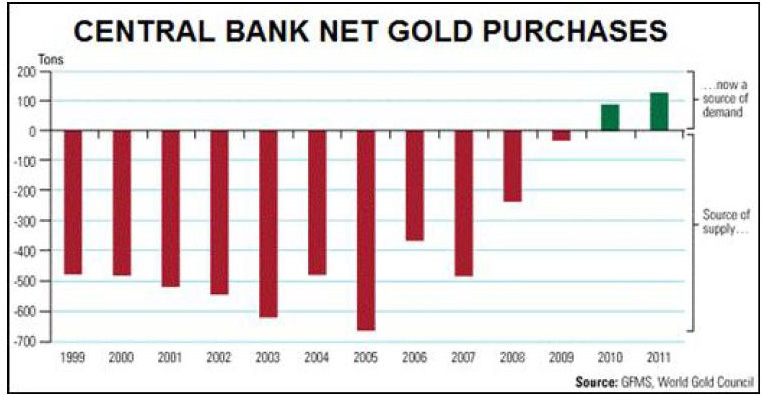

je viens de mettre la main sur un graphique fort révélateur ...

achat et ventes d'or,nets des banques centrales depuis la signature du 1er washington agreement d'après les statistiques officielles du GFMS

à propos de la signature du

Washington agreement et puisque cela refait surface en ce moment, avec une

interview de Dimitri Speck par James Turk

je vous invite à relire ou découvrir cet excellent papier de Ed Steer tout à fait prémonitoire :

les fameuses ventes d'or des BC de 1999 à 2009 correspondent en fait à ... des régularisations de prêt d'or fait aux bullions banks.et absolument pas à des ventes de physique http://www.gata.org/node/4244 Is the Washington Agreement a Fraud? - by Ed SteerSubmitted by Administrator on Sat, 2003-11-08 08:00. Section:

Essays

Archimedes was born in

287 BC in Syracuse, Sicily

Archimedes was a famous mathematician whose theorems and philosophies became world-known. In his own time he gained a reputation few other mathematicians of this period achieved. He is considered by most historians of mathematics as one of the greatest mathematicians of all time. He discovered pi.

Most of the facts about his life come from a biography about the Roman soldier Marcellus written by the Roman biographer Plutarch.

Archimedes was best known for his discovery of the relation between the surface and volume of a sphere and its circumscribing cylinder, for his formulation of a hydrostatic principle -- Archimedes' principle -- and for inventing the Archimedes screw, a device for raising water. Archimedes' Principle states that an object immersed in a fluid experiences a buoyant force that is equal in magnitude to the force of gravity on the displaced fluid.

Legend has it that Archimedes discovered his famous principle while taking a bath. He was so excited that he ran naked through the streets of Syracuse shouting, "Eureka, eureka!" -- "I have found it!"

He also invented things such as the hydraulic screw, the catapult, the lever, the compound pulley, and the burning mirror.

In mechanics Archimedes discovered fundamental theorems concerning the centre of gravity of plane figures and solids.

Archimedes probably spent some time in Egypt early in his career, but he resided for most of his life in Syracuse, the principal city-state in Sicily, where he was on intimate terms with its king, Hieron II. Archimedes published his works in the form of correspondence with the principal mathematicians of his time, including the Alexandrian scholars Conon of Samos and Eratosthenes of Cyrene.

Archimedes played an important role in the defense of Syracuse against the siege laid by the Romans in 213 BC by constructing war machines so effective that they long delayed the capture of the city. But Syracuse eventually was captured by the Roman general Marcus Claudius Marcellus in the autumn of 212 or spring of 211 BC, and Archimedes was killed in the sack of the city.You can read more about Archimedes

here.

* * *We've all had times when the light bulb has gone on and we've said, "Eureka! That's it!" These flashes of insight come not only with a feeling of euphoria, but also with the complete answer to the problem or question at hand ... a "great seeing," if you will. You don't see, you don't see, you don't see. ... Then all of a sudden, you see it all.

The experience I had last week was a derivative of that. "Eureka! Is that it?" A question, rather than a declaration of fact.

I didn't go shouting and running naked through the streets, or even around the office -- but it set off the proverbial light bulb. What precipitated it was an article by Chris Powell, secretary-treasurer of the Gold Anti-Trust Action Committee, posted at the GATA Internet site at Yahoo Groups last week. The story involved Germany's Bundesbank declaring (again) how it was going to be looking for a new agreement to sell even more gold when the Washington Agreement on gold expires in September 2004.

It wasn't the article itself that was of interest, as we've all heard this tired story too many times to let it put the fear of God into us any more. What got my attention was Chris's preamble to the article. This is what he had to say:

"And now Ernst Welteke, president of the Bundesbank, has given another interview musing about selling the bank's gold reserves, which happens whenever the central bankers are nervous that the gold price is getting out of hand. A Reuters story about that interview is appended."

"Keep in mind that when central bankers talk about selling gold, they usually mean writing off as sold their leased gold, gold that is long out of the vault and already sold into the market and a dangerous liability for the bullion banks that borrowed it. Such 'sales' don't add to the gold supply in the market; they help avert a short squeeze by expropriating national assets in favor of influential private interests -- interests that tend to employ central bankers before and after their careers with the central banks."

The moment that I read that, the "Eureka light" turned on. It occurred to me in a flash that this might be what the entire Washington Agreement was about. I fired off an e-mail to Chris with my suspicions, and this is the reply that I got back:

"So much about the Washington Agreement can't be any more than speculation, but better minds than mine in our cause - particularly Frank Veneroso -- have thought for some time that 'gold sales' were just bailouts for the bullion banks. If so, the Washington Agreement was devilishly clever. It was presented as a way of SUPPORTING the gold price by limiting sales so as to avoid hurting those struggling little countries that actually work for a living. What better cover for a scheme to SUPPRESS the price, or at least to keep it from exploding, then by eliminating the chance of a short squeeze?"

"Veneroso thought from the beginning that gold leasing had gotten out of control and that the central banks collectively didn't really know how much they had been leasing, and thus were looking for a method of gradual adjustment of the gold price to a more realistic level."

"I dunno, but I figure that, since they're all a bunch of crooks, misappropriating public wealth in favor of the money powers, the crookedest explanation is the most probable. ... But then I'm a gold nut!" Chris

* * *

For the first time the entire Washington Agreement makes sense ... at least to me. Once the European central banks put their heads together (back in 1999) and came clean with each other, they were absolutely horrified to find just how fast those gold bars were disappearing out of their vaults. That much we already know.

But it was the Washington Agreement that became the red herring to cover their tracks (and their collective behinds) as they attempted to keep a lid on the gold price while they dug themselves out of a physical and paper gold nightmare.

Let's take a look at the text of the agreement one more time....

* * *

Press Communique -- 26 September 1999

Statement on Gold

Oesterreichische Nationalbank

Banca d'Italia

Banque de France

Banco do Portugal

Schweizerische Nationalbank

Banque Nationale de Belgique

Banque Centrale du Luxembourg

Deutsche Bundesbank

Banco de España

Bank of England

Suomen Pankki

De Nederlandsche Bank

Central Bank of Ireland

Sveriges Riksbank

European Central Bank

In the interest of clarifying their intentions with respect to their gold holdings, the above institutions make the following statement:

Gold will remain an important element of global monetary reserves.

The above institutions will not enter the market as sellers, with the exception of already decided sales.

The gold sales already decided will be achieved through a concerted program of sales over the next five years. Annual sales will not exceed approximately 400 tonnes and total sales over this period will not exceed 2,000 tonnes.

The signatories to this agreement have agreed not to expand their gold leasings and their use of gold futures and options over this period.

This agreement will be reviewed after five years.

* * *

The supposed purpose of the Washington Agreement was to give "transparency" to these European central banks' gold dealings. They hoped to bring stability to a market that was always threatened by fears of central banks sales of gold. The "pomp and circumstance" that accompanied this announcement was very impressive. The central banks stated that they would not sell any more gold than their already arranged sales, which (they said) had been made prior to the signing of the agreement.

Now why would all these now desperate central banks come up with an agreement to sell even more gold, when the real purpose of the agreement was to stop it all together?

Item 3 in the agreement is the red herring. It is a smokescreen behind which the banks are, as Chris Powell said, "writing off as sold their leased gold, gold that is long out of the vault and already sold into the market and a dangerous liability for the bullion banks that borrowed it. Such 'sales' don't add to the gold supply in the market; they help avert a short squeeze by expropriating national assets in favor of influential private interests."

The last half of Item 2 of the agreement falls into the same category. If you remove that part of the sentence, plus all of Item 3, we have something closer to the truth. Read through the agreement again without those items. Veneroso and Powell are probably correct.

Would the 2,000 tonnes the central banks said they were going to sell be

over and above the approximately 1,400-tonnes-per-year deficit of gold demand over supply? The agreement doesn't say, but I can't see how that would be possible. It's obvious that the gold used to meet the deficit is coming out of central bank vaults at the rate of three to four tonnes per day. It would be interesting to know which banks are the unlucky ones who are supplying this demand, and whether they really want to.

Since the Washington Agreement was signed over four years ago, more than 4,000 tonnes of gold have left central bank vaults to fill the gap between mine supply (plus scrap) and physical demand. Another thousand plus tonnes will leave central bank vaults during 2004 as well. The central banks are being bled white.

One of the other logs to toss on this golden bonfire is the repayment of part or all of the hedge books of some of the gold companies over the last few years. I don't have the exact figure in front of me, but I seem to remember that 500+ tonnes was the number for 2002. The amount of gold originally borrowed by mining companies and now being repaid to their bullion banks (either in paper of one kind of another -- or in physical) has been quite substantial over the last number of years. As others have pointed out, if the bullion banks are being paid back and are covering their own short positions in gold, how come this gold isn't being shipped back out the door to the central banks to cover their short position as well? Just asking.

The reason is pretty obvious - at least to me. The gold is being sold into the market by the bullion banks even before it hits their front door ... undoubtedly with the full blessing of the central banks that originally owned all this leased gold. By doing things this way, the central banks slow the rate at which gold continues to leave their vaults. They just take cash in lieu of physical from the bullion banks - just as they have been publicly saying they wanted to do all along...selling gold (a dead asset) to earn an interest rate on the proceeds. This is how the central banks are helping the bullion banks out of ‘short squeeze' danger. Real cute, isn't it?

Wait a minute....

Well, golly gee! Look what just rolled off the presses from Reuters as reported in Bill Murphy's "Midas" commentary at

http://www.lemetropolecafe.com/index.html for November 4. Talking about paying down hedge books -- here's what Gold Fields Mineral Services has to say....

"NEW YORK, Nov. 4 (Reuters) -- For the first time in almost two years, global gold companies in the third quarter were net forward sellers of gold, taking advantage of rising market prices to protect the value of unmined bullion, according to market research firm Gold Fields Mineral Services.

"According to GFMS Managing Director Philip Klapwijk, gold miners collectively sold around 1 tonne of gold last quarter, after seven consecutive quarters of unusual net buying by producers to unwind hedges and benefit from the bull market in bullion. "Producer hedge buybacks played a significant role in gold's rally this year. Spot bullion hit a 7-year high at $393.30 an ounce on Sept. 25 and traded around $380 on Tuesday. Klapwijk was citing the results of the fourth Quarterly Gold Hedge Book Analysis, produced by GFMS on behalf of Investec, an international specialist banking group. He told Reuters on the sidelines of a precious metals seminar sponsored by GFMS and the Silver Institute that the amount of gold hedged wasless important than the change in profile of producers back to being net sellers.

"A GFMS/Investec press release on Tuesday said the report states that the global hedge book, adjusted for options delta, was essentially unchanged from the second quarter at 71.6 million ounces (2,227 tonnes)."

* * *

Well now -- all these ounces that the bullion banks were getting back from the pay-downs on the hedge books of the gold companies have disappeared during the last quarter. That means (of course) that the bullion banks are getting NO extra gold from the gold miners, and every ounce to cover the deficit is now coming right out of central bank vaults. Ouch! (Despite that, the gold price has continued to rise! Fancy that! I thought that that was what ‘the boys' were giving the world as the only reason that the gold price was going up! I think it's time for them to go back to the drawing board on that one.)

And talk about perfect timing -- In the same MIDAS commentary, gold market analyst John Brimelow posts the following:

"A number of commentaries note an upswing in physical of off take because of lower prices, including one on Reuters, which says:

"'In Singapore, the report for much of the bullion trade in Southeast Asia, shows a steady demand for gold especially from neighbouring Indonesia. This helped bullion bars stay at a premium of 10 U.S. cents, down from 30 cents two weeks ago. ...

Indonesia ... has been importing up to four tonnes of gold bars daily in the past few weeks, up from one tonne on a normal day."Brimelow continues:

"With today's announcement from the European Central Bank that a subordinate central bank sold 5 tonnes last week adding to the indication yesterday from the Swiss National Bank that it sold a larger than usual 9-10 tonnes in the same period, a picture is emerging of heavily accelerated central bank selling as gold approaches $390. Doubtless what has been reported is only the iceberg top."

Let me offer a different opinion.

The ECB and the Swiss National Bank (and others) are shouting from the rooftops that they are selling gold by the truckload because

they have no choice but to sell. As I mentioned previously, it takes three or four tonnes of gold per day just to meet the deficit, and that little story two paragraphs ago about Indonesia importing "up to four tonnes of gold bars daily in the past few weeks" chews up the 15 tonnes sold by the Swiss National Bank and the "subordinate" central bank in a week or less. Someone with a more suspicious nature might even assume that these two stories are directly related to each other.

What it boils down to is t

he central banks and bullion banks are making a virtue out of necessity. As GATA's Murphy long has said, they have to sell it or the price explodes.

Then, quickly on the heels of that commentary, Tim Wood of MineWeb.com comes up with this little gem:

"Central Bank Gold Sales on Knife-Edge". I can't speak for you, but along with the ramblings of Buba (Bundesbank), this "

Washington Agreement II" they talk about is plain unadulterated "el toro poo poo".

Smoke is billowing everywhere: Britain and its gold sales, Swiss bank sales of "surplus" gold, and the unexpected sales by Portugal, attributed by some to deliveries required under maturing call options written in earlier years, as GATA consultant Reg Howe has noted. Lastly, there appear to be some interesting goings-on in the gold department of one of the Dutch banks.

Here at home in Canada, the Bank of Canada continues to announce (almost monthly) the sale of a little more of what's left of our gold reserves, which are now less than ten tonnes.

That too is a crock.

When I published my essay "

When Irish Eyes are Smiling: the story of Brian Mulroney and Canada's gold," the good folks at the Bank of Canada told me that there had been no physical gold in the bank vaults for years. To quote my essay directly: "They advised me (early in 2002) that Canada does not really own this gold at all (at the time we were supposed to have about 40 tonnes). What was left of it had been leased out to various bullion banks years ago ...and yes, it (was) being accounted for as requested by International Monetary Fund accounting rules regarding leased gold. Canada's gold cupboard is bare ... not a 400-oz. good-delivery bar in sight."

So when the Bank of Canada is announcing these sales, they are just announcing the closing of forward sales contracts that were entered into literally years ago. How many years is anyone's guess.

Now, back to all this gold that's being sold. Lost in all of this is the question: Who is buying, and, by extension, who is being bailed out? Part of the gold is covering the daily deficit, and part of it is for ... what?

And gold derivatives continue rocketing skyward with every passing quarter.

As others (and now I) have pointed out for years, none of this activity is showing up in the annual (or monthly) inventory reports of the

World Gold Council or

Gold Fields Mineral Services. To put the credibility of the Washington Agreement in the esteemed company of these two organizations requires little mental effort. I think I'll toss the IMF and its gold-reporting standards into this distinguished group as well, for gold in hand, gold receivables, and gold swaps are recorded the same way, as being "in the vault." And how about

CPM Group? Sure, why not? Off to the guillotine with the lot of them!

After more than seven years, this derivatives-shrouded game of Three-Card Monty is starting to wear a little thin, and it's my belief that the Washington Agreement is a total farce, a piece of paper to wave at the gold world and shout "

Boo!!!" every time the gold price shows any signs of "irrational exuberance".

Bill Murphy's interview with Tim Wood at MineWeb pretty well sums it up.

And if a new Washington Agreement takes effect in October 2004, it will be (in my opinion) another con job, just like the current agreement.

Somehow, I just don't think they're going to get that far before the whole thing blows up. With Andy Smith of Mitsui recently moaning and groaning over at MineWeb about "speculators" driving the price up and how it's going to end badly for the longs, you just have to know that the shorts are in a world of hurt.

In closing, I'd like to quote someone a little more genteel, and whose understanding of the situation is certainly more visionary than mine. Reg Howe had this to say in the last paragraph of his essay "

Long Con: Mother of All Bank Runs":

"In many ways a more interesting question is how foreign central banks -- stuffed to the gills with dollar-denominated paper -- can accomplish the same objective." (That is, protecting themselves from an imploding dollar -- Ed) "And the answer is the same: with gold, their traditional reserve asset. When the central banks realize that too many are not just wise to their scam but also are taking advantage of it, that the gold con artists themselves have become the marks, then the greatest bank run in history will shift into high gear. It will be a run not just from dollars or even from paper currency in general, but from modern central banking itself, as the lenders of last resort succumb to the resurrected worldwide preference for the financial asset of last resort."

It's my bet that there aren't a lot of central banks left in Europe right now that "stand ready to lease gold should the price rise," to use Federal Reserve Chairman Alan Greenspan's words -- and those that are, are probably not very happy about it.

And my opinion is that this is all about to end badly - and soon. It couldn't happen to a nicer bunch of crooks.

If you feel that my vision of the Washington Agreement is closer to the truth than what's actually in the document itself, then all bouquets, kudos, and "attaboys" should be sent to Frank Veneroso and Chris Powell. If you disagree, then all fruits and vegetables that come to hand -- in whatever state of ripeness (or decomposition) they are in -- should be directed to the writer at the e-mail address below.

Ed Steer

Gold Anti-Trust Action Committee

Edmonton, Alberta CANADA

edsteer48@shaw.ca Hardinvestor

Hardinvestor

Hardinvestor

Hardinvestor

» COMSTOCK MINING Inc. (NYSE : LODE) Fil dédié:

» WORLD WAR III ? je suis vert de rage d'ouvrir ce fil dédié, on serre les miches: on commence avec Gerald Celente

» Les Podcast et interviews de David Brady, Sprott, Rick Rule, Katusa, Bix Weir, etc...SILJ (Hardin mini-fonds Silver Juniors et Royalties)

» Uranium /minières uranium

» a quoi joue la Russie ..

» TREASURY METALS PFS publiée edit: *NB: TML est devenue NEXTGOLD (NXG)

» Wheaton précious metals/ WPM

» Comment l'Union européenne nous prend pour des imbéciles