal étant, comme je le hurle souvent à sa suite, devenu PLUS RARE QUE L'OR .

Quoi qu'il en soit, je souhaite corriger le "point bas" qui vous sera présenté dans le brillant article qui suit; en effet, si 14 (Lorimer Wilson utilise 14) c'est bien le point bas du GSR SUR LA LONGUE et RECENTE PERIODE OBSERVEE,...SUR UNE PERIODE HISTORIQUE PLUS LONGUE, en revanche, c'est bien le ration de 15 (15/16) qui prévalait... et SURTOUT, notez qu'il ne s'agissait nullement d'un point bas temporaire, c'était LE PRIX NORMAL, les extrêmes, par définition oscillent autour du prix médian, c'est ce qui m'a amené à échafauder l'ambitieux raisonnement ci-dessus, que je développe un peu ici:

Un balancier qui est allé aux extrêmes dans un sens n'a rigoureusement aucune raison de rester à la moyenne (la parfaite verticale où il est immobilisé),(de cela, je ne discute même pas tant c'est évident), MAIS il tendra au préalable, emporté par son inertie, à exagérer dans le sens inverse, et ce, dans une proportion qui tendra à équivaloir à l'excès en cours de correction... c'est pourquoi, puisque la verticale géologique est de 15, je postule que le cours de l'Argent métal , qui a été sous évalué de plus de 5 fois (5.6 fois pour être précis) devrait corriger cet excès par une exagération proportionnelle...de l'autre côté de la verticale... et 15 divisé par 5.6, ça donne seulement 2.67 fois....

Et encore, souvenez vous que tant que l'argent géologiquement disponible n'a pas été extrait, en termes de disponibilité physique immédiate, le ratio théorique du Silver / Gold (l'Argent étant plus rare que l'OR) devrait carrément être négatif... alors, sans s'aventurer dans des thèses aussi minoritaires (ce qui n'implique du reste pas qu'elles soient délirantes), je pose et je maintiens que des ratios, (au moins temporaires durant la phase d'exagération antagoniste) de 5, voire 3, voire 2.67 (CQFD) me paraissent plus "raisonnables" qu'un simple retour au ratio géologique et historique, non, qu'il ne tende à la retrouver, à terme, c'est un fait probable, mais APRES une exagération corollaire et proportionnelle dans le sens d'une surévaluation temporaire correspondant à une classique phase de "Mania".

http://www.munknee.com/2010/09/2500-gold-could-easily-result-in-178-50-silver-heres-why/$2,500 Gold Could Easily Result in $178.50 Silver – Here’s Why!September 24, 2010 by Editor · 2 Comments More than 105 respected economists, academics, analysts and market commentators are of the firm opinion that gold will go to $2,500 and beyond before the parabolic peak is reached. In fact, the majority (62) think a price of $5,000 or more -even as high as $15,000 – is actually more likely! As such, just imagine what is in store for silver given its historical price relationship with gold! www.FinancialArticleSummariesToday.com; By: Lorimer Wilson; (Editor’s Note: This is a one-of-a-kind article which no doubt will get a great deal of attention and be posted on a large number of other financial sites and blogs. This is encouraged but to avoid copyright infringement the author’s name must be included with a hyperlink to the original article.)

Precious metal bull markets have 3 distinct demand-driven stages and we are now quickly approaching or perhaps even in the very early part of the last stage which occurs when the general public around the world starts investing in gold and this deluge of capital into gold causes it to escalate dramatically (i.e. go parabolic) in price.

GoldGold went up 24% in 2009 and is up 16% YTD and, as such, there are no shortage of prognosticators who see gold going parabolic reminiscent of 1979 when gold rose 289.3% in the course of just over a year (from a $216.55 closing price on Jan. 1, 1979 to a closing price of $843 per ounce barely a year later on Jan. 21, 1980) and 128% higher in a late-1979 parabolic blow-off of just under 11 weeks! A 289% increase in the price of gold from $1275 would put gold at $4,960. (More on what that might mean for the future price of silver is analyzed below.) That being the case what appear on the surface to be rather outlandish projections of what the bull market in gold will top out at don’t seem quite so far-fetched. (For a complete list of the 105 economists, academics, market analysts and financial commentators who maintain that gold will go parabolic to an average peak price of approx. $5,500 by 2014 please read this article.) SilverSilver has proven itself, time and again, to be a safe haven for investors during times of economic uncertainty and, as such, with the current economy in difficulty the silver market has become a flight to quality investment vehicle along with gold. The 49% increase in silver in 2009 (and 23% YTD) attests to that in spades. During the last parabolic phase for silver in 1979/80 it went from a low of $5.94 on January 2nd, 1979 to a close of $49.45 in early January, 1980 which represented an increase of 732.5% in just over one year. Such a percentage increase from a price of $21 would represent a future parabolic top price of $175. (For what that might mean for the future price of gold see the analysis below.) Frankly, such prices seem impossible in practical terms but that is what the numbers tell us. Gold:Silver RatioThe current gold:silver ratio has been range-bound between 70:1 and 60:1 for quite some time which is way out of whack with the historical relationship between the two precious metals. It begs the question: “Is now the perfect time to buy silver instead of the much more expensive gold metal?”How both gold and silver perform, in and of themselves, does not tell the complete picture by a long shot, however. More important is the price relationship – the correlation – of one to the other over time which is called the gold:silver ratio. Based on silver’s historical correlation r-square with gold of approximately 90 – 95% silver’s daily trading action almost always mirrors, and usually amplifies, underlying moves in gold. With significant increases in the price of gold expected over the next few years even greater increases are anticipated in silver’s price movement in the months and years to come because silver is currently seriously undervalued relative to gold as the following historical relationships attest.Let’s look at the gold:silver ratio from several different perspectives: - Over the past 125 years the mean gold:silver ratio (i.e. 50% above and 50% below) has been 66.9 ounces of silver to 1 ounce of gold. - In the last 25 years (since 1985) the mean gold:silver ratio has increased to 45.69:1 - The present gold:silver ratio has been range-bound between 60:1 and 70:1 (61.3:1 as of September 17/10). - Interestingly, during the build-up to the parabolic blow-off in 1979/80 silver outpaced gold going up 732.5% vs. gold’s 289.3% causing the ratio to drop from 38:1 in January 1979 to 13.99:1 at the parabolic peak for both metals in January,1980. Let’s now look at the various price levels for gold and the various silver:gold ratios mentioned above one by one and see what conclusions we can draw.First let’s use a present term price of $1,300 for gold and apply the various gold:silver ratios mentioned above in approximate terms and see what they do for the potential % increase in, and price of, silver. Gold @ $1,300 using a 61:1 gold:silver ratio puts silver at $21.31

Gold @ $1,300 using the above 45:1 gold:silver ratio puts silver at $28.89

Gold @ $1,300 using the above 14:1 gold:silver ratio puts silver at $92.86Now let’s apply the projected potential parabolic peaks of $2,500, $5,000 and $10,000 to the various gold:silver ratios and see what they suggest is the parabolic top for silver.@ $2,500 Gold

Gold @ $2,500 using the gold:silver ratio of 61:1 puts silver at $41

Gold @ $2,500 using the gold:silver ratio of 45:1 puts silver at $55.50

Gold @ $2,500 using the gold:silver ratio of 14:1 puts silver at $178.50Before we go any further the above analyses bears closer scrutiny. In paragraph four above it was noted that “During the last parabolic phase for silver in 1979/80 it went from a low of $5.94 on January 2nd, 1979 to a close of $49.45 in early January, 1980 which represented an increase of 732.5% in just over one year.” Such a percentage increase from the current price of almost $21 would represent a future parabolic top price of $175.It is interesting to note that the above $175 is almost identical to the $178.50 that occurred at the peak price level for gold and silver back in January, 1980. For the gold bugs who believe that gold is going to go even higher it can only mean a very much higher price for silver as the analyses below suggest.

@ $5,000 Gold

Gold @ $5,000 using the gold:silver ratio of 61.1 puts silver at $82

Gold @ $5,000 using the gold:silver ratio of 45:1 puts silver at $111

Gold @ $5,000 using the gold:silver ratio of 14:1 puts silver at $357

@ $10,000 Gold

Gold @ $10,000 using the gold:silver ratio of 61:1 puts silver at $164

Gold @ $10,000 using the gold:silver ratio of 45:1 puts silver at $222

Gold @ $10,000 using the gold:silver ratio of 14:1 puts silver at $714 !!

From the above it seems that, any way we look at it, physical silver is currently undervalued compared to gold bullion and is in position to generate substantially greater returns than investing in gold bullion. SummaryHistory will look back at the artificially high gold:silver ratio of the past century as an anomaly, caused by the dollar bubble and the world being deceived into believing that fiat currencies are real money, when in fact they are all an illusion. This fiat currency experiment will end badly in a currency crisis and when that happens, as it surely will, gold will go parabolic and silver along with it but even more so as the gold:silver ratio adjusts itself to a more historical correlation. The wealthiest people in the future will be those who put 10% to 15% (or perhaps more – much more!) of their portfolio dollars into physical silver today and were smart enough to research and pick the best silver mining/royalty stocks and warrants to maximize their returns. Indeed, while gold’s meteoric rise still has room to run, silver’s run is yet to get started. As such, it certainly appears evident that now is the time to buy all things silver.Editor’s Note:- This is a one-of-a-kind article which no doubt will get a great deal of attention and be posted on a large number of other financial sites and blogs. This is encouraged but to avoid copyright infringement the author’s name must be included with a hyperlink to the original article. - Sign up to receive every article posted via Twitter, Facebook, RSS feed or our Weekly Newsletter. - Submit a comment. Share your views on the subject with all our readers.  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Lust for Silver Returning: il y est, notamment, question du GS Ratio) Lust for Silver Returning: il y est, notamment, question du GS Ratio)

par g.sandro Lun 1 Nov 2010 - 21:46 | |

| Lust for Silver ReturningTuesday, October 26, 2010Source: http://www.gotgoldreport.com/2010/10/lust-for-silver-returning.html Vultures ( Got Gold Report subscribers) should catch a short, but important web log post by our good friend Eric King, of King World News. We deem Eric’s interview with Mexican billionaire Hugo Salinas Price worthwhile and timely. Readers can find it at this link. If the link doesn’t operate correctly, please copy and paste the entire link below in your browser: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2010/10/26_Hugo_Salinas_Price_-_Pushes_US_Gold_%26_Silver_Money.html Lust for Silver Returning Below is a small, condensed excerpt of a presentation we had intended to give at this week’s New Orleans Investment Conference but were instead bushwhacked with a temporary, but painful ailment causing us to cancel at the last minute. Again our apologies for the last minute change and special apologies to my dear friend Brien Lundin, organizer of the conference. We are on record as having said that the world is approaching the point where the public understanding of the actual scarcity of silver will rumble like an earthquake throughout a disbelieving population. The reason? Because for several generations people have been led to believe – by the price of silver – that silver is abundant and is no longer precious like its rarer sister gold. But silver wasn’t cheap because it was actually overabundant. Silver was cheap because it was apparently overabundant, in other words for artificial reasons. When that is the case then it is merely a question of time before the laws of economics reassert themselves. …Silver became cheaper than it should have because of an artificial oversupply of the metal into the markets by governments. … Freed from the shackles of hard money by the collapse of the Bretton Woods agreement, and believing that the world would continue to accept under-backed, grossly inflated fiat currencies forever, governments dishoarded accumulated strategic silver stockpiles they built up over two centuries. This “surplus metal” was a leftover remnant from when silver was actually used as money.… Continued… In addition to the government surplus silver flooding the small silver market, in 1980 the price of silver collapsed following an attempted corner of the market by the Hunt brothers with Arab partners. … Tens of thousands or perhaps millions of people had also bought into the rush into silver that peaked near $50 nominal in January, 1980. Nothing destroys demand for something more than a price collapse. An entire generation of people grew up in a world following that silver collapse where silver was not only not in demand, the price collapse “proved” it had reached idiotic levels and it “proved” that people who bought into the silver rush then were dumb bubble buyers. Silver became about as unloved as a metal can be for twenty five years or more. … During that period of apparent silver oversupply the unrealistically low price discouraged new production at the same time that demand for the metal was ramping up in a world full of stuff that used it. Computers, electronics, medicines, batteries … all kinds of uses that only require a tiny amount of silver per item, but the sheer volume of the stuff meant that demand for silver was rising and the world’s ability to supply new silver was greatly diminished. … For nearly two decades we have been in a silver supply deficit. Government dishoarding is over and so then is the “source” of silver that kept the price of silver artificially low. Then (1980) vs Now (2010)The world has a lot less silver sitting in vaults than it did 30 years ago. The best estimates are there is less than half as much as there was then.The world population is about 50% higher than it was in 1980. The sheer number of people on the planet that could possibly want to own some silver is more than two billion higher than then, and in 1980 people in China were prohibited from owning silver bullion. Today China’s 1.3 billion souls are actually being encouraged to own gold and silver in commercials on Chinese TV. … The number of people able to afford a small amount of silver metal is logarithmically higher than then. There are literally hundreds of millions more people the world considers “middle class” than there was in the last great rush into silver – some of whom will seek to protect a portion of their wealth in hard assets like silver. … The number of millionaires today compared to 1980 is exponentially higher – many of whom will seek to protect a portion of their wealth in metal. Since 1980 the various governments have increased world money supply by close to 1,000%. There are literally three orders of magnitude more dollars, yen, euro, francs, pounds sterling, etc. than there was in 1980. Governments know few limits when it comes to printing money when they are no longer kept in check by the monetary policemen of gold and silver. … For several generations people have been led to believe (artificially) that silver was no longer precious, or at least as precious as it used to be. For several generations government interference and manipulation of the money supply and the supply of actual metal gave people a reason to believe that silver was more abundant than it actually is. … For several generations the historic ratio of silver to gold was convoluted and overly high because of that interference. By the 1940s and again in the 1990s the silver to gold ratio reached as high as an absurd 100:1 or 100 ounces of silver to “buy” an ounce of gold. …  We think that there is a good reason that silver saw wide use as money in the world historically. We think there was also good reason for the old, historic ratios of between 15 and 20 ounces of silver to one ounce of gold too. We also think that silver became known as a “precious metal” for good and valid reasons.We think that silver has begun its journey back from being despised and looked down upon, back to its proper position as the second most popular precious and monetary metal. We do indeed think that silver is money.Think of it for a moment. Today, versus the last great rush into silver in 1980, we have 50% more people globally using 1,000% more dollars, yen, euros, pounds, etc. to chase less than half as much physical silver metal in a world where one can buy silver instantly, with a mouse click, in one’s study … maybe even in one’s underwear while browsing the internet for the latest market moving developments.This time when the world discovers what we have been saying since August of 1999 – that silver is cheap relative to gold – that silver is scarce relative to gold – that silver will not remain the bastard child of the precious metals forever, and so on … this time when the world discovers silver it will likely do so in the most extreme fashion ever. We think this global rush into silver will make the first surge into silver in 1980 look like a little league warm up. We also think that this Silver Express has finally begun to board. It may actually be inching forward just a little. We’ll see. … We cannot expect the average person to understand or to investigate the actual reasons for why silver was so beaten up and so hated for so long. Nor can we expect the average person to grasp the coming clash of the tectonic forces of overwhelming demand versus actual relative scarcity. All they will know is that the “lust for silver” has somehow returned, long after the train - long after this Silver Express has left the station… AND THEY STILL WON’T BELIEVE IT! But since when are the markets ever geared for “average people? …”That is all for now, but there is more to come.  Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: ratio Or-Argent / ratio gold-silver : file de suivi technique Re: ratio Or-Argent / ratio gold-silver : file de suivi technique

par marie Jeu 17 Fév 2011 - 22:10 | |

| gold 1383.85 $ +0.63% silver 31.75 $ +3.62% plus haut historique de 30 ans, en cloture .

ratio gold silver: 43.58 plus bas historique, en cloture depuis ..... regardez le graph de très LT que j'avais posté précédemment !!

peux pas mieux vous dire !! et Sandro qui est parti skier ... la tête qu'il va faire en se connectant.. Silver is THE King !

Sandro !!  les silver soldiers !      le graph conseille et sur les niveaux actuels du ratio, d'arbitrer silver contre gold .. mmouais...autant l'inverse est tentant ( arbitrage du gold contre silver aux plus hauts du ratio ) , autant cet arbitrage ci ne me séduit pas outremesure ... sf peut etre pour les portifs en wawas et autres certifs .. qui sont pas ma cup of tea.. comme chacun sait ceci étant dit.. cette stratégie part de l'hypothés qu'on ne peut pas casser à la baisse cette ligne de défense ... ce qui est justement en train de se produire .. et qui reste à confirmer par de nouveaux plus bas du ratio, très rapidement.... on sera vite fixés.. dans un sens ou dans l'autre !   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par marie le Ven 18 Fév 2011 - 16:20, édité 2 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: ratio Or-Argent / ratio gold-silver : file de suivi technique Re: ratio Or-Argent / ratio gold-silver : file de suivi technique

par marie Sam 19 Fév 2011 - 15:45 | |

| www.lemetropolecafe.com Dave from Denver…

The gold/silver ratioFriday, February 18, 2011The Gold/Silver Ratio PlummetsThe gold/silver ratio is an indicator with a few thousand years of track record. When ancient Rome was on a strict gold/silver standard and in its peak as an empire, this ratio was fixed at 8. For most of the balance of history up until the founding of the Federal Reserve in 1913, this ratio typically averaged around 15. Many of us believe that we will eventually see a GSR of 15 and maybe even lower. Here's where we are now: You all can work out your own math in terms of price targets using a GSR of 15. I know we will see at least $3000/oz gold eventually (and I believe a lot higher but most of you would not believe my target range so I'll keep it to myself and close colleagues). But assume $2000/oz gold and and GSR of 20. That yields $100/oz silver. Not a bad ROI, so who cares if you pay $33/oz and it corrects to $30 before heading higher? Silver has been ramping in price over the past few days. Given the degree of paper short interest vs. actual availability of physical supply to deliver - I'm referencing 1000 oz. bars and not 1 oz. bullion coins or lesser "junk" silver - it could get pretty "messy" to the upside in the silver market. Yesterday I was chatting with with a long-time expert in the precious metals market - and someone who I believe is as knowledgeable about this market as anyone actively participating now - who thinks that the house of cards that is the U.S. could potentially cave-in this year and the melt-up in the precious metals could be breathtaking. Of course, that will also lead to the implementation of unprecedented Governmental authority in this country and a lot of pain for most you out there.   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Invité

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: ratio Or-Argent / ratio gold-silver : file de suivi technique Re: ratio Or-Argent / ratio gold-silver : file de suivi technique

par marie Mar 10 Mai 2011 - 16:32 | |

| le point après le violent raid sur l'argent et le rebond du ratio or argent sur ses plus bas de 31 dans son ancienne zone plancher  est ce que les anciens plus bas ( surlignés en jaune ) vont se transformer en nouveaux plus hauts ? autrement dit : l'ancien plancher du ratio or argent, va t'il devenir un nouveau plafond? c'est fort possible d'après Gene Arensberg et je partage son avis.. le ratio or argent va reprendre sa décrue, et faire de nouveaux plus bas et pour ceux qui douteraient que SLV soit l'instrument du cartel SLV Metal Holdings

visez ce plongeon ..767.59 tonnes d'argent sont sorties du fond en 1 seule semaine .( la courbe rouge représente le nb de tonnes d'argent détenues par l'etf , et en bleu, c'est le fixing de londres ) d'après une autre source, en 9 séances pas moins de 4 fois le nb de parts etf SLV ont été vendues à découvert n peu avant et pendant le raid amorcé le 2 mai dernier c'est pas vraiment ce qu'on appelle de la liquidation de spéculateurs ça ..   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  Re: ratio Or-Argent / ratio gold-silver : file de suivi technique Re: ratio Or-Argent / ratio gold-silver : file de suivi technique

par marie Sam 14 Mai 2011 - 0:15 | |

| à voir absolument pour ces graphs de très long terme du ratio or argent interessant aussi , le ratio or argent et les récessions normalement, l'argent étant considéré comme un métal industriel, les périodes de récesion lui sont défavorables et voient donc monter le ratio or /argent... mais depuis le dernier épidode 2008 , rien de tel m'est avis que la raison en est que l'argent reprend une dimension monétaire ...et aussi que la prochaine récession sera de type inflationniste... les esprits chagrins me diront que justement non .. en entre en récession ( de type déflationniste )et que c'est pour ça que le ratio or argent remonte à nouveau .. et que ça va continuer .. je pense que non ..au contraire .. le rebond du ratio depuis 2 mai n'est pas du à anticipation récession, mais bien à une néme et particuliérement violente manipulation de nos habituels suspects ... et comme disait Gene Arensberg plus haut dans la file .. l'ancien plancher du ratio, pourrait se transformer en plafond .. notez que tout les graphs de cet article ont été préparés avant la correction des 2 métaux et surtout de l'argent .. . le ratio or argent est aujourd'hui à 42.36 http://www.caseyresearch.com/editorial.php?page=articles/gold-silver-ratio-another-look&ppref=TWT217ED0511A  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  le point technique sur les ratio or / argent et argent / dow jones le point technique sur les ratio or / argent et argent / dow jones

par marie Jeu 3 Mai 2012 - 15:33 | |

| le point technique sur les ratio or / argent et argent / dow jones www.lemetropolecafe.com RR:… Calling all ‘Rocketeers of the Happy Silver Ship’, Sir Issac Newton once stated: To every action there is always an equal and opposite reaction, Well you nailed it Issac. Following the euphoric spike up in early 2011, all Rocketship passengers have been through a grinding, frustrating, irrational and often stomach crunching corrective phase, that has likely thrown many out of their seats and most others clutching for the sick bag! It’s been a monster, but for all it’s brutality, the price is still some 262% higher than it was in late 2008 and still some 50% higher than it’s highs pre the 2008 Credit Crisis. I’d challenge anyone to bring forward another asset class that’s shown such strength? It’s outperformed the FTSE, the Dow, Property, Copper, Oil, land- Even it’s cousin Gold! The point to take on board is that regardless of this last 12 month ‘knife twister’, Hi-Ho has still shone brighter than any other competitor on the score board and it’s looked after the purchasing power for any long term investor more efficiently than almost anything else! Anyway history aside, it’s the future I’m interested in and judging from the fact that almost every light on my Bridge is now starting to flash green, I thought I’d give you all a heads up on my expectations going forward. Those who have to live with me will know only too well how intensely I follow the charts and other variables associated to my favourite metal to determine the best and most suitable path to steer my beloved ship. Well almost the entire basket of variables I study are presently screaming the expectation that we are at or close to a significant near term upturn in Hi-Ho’s favour which means the next 18 months are likely to be very rewarding for all those checked in to first class seats from here! I can’t (or won’t) include my entire collection of conformative charts to show you why I expect this to be a great entry point for all those looking for further Rocket Exposure, I haven’ the time or patience and besides which most get bored of pretty pictures after the first 2 or 3. However I’ve included below a sample that highlight how extremely oversold Silver seems to be against its own long term average and it’s counterparts. The first is the Gold-Silver Ratio which has been working in Hi-Ho’s favour ever since the grotesque sell off in the back of 2008. In general terms whenever Silver outperforms Gold (the chart falls), the precious metals are moving up, as Hi-Ho tends to out run his cousin Ol Yella in Bull Phases. As the chart clearly depicts Gold has been outperforming Silver for the last 12 months (co-inciding with Silver’s corrective phase), but we are now grinding up against the 3.5 year upper declining trend line. Of course in certain circumstances, there is the chance we might see this trend line broken and the corrective phase continue, but I am strongly expect to see this trend line hold, given how extra-ordinarily oversold Silver is against almost every other asset class and how bullish the technical set up has become for the metal. If I’m correct, the monthly close yesterday against this trend line is indicative that a turn is in the works and that a run lower is likely to materialise within the next 4 weeks. ratio or / argent The second chart below highlights how absurdly oversold Silver is against the general equity market. The Chart is a monthly graph of the Silver-Dow Ratio (Candlestick pattern) with the Price of Silver overlaid as a black line. Taking the RSI (Relative Strength Index) at the top of the graph, one can see how oversold Silver has become on a monthly basis against general equities, with the RSI back below the 50 level. I have highlighted on every other occasion in this Bull Cycle to date when the RSI has been below the 50 level and how the price of Silver has performed in the months post ceding such events. You have to wonder if there has truly been a better buying signal?!? ratio Argent / dow jones And as if to compound everything else, I was speaking to my Futures broker today, who confirmed that the interest from his clients in the precious metals sector (and Silver in particular) is at multi-year lows! This is an astonishing fact, given that so far in this 9 year Bull Cycle to date Silver has risen from circa $4 to $31 and yet still Jo Public has little appetite for speculation in the noble metal! Compare with 9 years into the Housing Bull Cycle and remember the desperation by almost the entire population still needing to get onto the property ladder; Parents were helping their kids, even the Government was assisting wherever it could! You all know (or should do by now) where we are in this irretractable Global Financial Mess. You all know (or should do by now) what medium of investment has best served it’s customers interest over such extra-ordinary times. Of course there is no ‘Sure Thing’ in finance, but from where I sit the view from the Bridge is increasingly indicative that the next upwards phase for this Mighty Shining Steer is just about to begin. This time we’re likely to spike through the old 1980 high of $50 and then I truly expect the fireworks to kick off! Your Captain is well and truly ‘Locked and loaded’, Kind regards, Rich (Live from 'The Bridge of the Silver Rocket Ship')   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  Mark J lundeen Mark J lundeen

par marie Lun 7 Mai 2012 - 15:26 | |

| très interessant article sur les perspectives du ratio or /argent, mais aussi sur les fondamentaux de ce bull market ... On retiendra évidemment que l'argent amplifie Toujours les mouvements de l'or, à la hausse, comme à la baisse et que par conséquent, un ratio or argent, haussier signifie inévitablement un repli des 2 métaux ! je le rappelle, car certains ont trop souvent tendance à l'oublier Pour ce qui est de la correction en cours, Lundeen pense qu'elle n'est pas terminée et pourra se prolonger jusquà cet été - Citation :

- With the coming troubles in Europe's banking system (and America's still later), I suspect we may see lower prices in gold and silver coming this summer, as was the case during 2008 with the US mortgage crisis. My reasoning is that the same banks having problems with their finances also have firm control over the paper gold and silver markets in New York and London. I expect these banks will do what they have to do to, to keep gold and silver from advancing strongly during a crisis in the global debt markets. But 2012 is not 2008, so I can't guarantee better: that is, lower prices to buy gold and silver in the next few weeks or months. But on Thursday, the near COMEX futures contract for silver had a $29 handle on it!

mais ensuite, le bull reprendra tout ces droits, avec des objectifs finaux inférieur à 10 , pour le ratio .acheter de l'argent, rapportera bien d'avantage que l'or http://www.gold-eagle.com/editorials_12/lundeen050612.html  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  Analyse du ratio OR /Argent en GANN : Achetez du SILVER! Exclusivité hardinvestor Analyse du ratio OR /Argent en GANN : Achetez du SILVER! Exclusivité hardinvestor

par g.sandro Sam 12 Mai 2012 - 11:12 | |

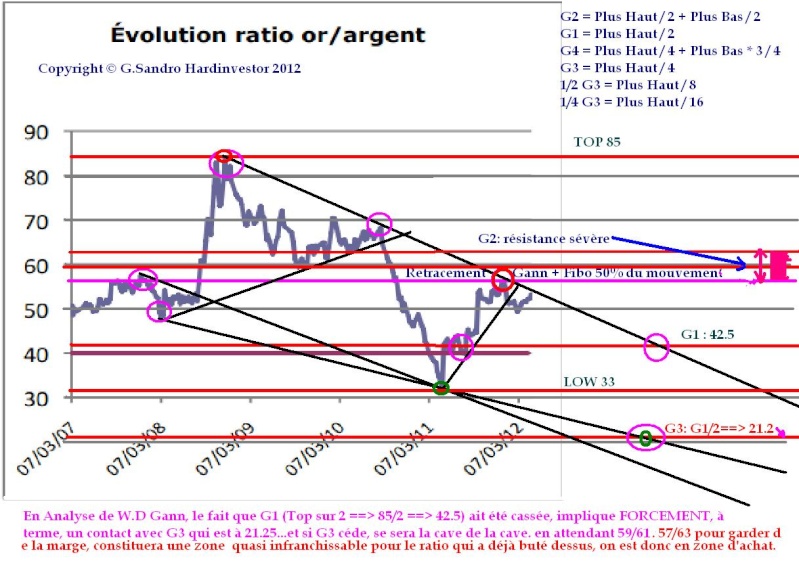

| ZONE d'achat pour l'Argent dont le ratio vs Or DOIT passer par 21.25 puisque la cruciale barre "G1" a été violée...si 21.25 venait à céder à son tour, ce que l'étude des fondamentaux développée dans cette file nous permet de considérer comme inéluctable, le ratio s'effondrerait littéralement et durablement: d'abord vers 10.63, puis, en cas de violation, vers 5.32 qui constitue un objectif fantastique, surtout dans un scénario de hausse de l'Or contre toutes devises.

Prenez le temps de vous projeter dans cette hypothèse de 21.25, puis de 10.63 et enfin, de 5.32 (dont, par parenthèse, rien ne garantit qu'elle ne pourrait pas céder aussi, vous connaissez ma théorie de la dynamique du balancier, souvent développée ici)...Essayez, je vous garantis que vous n'allez pas en croire votre calculette...

Ainsi et par exemple: si vous retenez un prix de l'OR de 8000$, qui n'est pas délirant si on actualise la réalité de l'évolution quantitative de la masse monétaire...

- un ratio de 21.25 (qui est un minimum CERTAIN selon W.D GANN) donnerait le Silver à 376$/oz.

- un ratio de 10.63, (qui est plus que probable au vu du ratio ratio historique de 15 (13 à 16 selon les époques depuis des millénaires) et, surtout du ratio géologique or/argent de la croute terrestre et de l'épuisement continu des densité de métal par tonne extraites) amènerait le Silver à 752$.- un ratio de 5.32 qui semble délirant, mais qui reste très conservateur au vu des études comparées des stocks above ground d'Or et d'Argent, amènerait le Silver à 1503$/oz.Bon alors, ok, on n'en est pas là...: d'une part Gold n'est pas (encore) à 8000$ et en plus, il ne s'agit ici que de projections théoriques, ok...mais la puissance des ratios de Gann étant ce qu'elle est, et sa crédibilité historique ayant été maintes fois avérée, avouez que c'est assez hallucinant... regardez, même si l'Or devait ne plus monter et demeurer à son cours actuel de 1580; ce que ses fondamentaux permettent de considérer comme impossible à moyen/long terme au vu de la situation financière et monétaire actuelle et prévisible, et bien, même ainsi... - un ratio de 21.25 ==> Silver = 74.35$

- un ratio de 10.63 ==> Silver = 148.63$

- un ratio de 05.32 ==> Silver = 297.00$et bien entendu, vous pouvez appliquer ce raisonnement avec ses cours en €Alors, à 28.89$, a fortiori après sa déculottée récente, l'Argent peut légitimement effrayer...c'est humain: mais il est désormais manifestement en survente et à l'aube de sa saisonnalité favorable, alors? Dangereux l'Argent? Certes, et il vient de le prouver à nouveau, mais honnêtement, le véritable risque est de ne pas en détenir.[/b]   Silver is king, Go Gold ! Silver is king, Go Gold !

G.Sandro G.Sandro pas de copier collé: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  Merci Sandro Merci Sandro

par marie Sam 12 Mai 2012 - 20:59 | |

| Merci Sandro, superbe taff et je ne peux qu'appuyer : les analyses en Gann, je trouve ça top +++ ET on n'en voit pourtant très peu sur le net, et encore moins sur les sites d'analyse techniques francophones donc encore bravo et merci à toi, qui en a fait une de tes spécialités !       Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  ratio or argent, objectif CT 54 ratio or argent, objectif CT 54

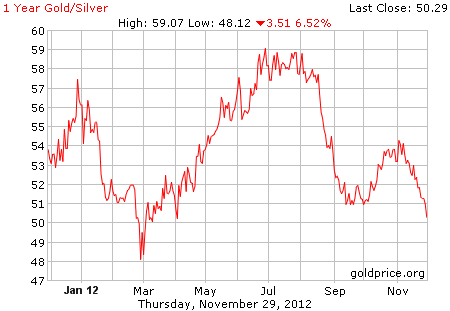

par marie Ven 19 Oct 2012 - 18:09 | |

| ratio or argent, objectif CT 54 - Citation :

- However, rising growth and geopolitical risks, along with political uncertainty in some of the major western countries has me thinking gold may play a little catch-up with silver in the coming weeks. The inability of the gold/silver ratio to sustain recent downticks below 51, and the subsequent rise above the 20-day moving average may be an early indication of this. Near-term potential in the ratio is back to the 54.00 area, where the 38.2% retracement level of the recent decline corresponds closely with the 200-day moving average.

Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook

Dernière édition par marie le Ven 30 Nov 2012 - 18:40, édité 1 fois |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   |  ratio or argent franchit à la baisse le support des 51 ratio or argent franchit à la baisse le support des 51

par marie Ven 30 Nov 2012 - 17:25 | |

| ratio or argent franchit à la baisse le support des 51 , et ce en plein raid du cartel c'est tout à fait exceptionnel, puisque d'habitude et dans ces cas là, l'or résistant mieux que l'argent, ça fait remonter le ratio tout ça confirme encore qu'il est en train de se passer qq chose de très bullish sur l'argent métal  source sourceaujourd'hui et en live, le ratio est un peu remonté et s'établit à 50.99 . A suivre donc pour vérifier que les prochaines clotures restent sous 51, et confirment la tendance baissière du ratio et donc la superformance de l'argent vs or ******************** edit 30 nov 2012 à 19h44 : bon, c'est pas gagné ! avec le raid de ce vendredi où l'argent dévisse de 2.80% , le ratio or argent repasse au dessus des 51 à 51.38 au moment où je poste   Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   |  volatilité de l'argent vs or volatilité de l'argent vs or

par marie Mar 19 Fév 2013 - 22:45 | |

| on ne peut pas parler du ratio or argent, sans évoquer son corollaire, la volatilité des cours argent métal , bien plus importante que celle de l'or , quand les 2 métaux sont en trend haussier, les hausses de l'argent surpassent très largement celles de l'or et inversement les graphs de LT montrent, sans aucune ambiguité la superformance de l'argent depuis 2003 mais également sur la période 1971-1980 alors oui et plus que jamais : acheter l'argent : en plus c'est pil le bon moment là ... ! http://www.caseyresearch.com/articles/embrace-silvers-volatility-all-way-bank  Marie Marie Pas de copier-coller: merci de faire un lien vers ce post. Suivez Hardinvestor sur Twitter et sur Facebook |

|

Skipper

Inscription : 05/02/2005

Messages : 20140

| |   | | |

Captain

Inscription : 04/02/2005

Messages : 14576

| |   | | |

| |   | |

Sujets similaires |  |

|

| Page 1 sur 2 | Aller à la page : 1, 2  | | | | Permission de ce forum: | Vous ne pouvez pas répondre aux sujets dans ce forum

| |

| |

; | |

Hardinvestor

Hardinvestor

Hardinvestor

Hardinvestor

» COMSTOCK MINING Inc. (NYSE : LODE) Fil dédié:

» WORLD WAR III ? je suis vert de rage d'ouvrir ce fil dédié, on serre les miches: on commence avec Gerald Celente

» Les Podcast et interviews de David Brady, Sprott, Rick Rule, Katusa, Bix Weir, etc...SILJ (Hardin mini-fonds Silver Juniors et Royalties)

» Uranium /minières uranium

» a quoi joue la Russie ..

» TREASURY METALS PFS publiée edit: *NB: TML est devenue NEXTGOLD (NXG)

» Wheaton précious metals/ WPM

» Comment l'Union européenne nous prend pour des imbéciles